Question: Please help me with this. Pretty please Exercise 1 Dewitt Co. budgeted its activity for October 2019 from the following information: Sales are budgeted at

Please help me with this. Pretty please

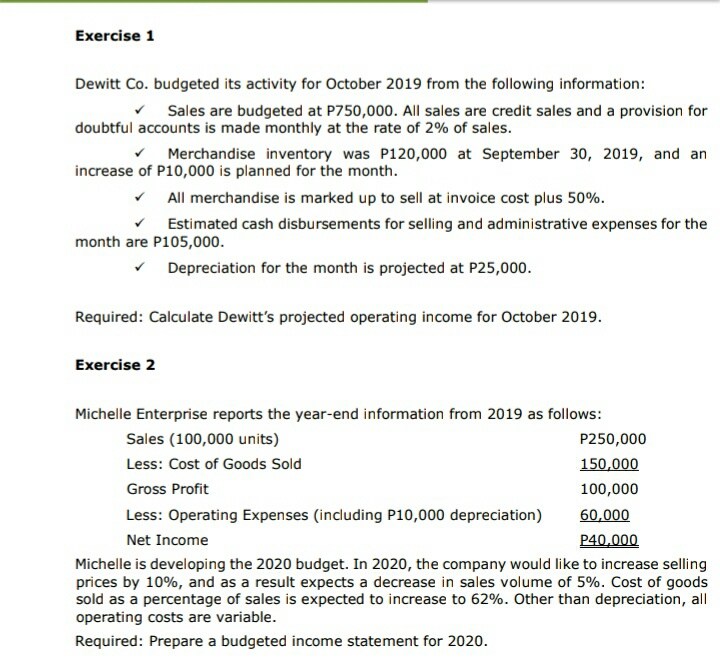

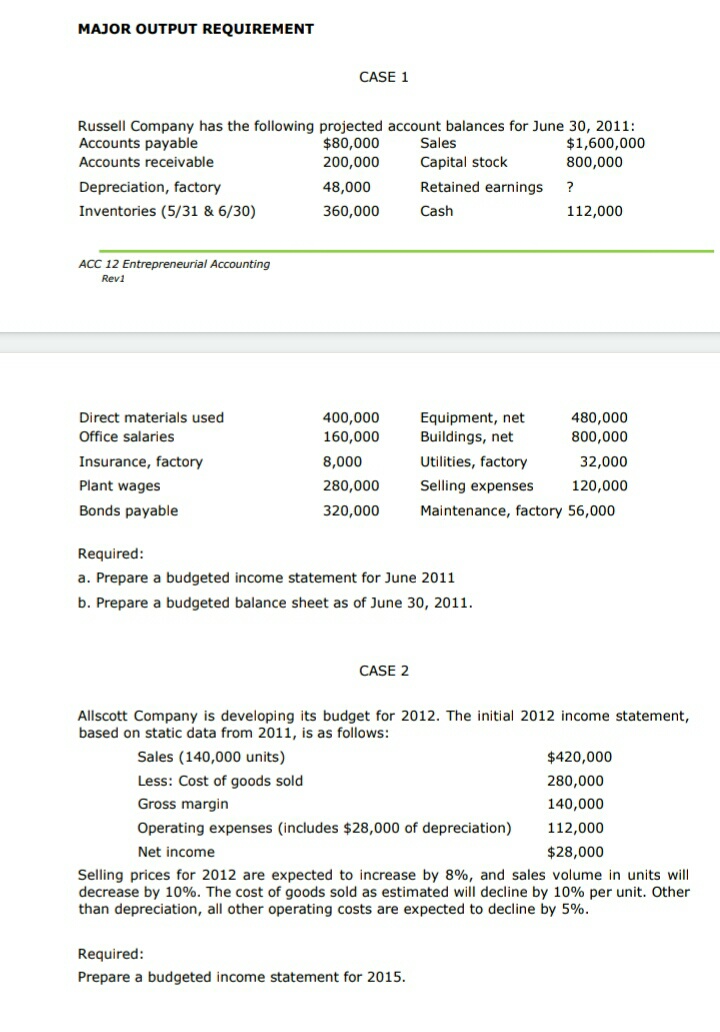

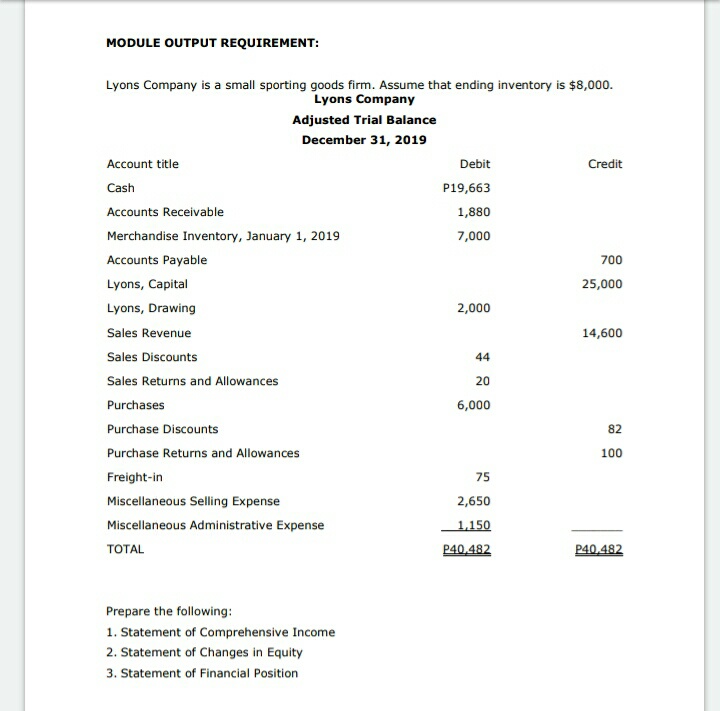

Exercise 1 Dewitt Co. budgeted its activity for October 2019 from the following information: Sales are budgeted at P750,000. All sales are credit sales and a provision for doubtful accounts is made monthly at the rate of 2% of sales. Merchandise inventory was P120,000 at September 30, 2019, and an increase of P10,000 is planned for the month. All merchandise is marked up to sell at invoice cost plus 50%. Estimated cash disbursements for selling and administrative expenses for the month are P105,000. Depreciation for the month is projected at P25,000. Required: Calculate Dewitt's projected operating income for October 2019. Exercise 2 Michelle Enterprise reports the year-end information from 2019 as follows: Sales (100,000 units) P250,000 Less: Cost of Goods Sold 150,000 Gross Profit 100,000 Less: Operating Expenses (including P10,000 depreciation) 60,000 Net Income P40,000 Michelle is developing the 2020 budget. In 2020, the company would like to increase selling prices by 10%, and as a result expects a decrease in sales volume of 5%. Cost of goods sold as a percentage of sales is expected to increase to 62%. Other than depreciation, all operating costs are variable. Required: Prepare a budgeted income statement for 2020.MAJOR OUTPUT REQUIREMENT CASE 1 Russell Company has the following projected account balances for June 30, 2011: Accounts payable $80,000 Sales $1,600,000 Accounts receivable 200,000 Capital stock 800,000 Depreciation, factory 48,000 Retained earnings ? Inventories (5/31 & 6/30) 360,000 Cash 112,000 ACC 12 Entrepreneurial Accounting Rev1 Direct materials used 400,000 Equipment, net 480,000 Office salaries 160,000 Buildings, net 800,000 Insurance, factory 8,000 Utilities, factory 32,000 Plant wages 280,000 Selling expenses 120,000 Bonds payable 320,000 Maintenance, factory 56,000 Required: a. Prepare a budgeted income statement for June 2011 b. Prepare a budgeted balance sheet as of June 30, 2011. CASE 2 Allscott Company is developing its budget for 2012. The initial 2012 income statement, based on static data from 2011, is as follows: Sales (140,000 units) $420,000 Less: Cost of goods sold 280,000 Gross margin 140,000 Operating expenses (includes $28,000 of depreciation) 112,000 Net income $28,000 Selling prices for 2012 are expected to increase by 8%, and sales volume in units will decrease by 10%. The cost of goods sold as estimated will decline by 10% per unit. Other than depreciation, all other operating costs are expected to decline by 5%. Required: Prepare a budgeted income statement for 2015.MODULE OUTPUT REQUIREMENT: Lyons Company is a small sporting goods firm. Assume that ending inventory is $8,000. Lyons Company Adjusted Trial Balance December 31, 2019 Account title Debit Credit Cash P19,663 Accounts Receivable 1,880 Merchandise Inventory, January 1, 2019 7,000 Accounts Payable 700 Lyons, Capital 25,000 Lyons, Drawing 2,000 Sales Revenue 14,600 Sales Discounts 44 Sales Returns and Allowances 20 Purchases 6,000 Purchase Discounts 82 Purchase Returns and Allowances 100 Freight-in 75 Miscellaneous Selling Expense 2,650 Miscellaneous Administrative Expense 1,150 TOTAL P40.482 P40.482 Prepare the following: 1. Statement of Comprehensive Income 2. Statement of Changes in Equity 3. Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts