Question: Please help me with this problem and show your work on excel. Econ Stats please and thank you. Please show what to fill in the

Please help me with this problem and show your work on excel. Econ Stats please and thank you. Please show what to fill in the template and how you got that answer.

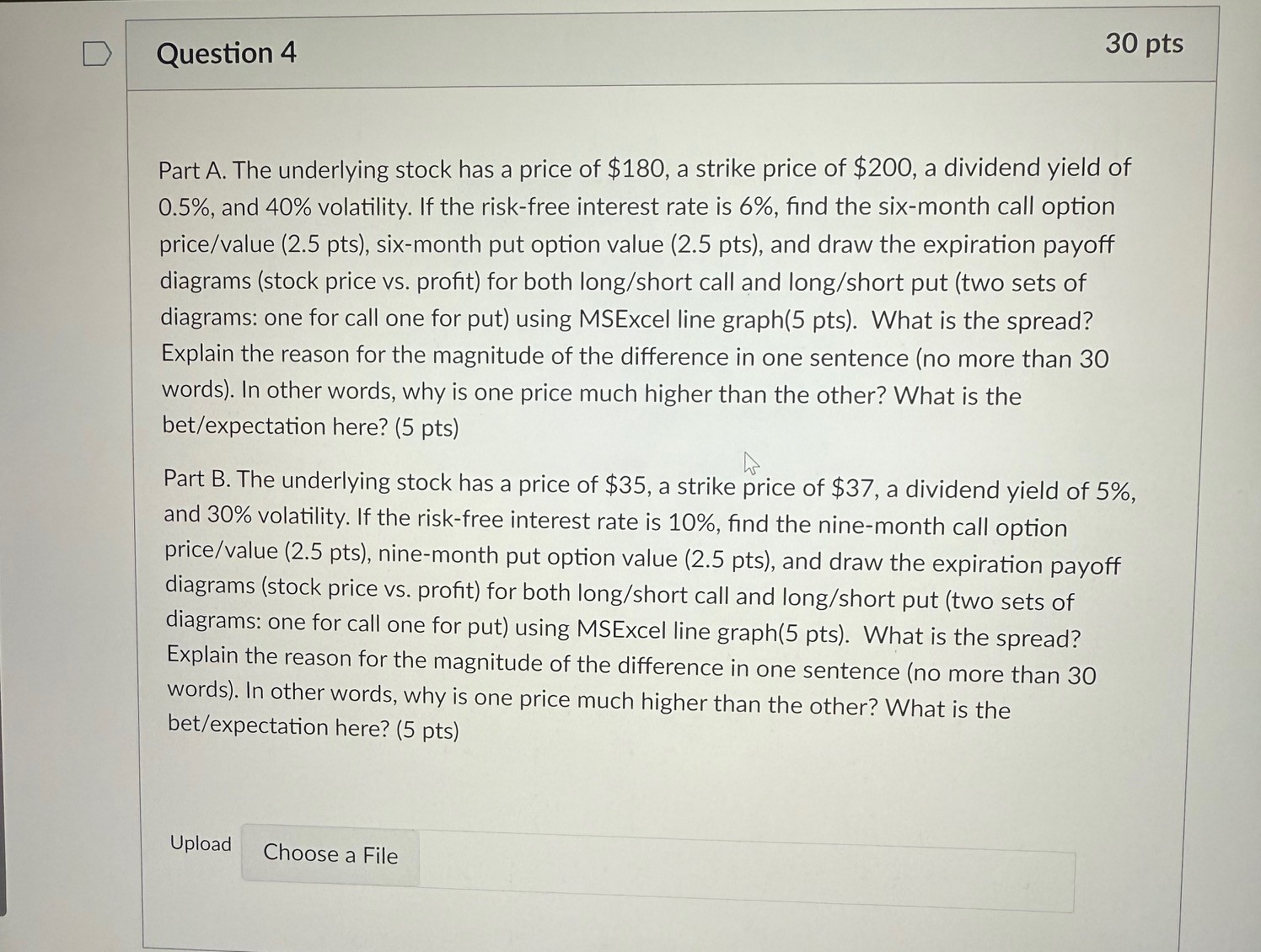

Part A The underlying stock has a price of $ a strike price of $ a dividend yield of and volatility. If the riskfree interest rate is find the sixmonth call option pricevalue pts sixmonth put option value pts and draw the expiration payoff diagrams stock price vs profit for both longshort call and longshort put two sets of diagrams: one for call one for put using MSExcel line graph pts What is the spread? Explain the reason for the magnitude of the difference in one sentence no more than words In other words, why is one price much higher than the other? What is the betexpectation here? pts

Part B The underlying stock has a price of $ a strike price of $ a dividend yield of and volatility. If the riskfree interest rate is find the ninemonth call option pricevalue pts ninemonth put option value pts and draw the expiration payoff diagrams stock price vs profit for both longshort call and longshort put two sets of diagrams: one for call one for put using MSExcel line graph pts What is the spread? Explain the reason for the magnitude of the difference in one sentence no more than words In other words, why is one price much higher than the other? What is the betexpectation here? pts

Upload Put Value

Spread Absolute Value of The Difference between Call Option Price and Put Option Price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock