Question: Please help me with this problem. I am don't know how to construct this binomial tree E1. You suspect that Delta airlines will merge with

Please help me with this problem. I am don't know how to construct this binomial tree

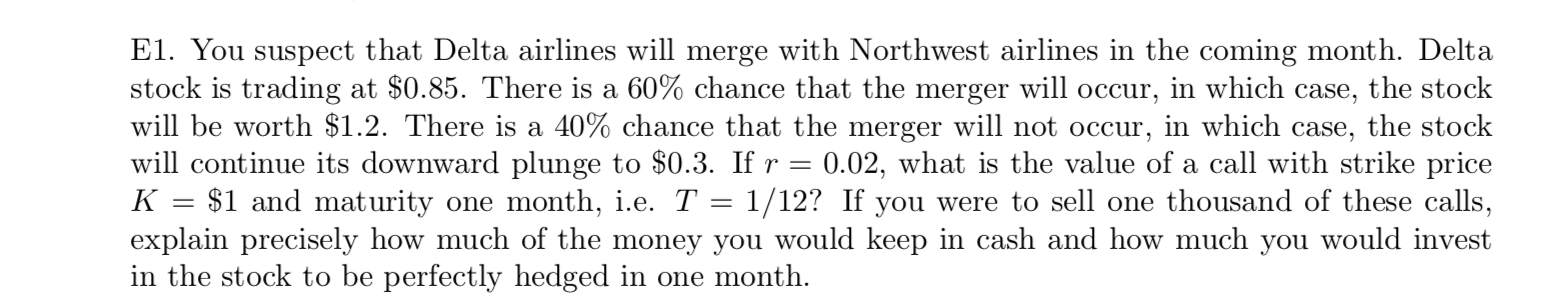

E1. You suspect that Delta airlines will merge with Northwest airlines in the coming month. Delta stock is trading at $0.85. There is a 60% chance that the merger will occur, in which case, the stock will be worth $1.2. There is a 40% chance that the merger will not occur, in which case, the stock will continue its downward plunge to $0.3. If T' = 0.02, what is the value of a call with strike price K = $1 and maturity one month, i.e. T = 1/ 12? If you were to sell one thousand of these calls, explain precisely how much of the money you would keep in cash and how much you would invest in the stock to be perfectly hedged in one month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts