Question: please help me with this problem. im so confused thank you so much When Crossett Corporation was organized in January Year 1, it immediately issued

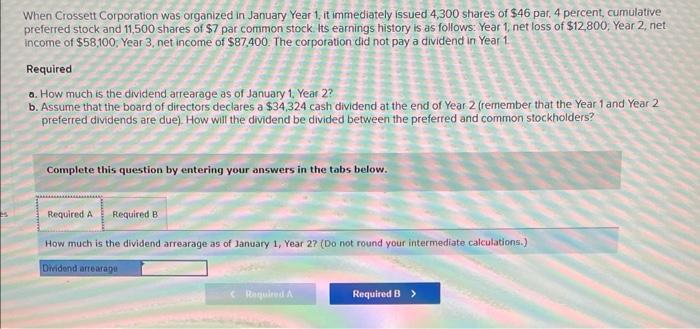

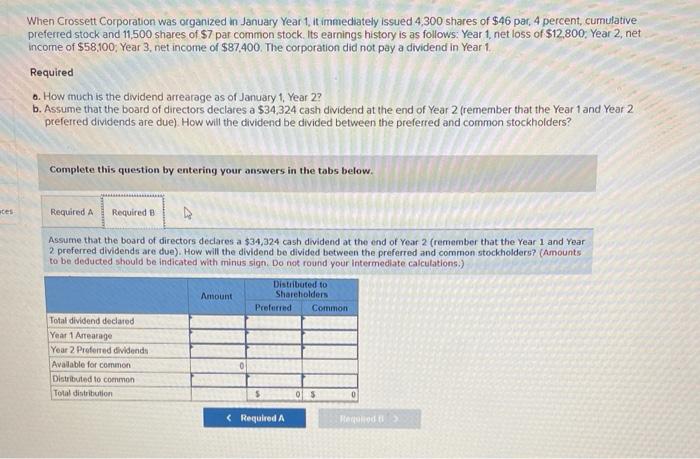

When Crossett Corporation was organized in January Year 1, it immediately issued 4,300 shares of $46 par, 4 percent, cumulative preferred stock and 11,500 shares of $7 par common stock. Its earnings history is as follows: Year 1, net loss of $12,800, Year 2, net income of $58,100; Year 3 , net income of $87,400. The corporation did not pay a dividend in Year 1 . Required o. How much is the dividend arrearage as of January 1 , Year 2 ? b. Assume that the board of directors declares a $34,324 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. How much is the dividend arrearage as of January 1 , Year 2? (Do not round your intermediate calculations.) When Crossett Corporation was organized in January Year 1, it immediately issued 4,300 shares of $46 par, 4 percent, cumulative preferred stock and 11,500 shares of $7 par common stock. Its earnings history is as follows: Year 1, net loss of $12,800 : Year 2, net income of $58,100; Year 3 , net income of $87,400. The corporation did not pay a dividend in Year 1 . Requited 0. How much is the dividend arrearage as of January 1 , Year 2 ? b. Assume that the board of directors declares a $34,324 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Assume that the board of directors declares a $34,324 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? (Amounts to be deducted should be indicated with minus sign. Do not round your intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts