Question: Please help me with this problem P10-1A. I have attached a sample solution sheet. Thanks! PROBLEM 10-1B (a) Jan. 1 Cash... Notes Payable 18,000 5

Please help me with this problem P10-1A. I have attached a sample solution sheet.

Thanks!

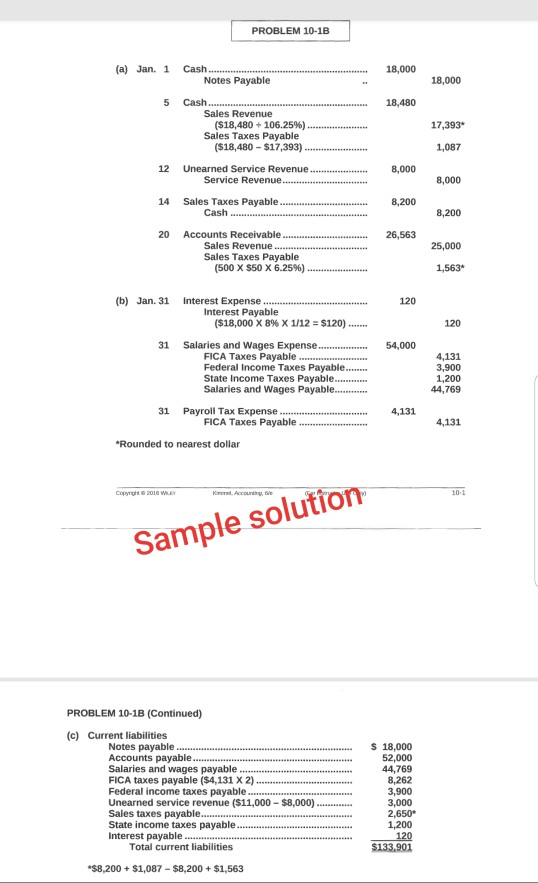

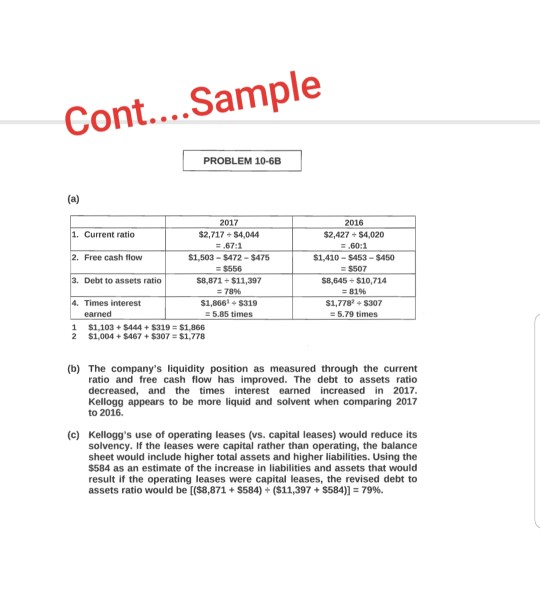

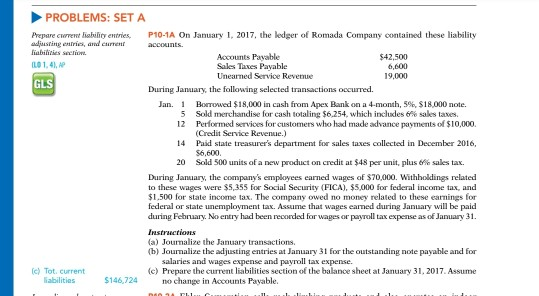

PROBLEM 10-1B (a) Jan. 1 Cash... Notes Payable 18,000 5 Cash 18,480 Sales Revenue ($18,480 106.25%) 17,393* 1,087 8,000 Sales Taxes Payable ($18,480-$17,393) 12 Unearned Service Revenue 8,00 Service Revenue 14 Sales Taxes Payable 8,200 20 Accounts Receivable 26,563 Sales Revenue Sales Taxes Payable 25,000 (500 XS50 X 6.2596) (b) Jan. 31 Interest Expense Interest Payable ($18,000 X 8% X 1/12 $120) 31 Salaries and Wages Expense 54,000 FICA Taxes Payable Federal Income Taxes Payable... State Income Taxes Payable Salaries and Wages Payable. 3,900 1,200 44,769 31 Payroll Tax Expense 4,131 FICA Taxes Payable 4,131 Rounded to nearest dollar 10-1 Sample solution PROBLEM 10-1B (Continued) (c) Current liabilities 18,000 52,000 44,769 Notes payable Accounts payable. salarieses payable (Snayable8000)00 FICA taxes payable ($4,131 X 2) Federal income taxes payable Unearned service revenue ($11,000 S8,000) Sales taxes payable State income taxes payable.. Interest payable and wages payable 2,650* Total current liabilities $133,901 $8,200+$1,087-$8,200+$1,563 Cont....Sample PROBLEM 10-6B 2017 $2,717 S4,044 67:1 1,503-$472-$475 $556 8,871 $11,397 78% $1,866 $319 5.85 times 2016 1. Current ratio $2,427 S4,020 Free cash flow 1,410-$453-$450 $507 $8,645+ $10,714 Debt to assets ratio Times interest $1,7782+$307 5.79 times 1 $1,103$444+$319 $1,866 2 $1,004+$467+$307 $1,778 (b) The company's liquidity position as measured through the current ratio and free cash flow has improved. The debt to assets ratio decreased, and the times interest earned increased in 2017 Kellogg appears to be more liquid and solvent when comparing 2017 to 2016. (c) Kellogg's use of operating leases (vs. capital leases) would reduce its solvency. If the leases were capital rather than operating, the balance sheet would include higher total assets and higher liabilities. Using the $584 as an estimate of the increase in liabilities and assets that would result if the operating leases were capital leases, the revised debt to assets ratio would be [($8,871 + S584) + ($11,397 + S584)) 7996. PROBLEMS: SETA Prepare cwrrent liahility etries, P10-1A On January , 2017, the ledger o Romada Company contained these liability adjusting entries, and caurnenr iabilities section LO 1,41, AP accounts Accounts Pavable Sales Taxes Pavable Unearned Service Revenue $42,500 6,600 19,000 GLS During January, the following selected transactions occurred. Jan. 1 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. 5 12 Performed services for customers who had made advance payments of $10,000 14 Paid state treasurer's department for sales taxes collected in December 2016, 20 Sold 500 units af a new product on credit at $48 per unit, plus 6% sales tax. Sold merchandise for cash totaling $6,254, which includes 6% sales taxes. (Credit Service Revenue 6,600 During January, the company's employees earned wages of $70,000. Withholdings related to these wages were $5,355 for Social Security (FICA), $5,000 for federal income tax, and $1,500 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during Fehruary. No entry had been recorded for wages or payroll tax expense as of January 31 a) Joumalize the January transactions. b) Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payroll tax expense (e) Prepare the current liabilities section of the balance sheet at January 31, 2017. Assume (c) Tot. current labilities 146,724 hange in Accounts Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts