Question: PLEASE HELP ME WITH THIS PROBLEM. PLEASE SHOW ALL STEPS ON HOW TO GET TO THE ANSWER. SHOW ALL WORK, I DON'T UNDERSTAND IT. THANK

PLEASE HELP ME WITH THIS PROBLEM. PLEASE SHOW ALL STEPS ON HOW TO GET TO THE ANSWER. SHOW ALL WORK, I DON'T UNDERSTAND IT. THANK YOU!!

Show all steps of how to get each number and percent. If you use excel, then please show the breakdown of the formula used. THANK YOU!!

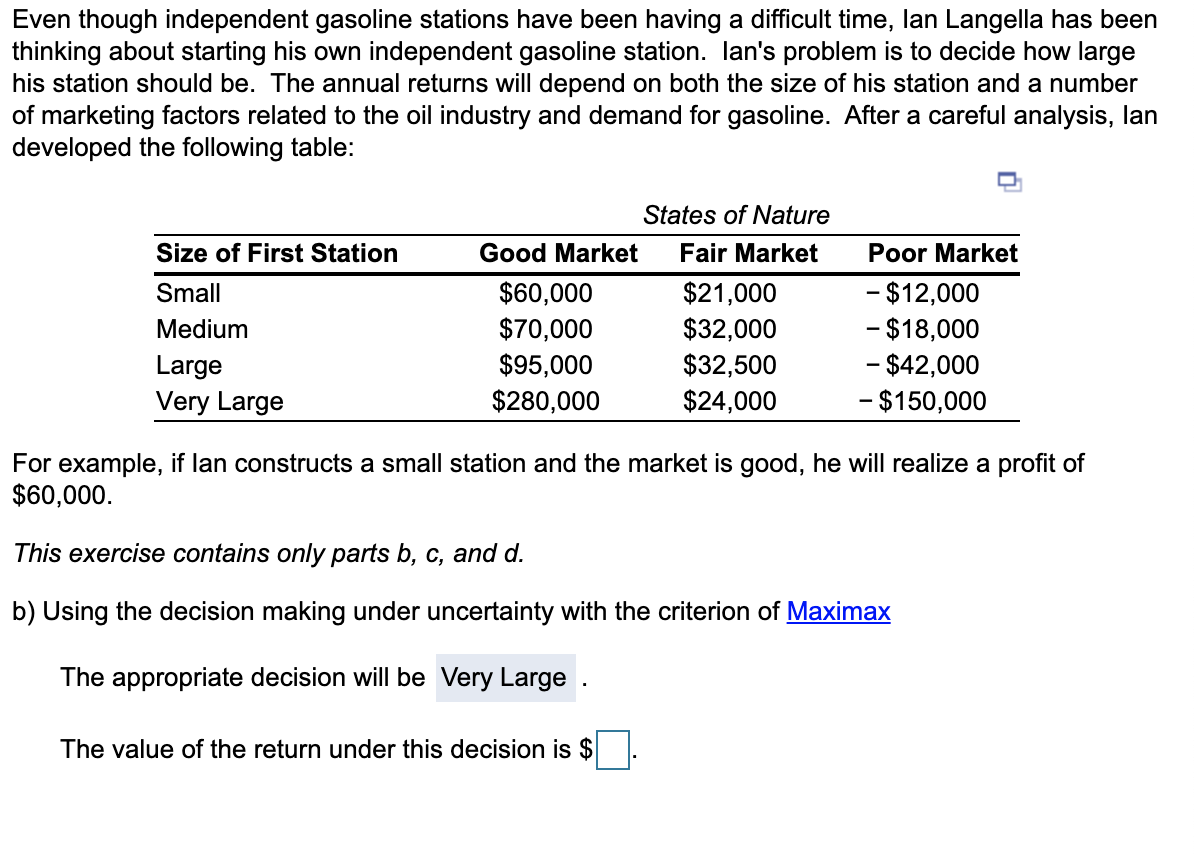

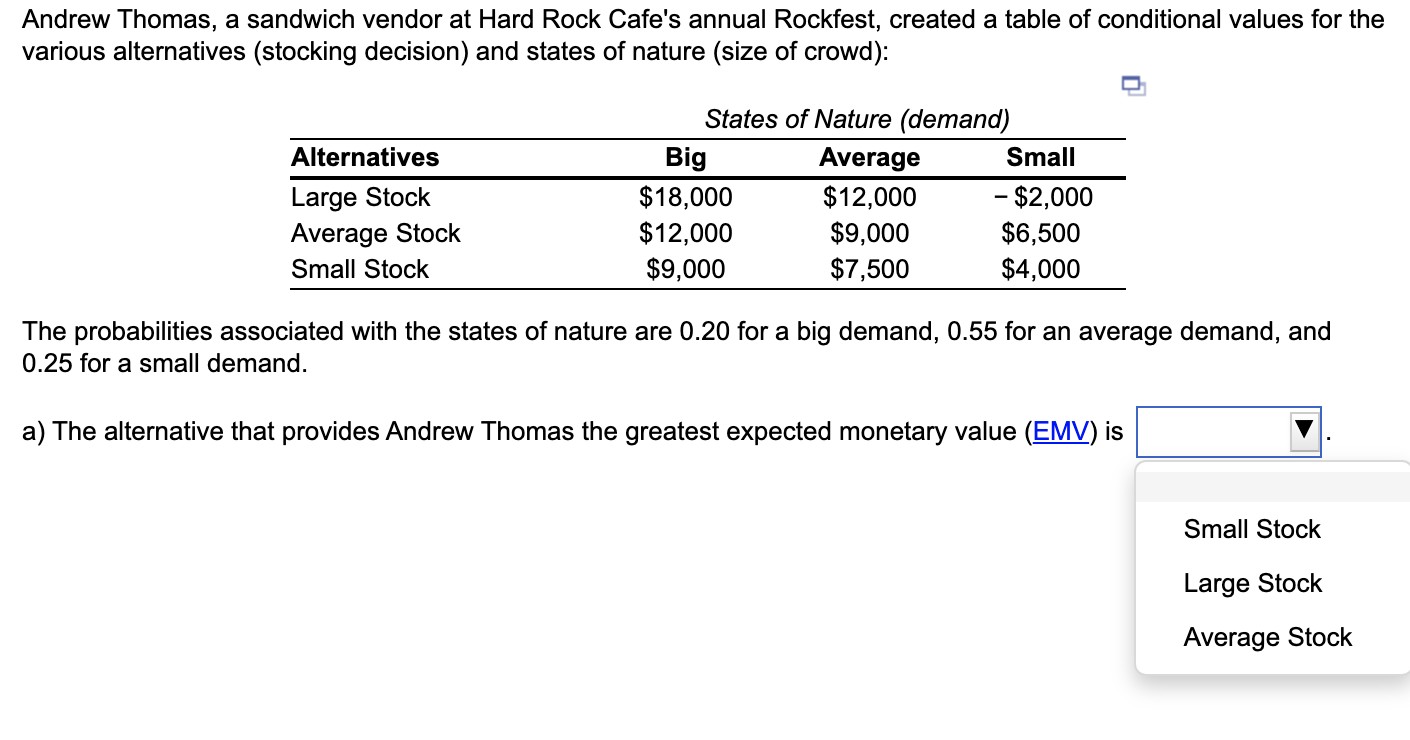

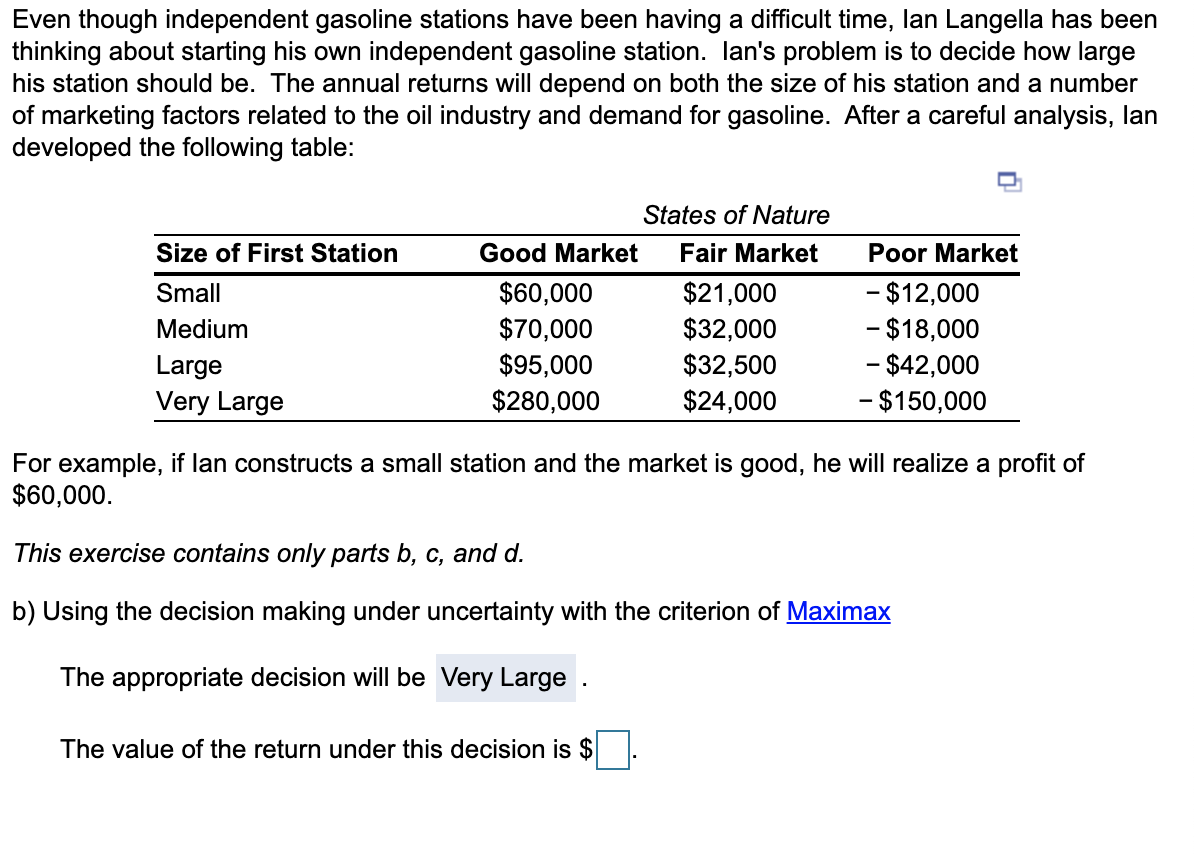

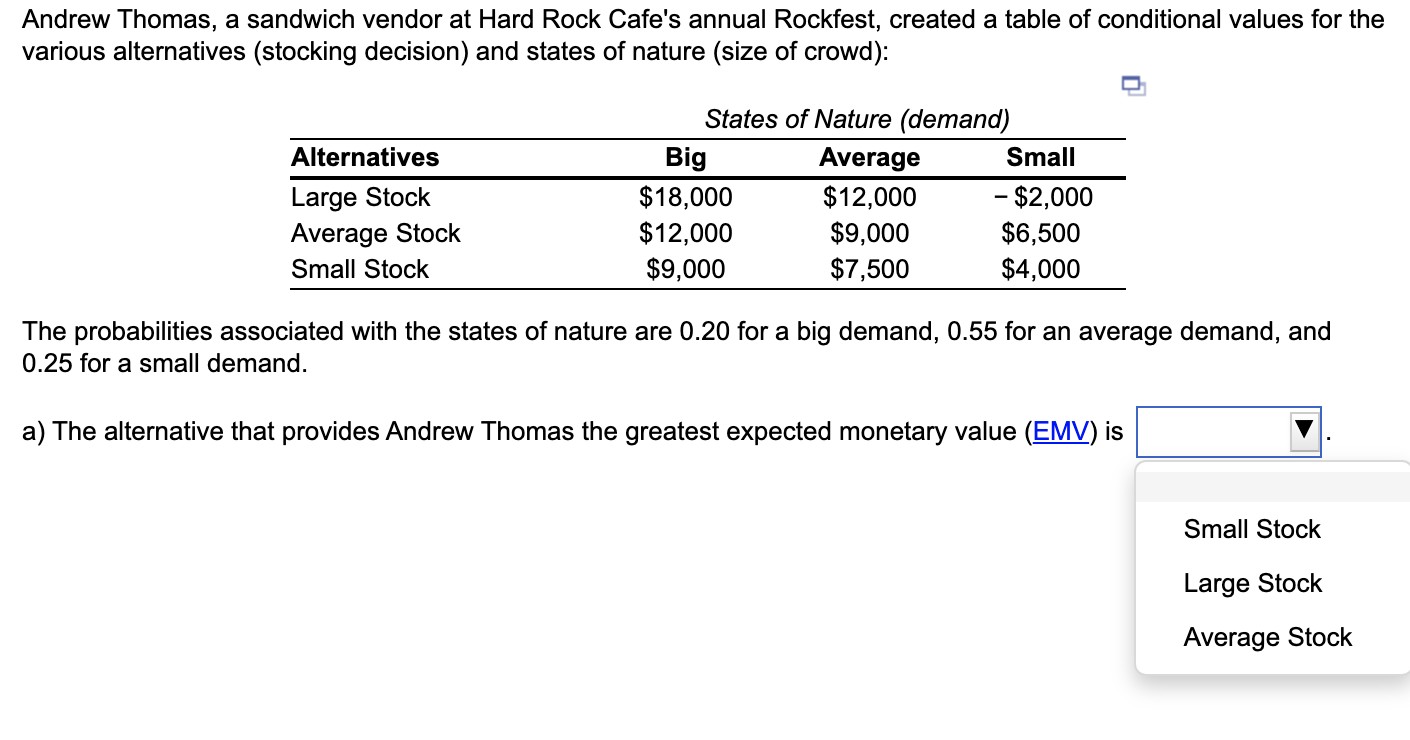

Even though independent gasoline stations have been having a difficult time, lan Langella has been thinking about starting his own independent gasoline station. Ian's problem is to decide how large his station should be. The annual returns will depend on both the size of his station and a number of marketing factors related to the oil industry and demand for gasoline. After a careful analysis, lan developed the following table: Size of First Station Poor Market Small Medium Large Very Large States of Nature Good Market Fair Market $60,000 $21,000 $70,000 $32,000 $95,000 $32,500 $280,000 $24,000 - $12,000 - $18,000 - $42,000 - $150,000 on and market is good, he will realize a profit of For example, if lan constructs a small sta $60,000. This exercise contains only parts b, c, and d. b) Using the decision making under uncertainty with the criterion of Maximax The appropriate decision will be Very Large . The value of the return under this decision is $ Andrew Thomas, a sandwich vendor at Hard Rock Cafe's annual Rockfest, created a table of conditional values for the various alternatives (stocking decision) and states of nature (size of crowd): Alternatives Large Stock Average Stock Small Stock States of Nature (demand) Big Average Small $18,000 $12,000 - $2,000 $12,000 $9,000 $6,500 $9,000 $7,500 $4,000 The probabilities associated with the states of nature are 0.20 for a big demand, 0.55 for an average demand, and 0.25 for a small demand. a) The alternative that provides Andrew Thomas the greatest expected monetary value (EMV) is Small Stock Large Stock Average Stock