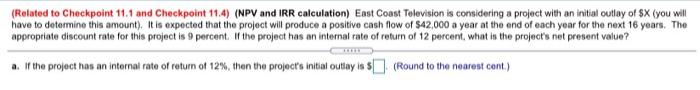

Question: please help me with this problems 6) 7) (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is considering a

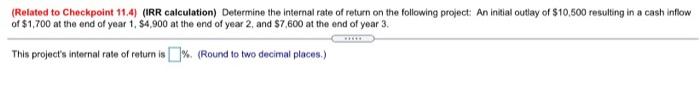

(Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is considering a project with an initial outlay of $X (you will have to determine this amount). It is expected that the project will produce a positive cash flow of 542,000 a year at the end of each year for the next 16 years. The appropriate discount rate for this project is 9 percent. If the project has an internal rate of return of 12 percent, what is the project's not present value? a. If the project has an internal rate of return of 12%, then the projects initial outlay is $(Round to the nearest cont.) (Related to Checkpoint 11.4) (IRR calculation) Determine the Internal rate of return on the following project: An initial outlay of $10,500 resulting in a cash inflow of $1,700 at the end of year 1, $4,900 at the end of year 2, and $7,600 at the end of year 3. This project's internal rate of return is [% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts