Question: Please help me with this question. #4. (18 marks) Silly Cow Farm wants to purchase brand new equipment for their farm for $270,000. Its physical

Please help me with this question.

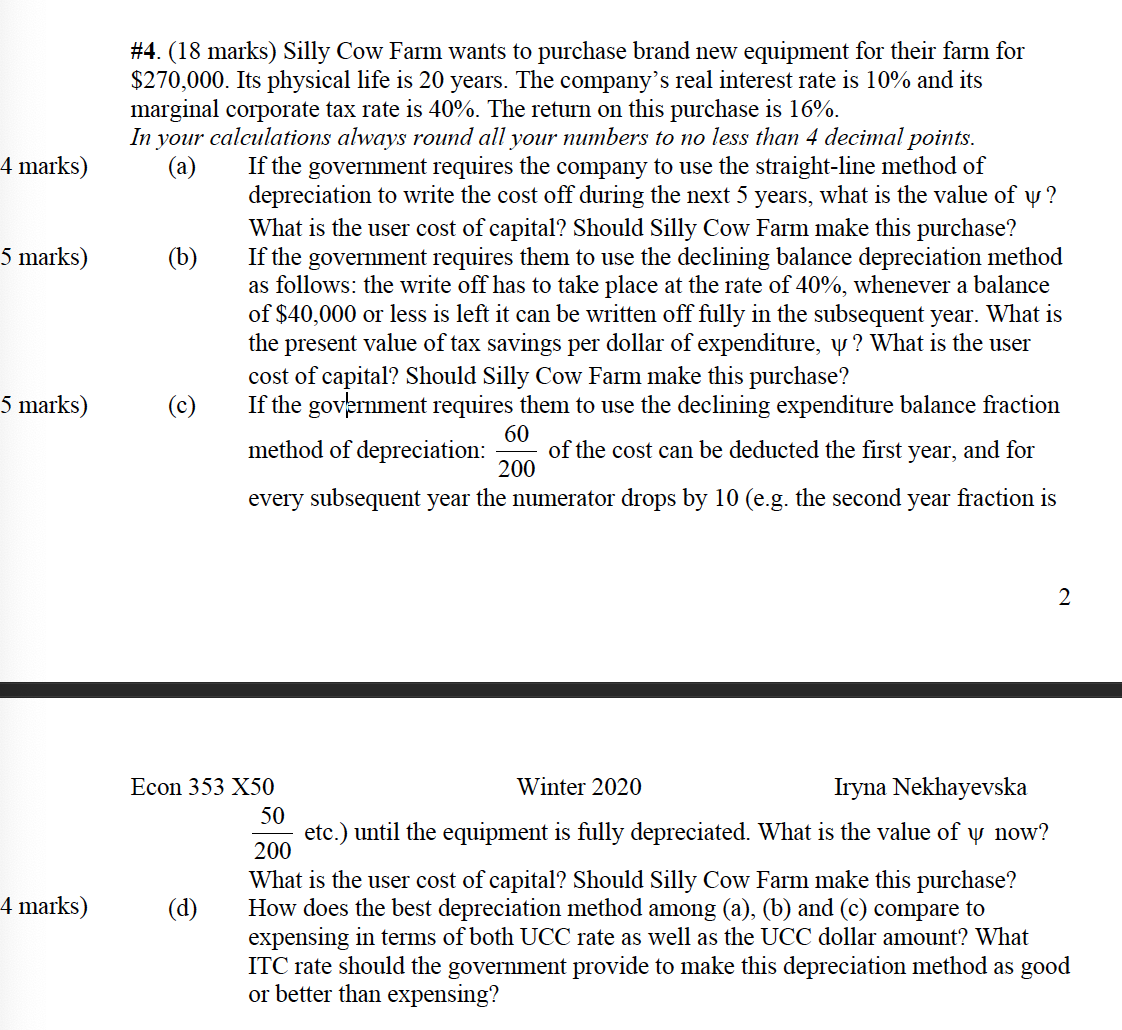

#4. (18 marks) Silly Cow Farm wants to purchase brand new equipment for their farm for $270,000. Its physical life is 20 years. The company's real interest rate is 10% and its marginal corporate tax rate is 40%. The return on this purchase is 16%. In your calculations always round all your numbers to no less than 4 decimal points. 4 marks) (a) Ifthe govermnent requires the company to use the straight-line method of depreciation to write the cost off during the next 5 years, what is the value of q; ? What is the user cost of capital? Should Silly Cow Farm make this purchase? 5 marks) (b) Ifthe govermnent requires them to use the declining balance depreciation method as follows: the write off has to take place at the rate of 40%, whenever a balance of $40,000 or less is left it can be written o' fully in the subsequent year. What is the present value of tax savings per dollar of expenditure, u! ? What is the user cost of capital? Should Silly Cow Farm make this purchase? 5 marks) (0) Ifthe govhrmnent requires them to use the declining expenditure balance fraction method of depreciation: i of the cost can be deducted the rst year, and for 200 every subsequent year the numerator drops by 10 (e. g. the second year fraction is Econ 353 X50 Winter 2020 Iryna Nekhayevska % etc.) until the equipment is fully depreciated. What is the value of u; now? What is the user cost of capital? Should Silly Cow Farm make this purchase? 4 marks) (d) How does the best depreciation method among (a), (b) and (0) compare to expensing in terms of both UCC rate as well as the UCC dollar amount? What lTC rate should the government provide to make this depreciation method as good or better than expensing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts