Question: Please help me with this question! 6) In this problem we try to complete the class notes regarding the Geman-El Karoui-Rochet general option pricing formula.

Please help me with this question!

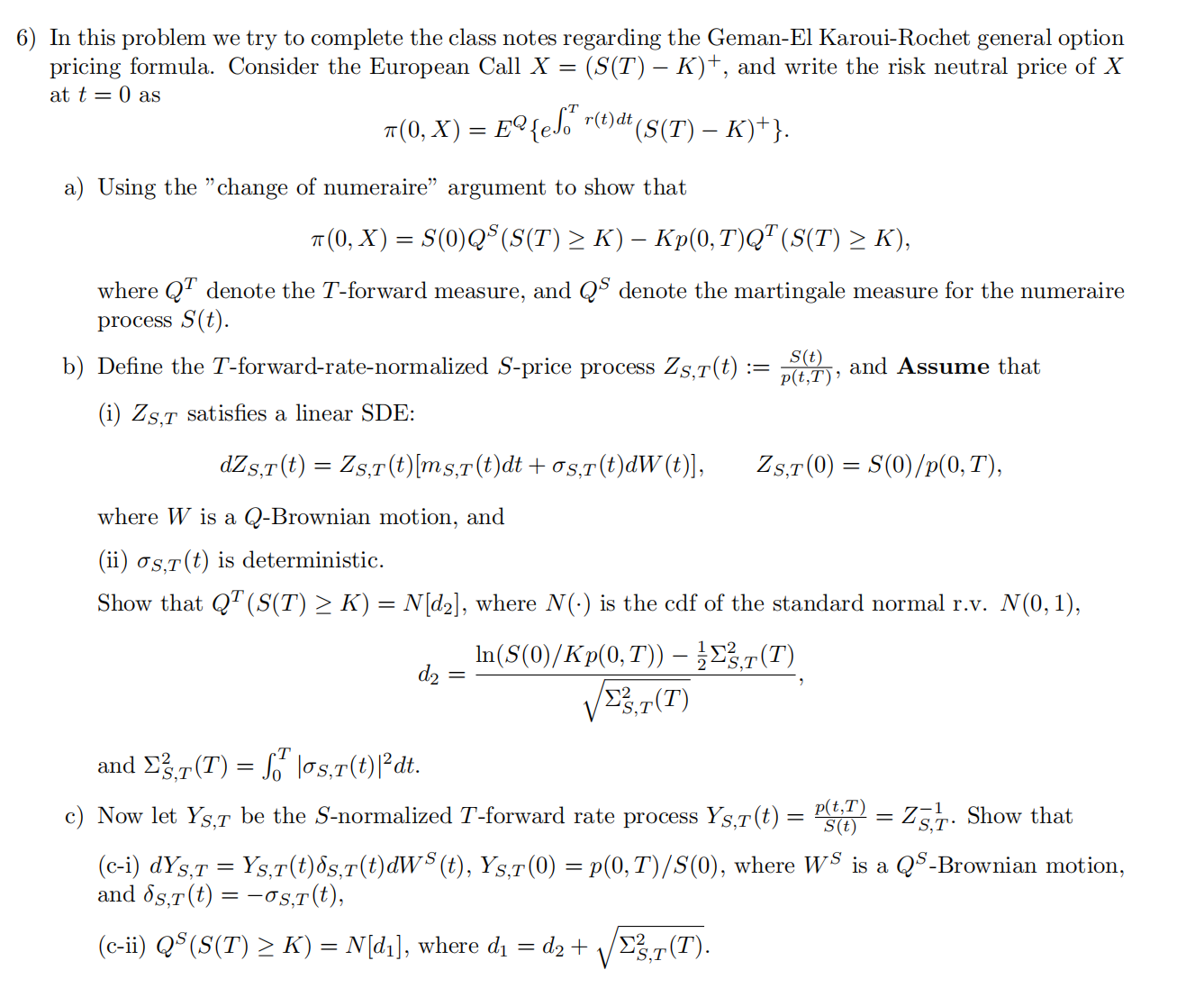

6) In this problem we try to complete the class notes regarding the Geman-El Karoui-Rochet general option pricing formula. Consider the European Call X = (S(T) - K)+, and write the risk neutral price of X at t = 0 as T ( 0, X) = EQ teJo r(t) at ( S ( T) - K)+ }. a) Using the "change of numeraire" argument to show that 7 ( 0, X ) = S( 0) Q s ( S ( T ) 2 K) - Kp( 0, T) QT ( S( T) > K), where Q" denote the T-forward measure, and Q5 denote the martingale measure for the numeraire process S(t). b) Define the T-forward-rate-normalized S-price process Zs,T(t) := so p(t,T) , and Assume that (i) Zs,T satisfies a linear SDE: dZs,T (t) = Zs,T(t) [ms,r(t) dt + os,r(t)dW(t)], Zs, r (0) = S(0) / p(0, I), where W is a Q-Brownian motion, and (ii) os,T(t) is deterministic. Show that Q" (S(T) 2 K) = N[d2], where N(.) is the cdf of the standard normal r.v. N(0, 1), In(S(0) / Kp(0, T)) - E3,I( T) d2 = VE'S, I ( I) and E'3,T(T) = So los,r(t) |2dt. c) Now let Ys,T be the S-normalized T-forward rate process Ys,r(t) = P94 = ZST. Show that (c-i) dys,T = Ys,r(t)8s,r(t)dws(t), Ys,r(0) = p(0, T)/S(0), where WS is a Q5-Brownian motion, and os,T (t) = -Os,T(t), (c-ii) Qs (S(T) 2 K) = N[di], where di = d2 + E's,I(T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts