Question: Please help me with this question and answer it completely. Thank you very much! Question 4 (15 marks) ABC Ltd. considers to issue $100mil debts

Please help me with this question and answer it completely. Thank you very much!

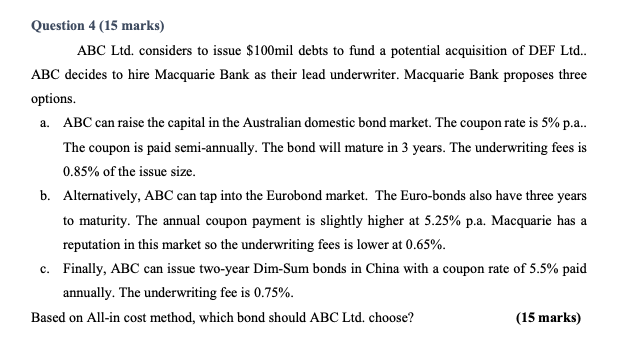

Question 4 (15 marks) ABC Ltd. considers to issue $100mil debts to fund a potential acquisition of DEF Ltd.. ABC decides to hire Macquarie Bank as their lead underwriter. Macquarie Bank proposes three options a. ABC can raise the capital in the Australian domestic bond market. The coupon rate is 5% p.... The coupon is paid semi-annually. The bond will mature in 3 years. The underwriting fees is 0.85% of the issue size. b. Alternatively, ABC can tap into the Eurobond market. The Euro-bonds also have three years to maturity. The annual coupon payment is slightly higher at 5.25% p.a. Macquarie has a reputation in this market so the underwriting fees is lower at 0.65%. c. Finally, ABC can issue two-year Dim-Sum bonds in China with a coupon rate of 5.5% paid annually. The underwriting fee is 0.75%. Based on All-in cost method, which bond should ABC Ltd. choose? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts