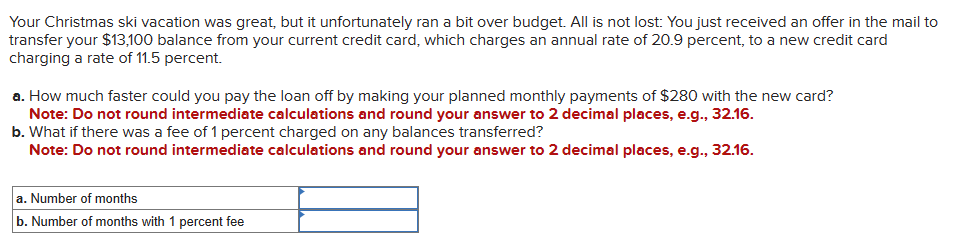

Question: Please Help me with this question and explain how to calculate Your Christmas ski vacation was great, but it unfortunately ran a bit over budget.

Please Help me with this question and explain how to calculate

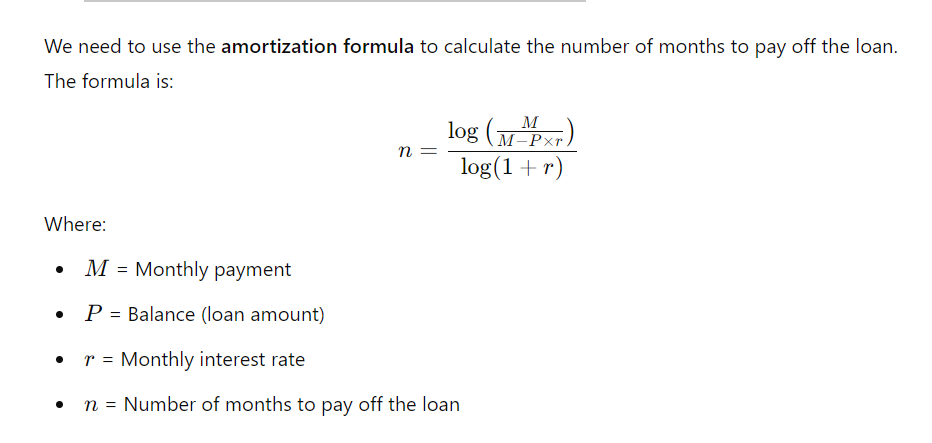

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

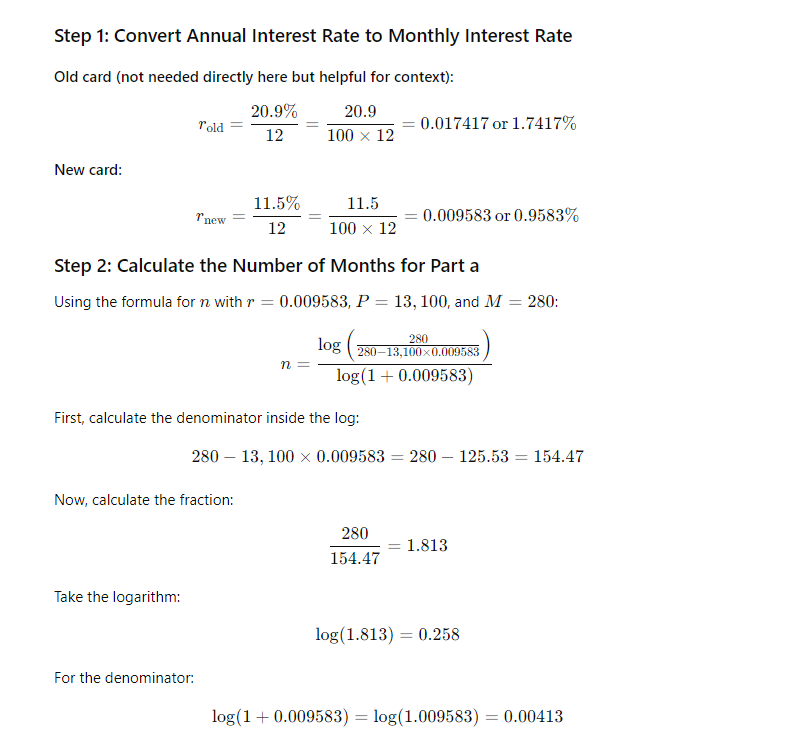

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

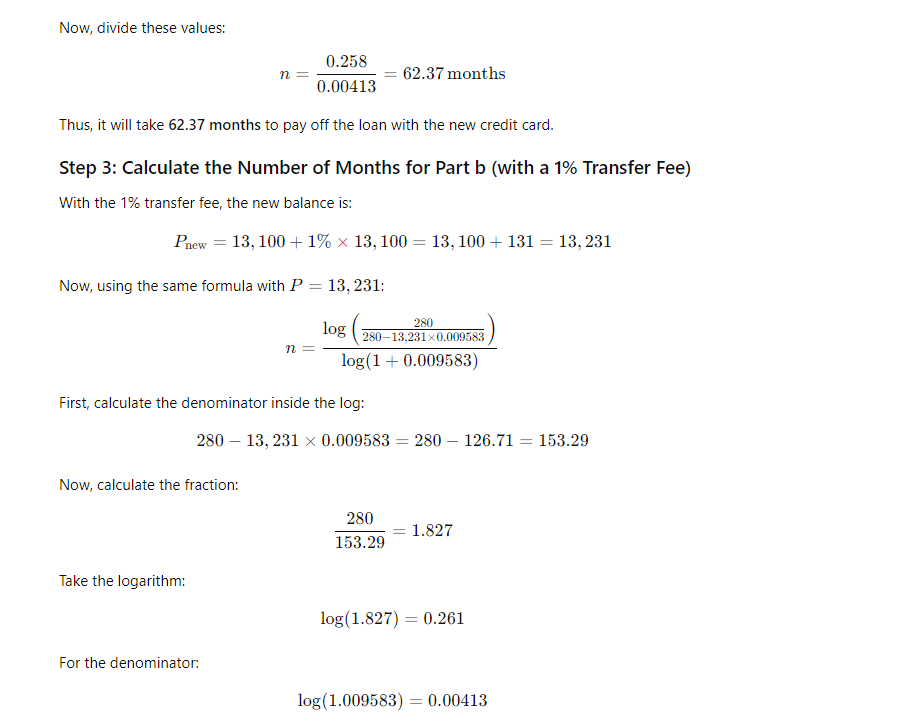

Step: 2 Unlock

Step: 3 Unlock