Question: please help me with this question and it has 3 subquestions. GBC Corp. has annual sales of RM100,000,000 with cost of goods sold of RM50,735,000

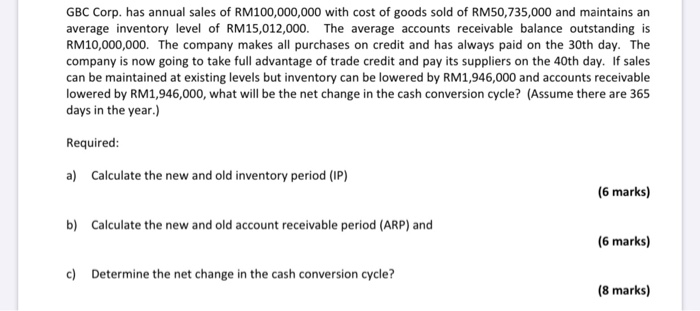

GBC Corp. has annual sales of RM100,000,000 with cost of goods sold of RM50,735,000 and maintains an average inventory level of RM15,012,000. The average accounts receivable balance outstanding is RM10,000,000. The company makes all purchases on credit and has always paid on the 30th day. The company is now going to take full advantage of trade credit and pay its suppliers on the 40th day. If sales can be maintained at existing levels but inventory can be lowered by RM1,946,000 and accounts receivable lowered by RM1,946,000, what will be the net change in the cash conversion cycle? (Assume there are 365 days in the year.) Required: a) Calculate the new and old inventory period (IP) (6 marks) b) Calculate the new and old account receivable period (ARP) and (6 marks) c) Determine the net change in the cash conversion cycle? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts