Question: please help me with this question and please explain it clearly how i get that number. i get stuck on this one :( thank you

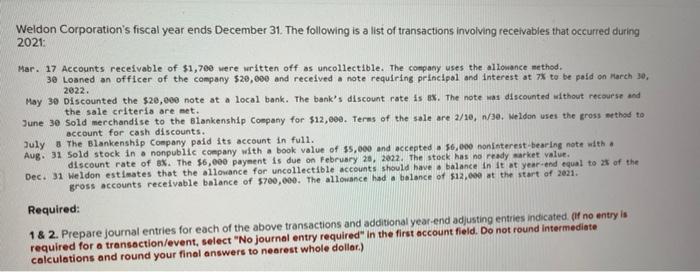

Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving recelvables that occurred during 2021: Mar. 17 Accounts receivable of $1,700 were written off as uncollectible. The conpany uses the allowance aethod. 30 Loaned an officer of the company $20,000 and recelved a note requiring princlpol and interest at 75 to be poid on rarch 30 , 2022. May 30 Discounted the $20,000 note at a local bank. The bank's discount rate is ax. The note was discounted without recourse and the sale criteria are met. June 30 5old mecchandise to the Blankenship Coepany for $12,000. Terns of the sale are 2/10,n/30. Weldon wses the gross wethod to account for cash discounts. July 8 The Blankenship Company paid its account in full. Aug. 31 Sold stock in a nonpublic company with a book value of 35,000 and accepted a 56,000 noniaterest-bearing note with a discount rate of ax. The $6,000 paynent is due on februsry 20, 2022. The stock has no ready aarket value. Dec. 31 Weldon estleates that the allowance for uncollectible accounts should have a balance in It ot year-end equal to 25 of the gross accounts recelvable balance of 5700,000 . The allowance had a belance of s12, 000 at the start of 2021. Required: 18 2. Prepare journal entries for each of the above transactions and additional year-end adjusting enties indicated (If no entry is required for a transection/event, select "No journal entry required" in the first account field. Do not round intermediate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts