Question: Please help me with this question CP 10-3 On January 1, 2019, the date of bond authorization, Sydney Corp. issued 3-year, 12-per cent bonds with

Please help me with this question

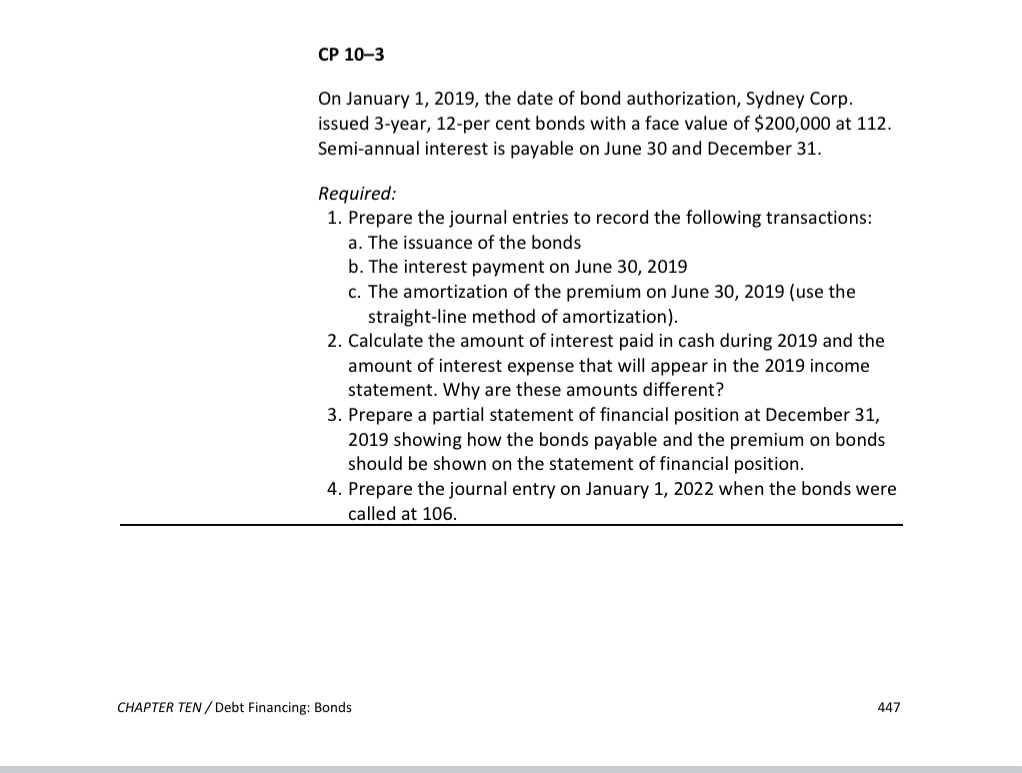

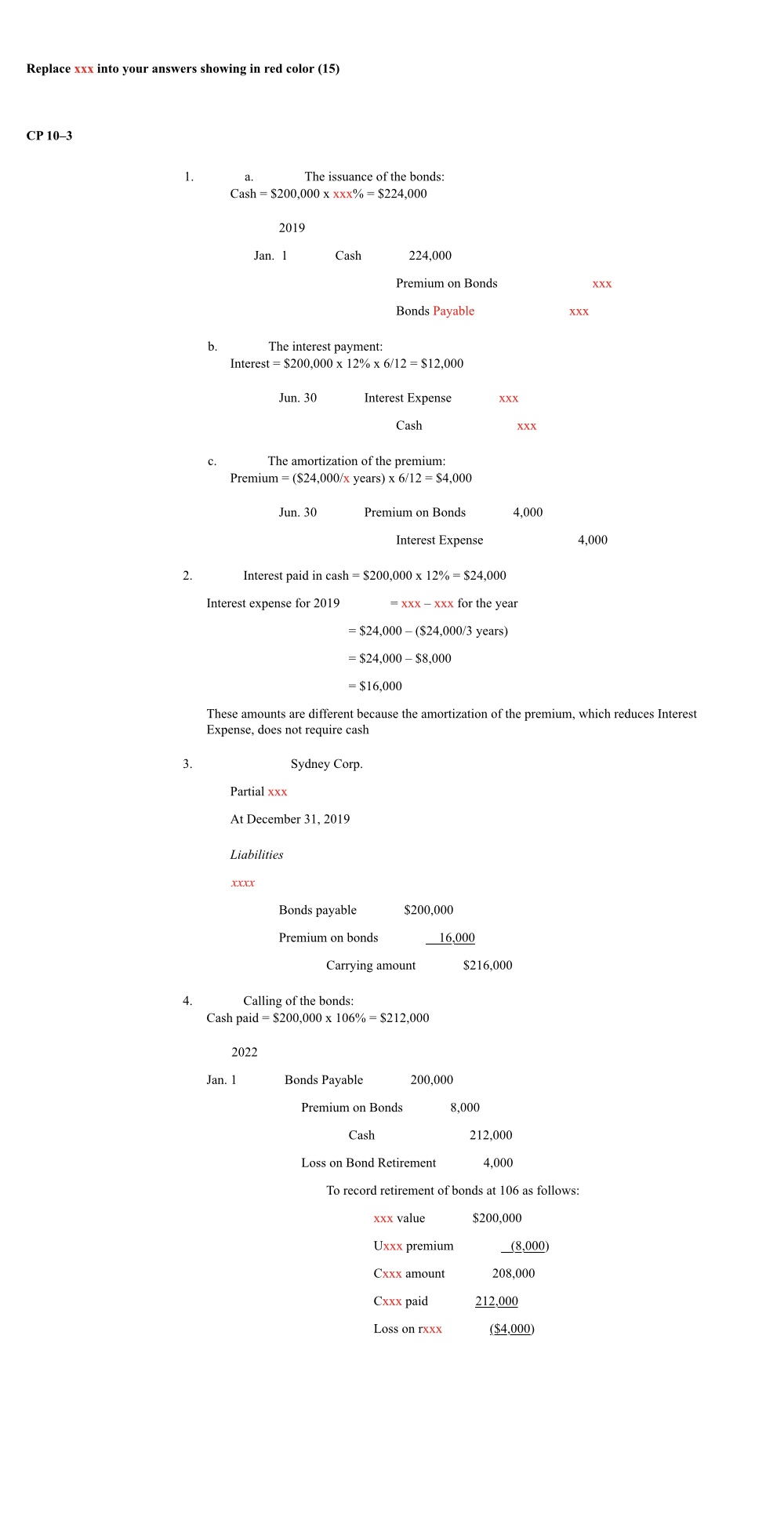

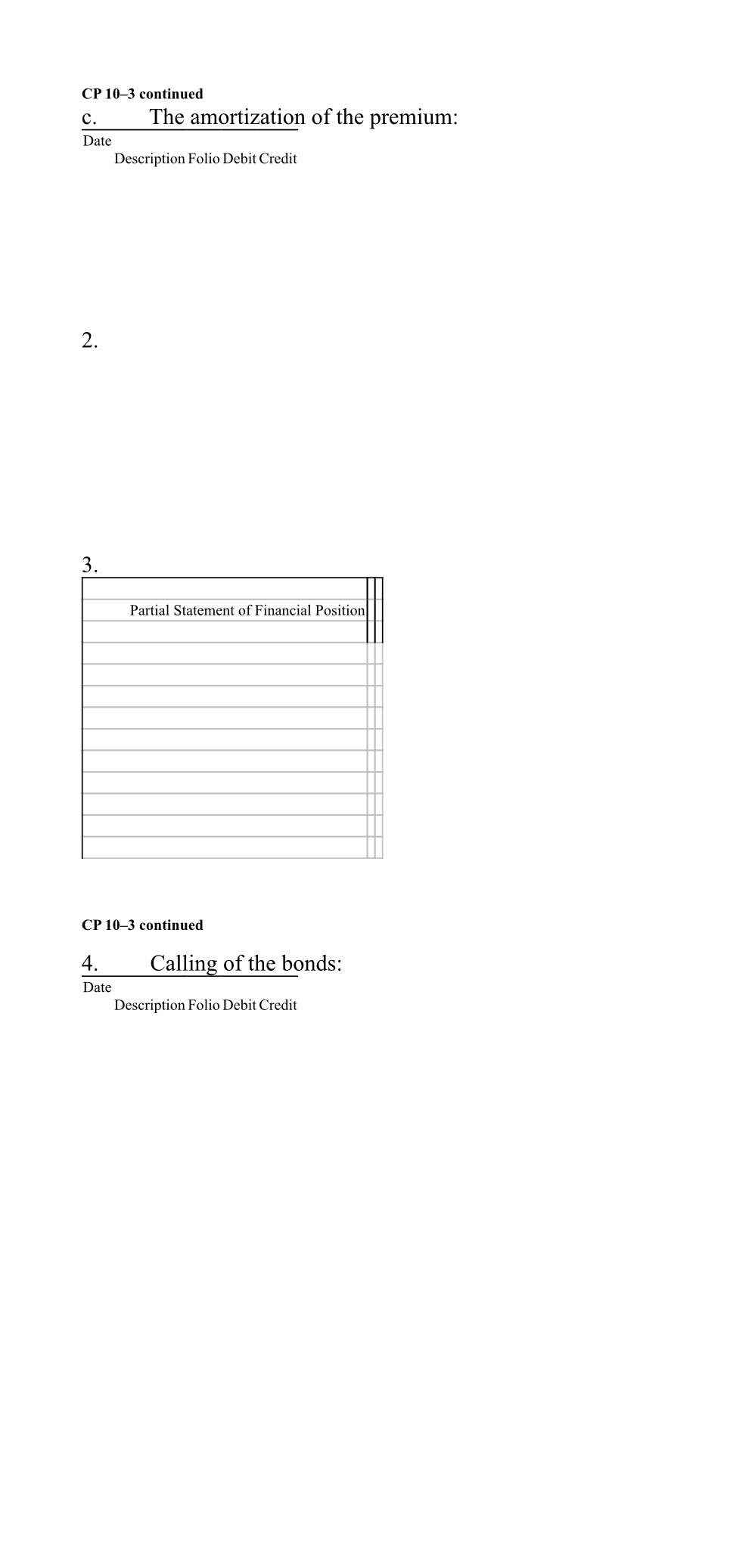

CP 10-3 On January 1, 2019, the date of bond authorization, Sydney Corp. issued 3-year, 12-per cent bonds with a face value of $200,000 at 112. Semi-annual interest is payable on June 30 and December 31. Required: 1. Prepare the journal entries to record the following transactions: a. The issuance of the bonds b. The interest payment on June 30, 2019 c. The amortization of the premium on June 30, 2019 {use the straight-line method of amortization}. 2. Calculate the amount of interest paid in cash during 2019 and the amount of interest expense that will appear in the 2019 income statement. Why are these amounts different? 3. Prepare a partial statement ofnancial position at December 31, 2019 showing how the bonds payable and the premium on bonds should be shown on the statement of financial position. 4. Prepare the journal entry on January 1, 2022 when the bonds were called at 106. CHAPTER TEN/Debt Financing: Bonds 44? Replace xxx intn your answers showing in red color (15) (3? 103 1. a. The issuance of the bonds: Cash = $200,000 x xxx% = $224,000 2019 Jan. 1 Cash 224,000 Premium 0n Bonds xxx Bonds Payable xxx 13. The interest payment: Interest= $200,000 x 12% x 61'12 = $12,000 Jun 30 Interest Expense xxx Cash xxx 0. The amnrtization 0f the premium: Premium = {$24,000fx years) x 6! 12 = $4,000 Jun. 30 Premium on Bonds 4,000 Interest Expense 4,000 2 Interest paid in cash = $200,000 x 12% = $24,000 Interest expense for 2019 = xxx xxx for the year = $24,000 ($240000 years} : $24,000 7 38,000 = $16,000 These amounts are different because the amortization of the premium, which reduces Interest Expense. does not require cash 3_ Sydney Corp. Partial xxx AtDecember3l.2019 Liabilities WK Bonds payable $200,000 Premium on bonds Aw Carrying amuunl $216,000 4, Calling of the bonds: Cash paid = $200,000 x 106% = $212,000 2022 Jan. 1 Bends Payable 200,000 Premium on Bonds 8,000 Cash 212.000 Loss nn Bond Retirement 4,000 To record retirement of bonds at 106 as follows: xxx value $200,000 Uxxx premium ) Cxxx amount 208,000 Cxxx paid m Loss on rxxx (gm CP 103 continued c. The amortization of the premium: Date Description Folio Debit Credit CP 10-3 continued 4. Calling of the bonds: Date Description Folio Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts