Question: Please help me with this question. Part 1 - Scenario Study (30 marks) Expected Rate of Return Counter- Utility High-Tech Cyclical Treasury Bill Index Fund

Please help me with this question.

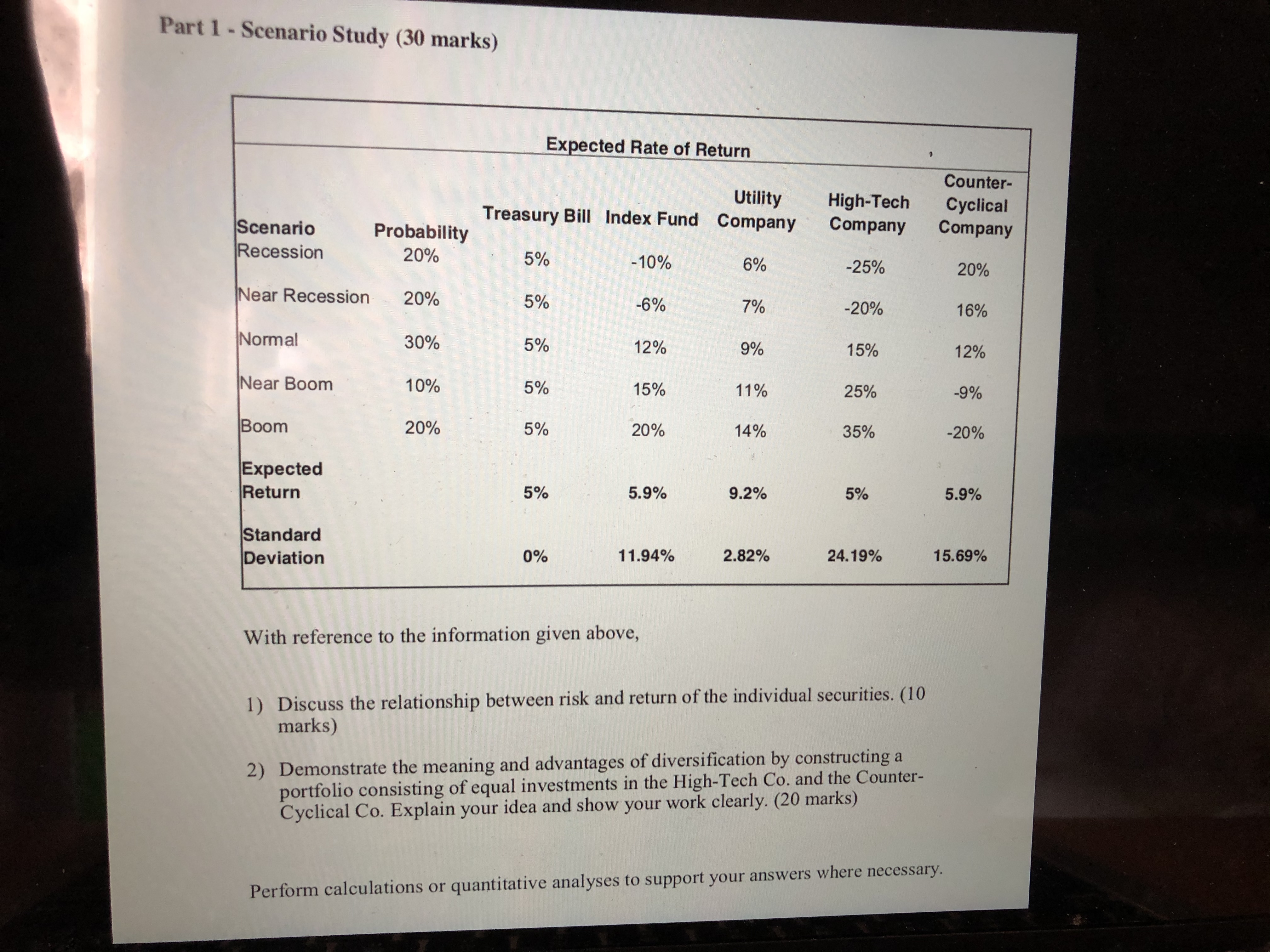

Part 1 - Scenario Study (30 marks) Expected Rate of Return Counter- Utility High-Tech Cyclical Treasury Bill Index Fund Company Company Company Scenario Probability Recession 20% 5% -10% 6% -25% 20% Near Recession 20% 5% -6% 7% -20% 16% Normal 30% 5% 12% 9% 15% 12% Near Boom 10% 5% 15% 11% 25% 9% Boom 20% 5% 20% 14% 35% -20% Expected 5% 5.9% 5% 5.9% Return 9.2% Standard 0% 11.94% 2.82% 24.19% 15.69% Deviation With reference to the information given above, 1) Discuss the relationship between risk and return of the individual securities. (10 marks) 2) Demonstrate the meaning and advantages of diversification by constructing a portfolio consisting of equal investments in the High-Tech Co. and the Counter- Cyclical Co. Explain your idea and show your work clearly. (20 marks) Perform calculations or quantitative analyses to support your answers where necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts