Question: please help me with this question. please explain and be clear. The following data were taken from the balance sheet accounts of Pronghorn Corporation on

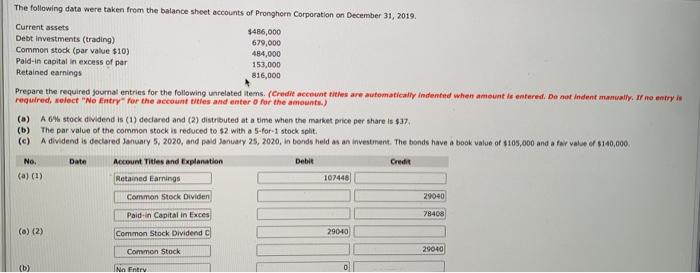

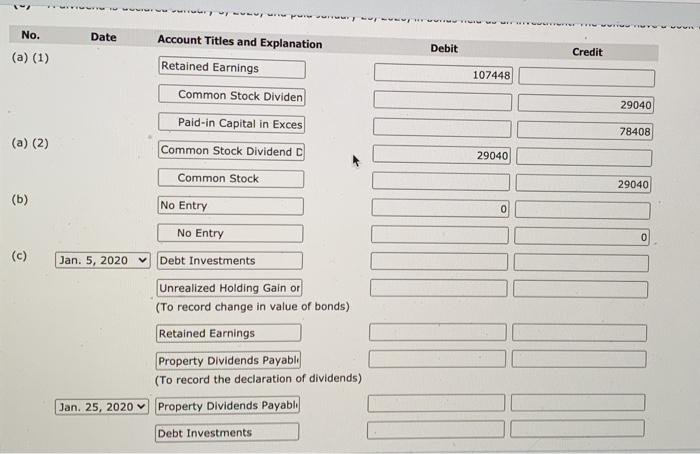

The following data were taken from the balance sheet accounts of Pronghorn Corporation on December 31, 2019 Current assets $486,000 Debt Investments (trading) 679,000 Common stock (par value $10) 484,000 Pald-in capital in excess of par 153,000 Retained earnings 816,000 Prepare the required journal entries for the following unrelated items. (Credit account titles are automatically indented when amount de entered Do not Indent manually. If no entry required, select "No Entry for the account titles and enter for the amounts.) (a) A6% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $37 (b) The par value of the common stock is reduced to $2 with a 5-for-1 stock split (c) A dividend is declared January 5, 2020, and paid January 25, 2020, in bonds held as an investment. The bonds have a book value of $105,000 and a far vale 140,000 No. Date Account Titles and Explanation Debit Credit (a) (1) Retained Earnings 107448 Common Stock Dividen 29040 Paid-in Capital in Exces 78408 (0) (2) Common Stock Dividend C 29040 Common Stock 29040 (b) N Ent 0 vu No. Date Debit Credit (a) (1) Account Titles and Explanation Retained Earnings Common Stock Dividen 107448 29040 Paid-in Capital in Exces 78408 (a) (2) Common Stock Dividend D 29040 Common Stock 29040 (b) 0 No Entry No Entry 0 (c) Jan. 5, 2020 Debt Investments Unrealized Holding Gain or (To record change in value of bonds) Retained Earnings Property Dividends Payabli (To record the declaration of dividends) Jan. 25, 2020 Property Dividends Payabl Debt Investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts