Question: please help me with this question Question 1 (14 marks - 26 minutes) Rose Apothecary Ltd.s comparative balance sheets at December 31, 20x2 and 20x1,

please help me with this question

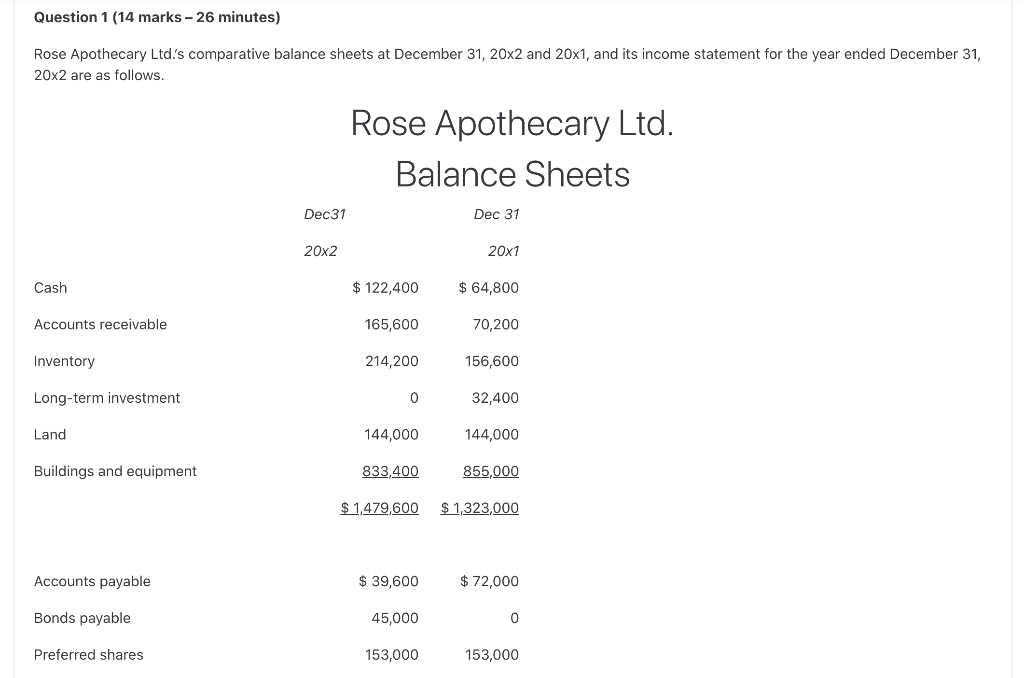

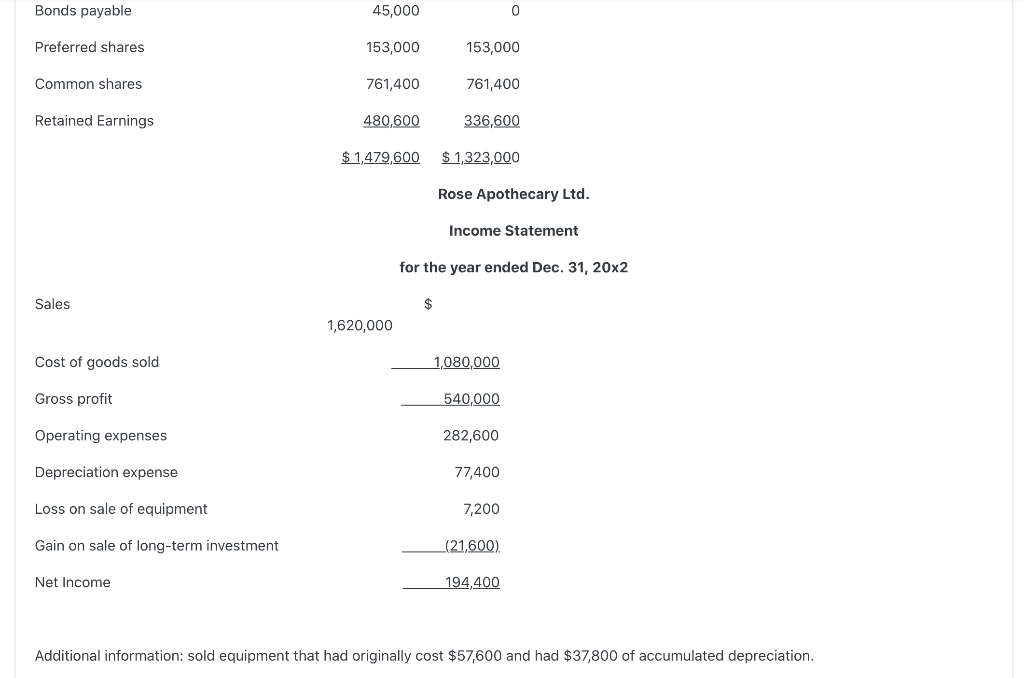

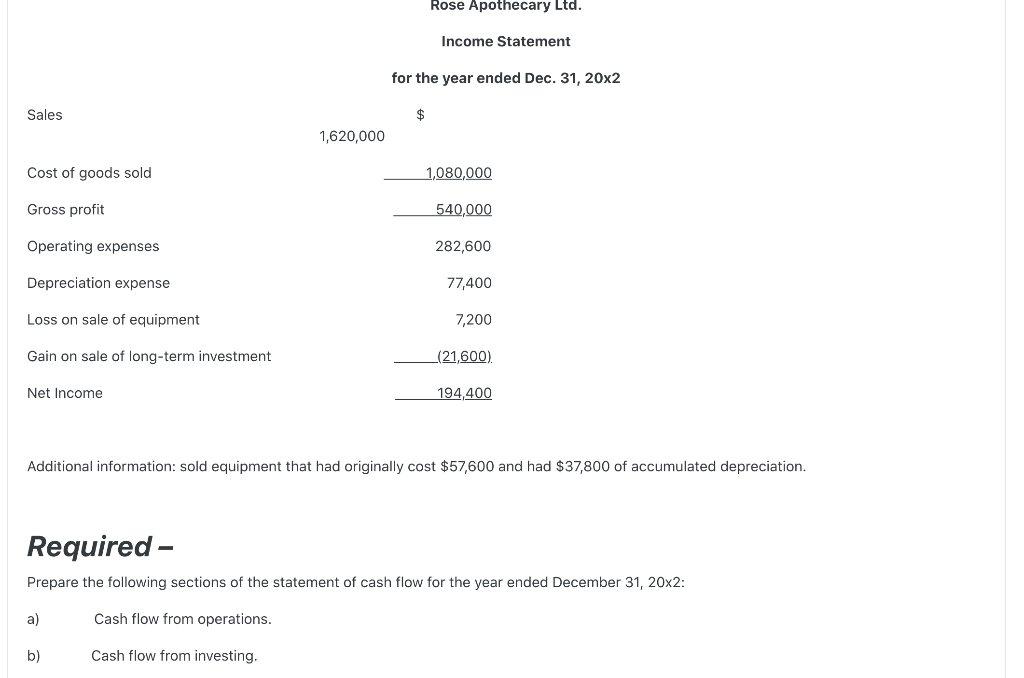

Question 1 (14 marks - 26 minutes) Rose Apothecary Ltd.s comparative balance sheets at December 31, 20x2 and 20x1, and its income statement for the year ended December 31, 20x2 are as follows. Rose Apothecary Ltd. Balance Sheets Dec 31 Dec 31 20x2 20x1 Cash $ 122,400 $ 64,800 Accounts receivable 165,600 70,200 Inventory 214,200 156,600 Long-term investment 0 32,400 Land 144,000 144,000 Buildings and equipment 833,400 855,000 $ 1,479,600 $ 1,323,000 Accounts payable $ 39,600 $ 72,000 Bonds payable 45,000 0 Preferred shares 153,000 153,000 Bonds payable 45,000 0 Preferred shares 153,000 153,000 Common shares 761,400 761,400 Retained Earnings 480,600 336,600 $ 1,479,600 $ 1,323,000 Rose Apothecary Ltd. Income Statement for the year ended Dec. 31, 20x2 Sales $ 1,620,000 Cost of goods sold 1,080,000 Gross profit 540,000 Operating expenses 282,600 Depreciation expense 77,400 Loss on sale of equipment 7,200 Gain on sale of long-term investment (21,600) Net Income 194,400 Additional information: sold equipment that had originally cost $57,600 and had $37,800 of accumulated depreciation. Rose Apothecary Ltd. Income Statement for the year ended Dec. 31, 20x2 Sales $ 1,620,000 Cost of goods sold 1,080,000 Gross profit 540,000 Operating expenses 282,600 Depreciation expense 77,400 Loss on sale of equipment 7,200 Gain on sale of long-term investment (21,600). Net Income 194,400 Additional information: sold equipment that had originally cost $57,600 and had $37,800 of accumulated depreciation. Required - Prepare the following sections of the statement of cash flow for the year ended December 31, 20x2: a) Cash flow from operations. b) Cash flow from investing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts