Question: please help me with this question. Question 6 Loic is planning to purchase a Treasury bond paying a (i j2 coupon rate of 1.84% p.a.

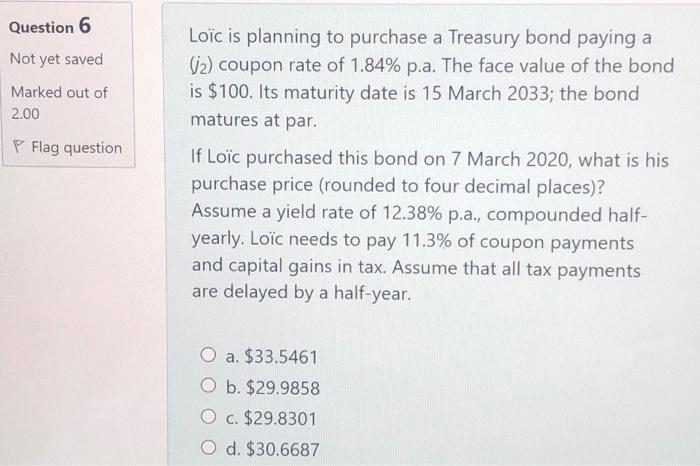

Question 6 Loic is planning to purchase a Treasury bond paying a (i j2 coupon rate of 1.84% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loc purchased this bond on 7 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 12.38% p.a., compounded halfyearly. Loc needs to pay 11.3% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year. a. $33.5461 b. $29.9858 c. $29.8301 d. $30.6687

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts