Question: Please help me with this question, specifically part B and please show your work. Thank you [Time Traveler] You're walking in the Arboretum, enjoying a

Please help me with this question, specifically part B and please show your work. Thank you

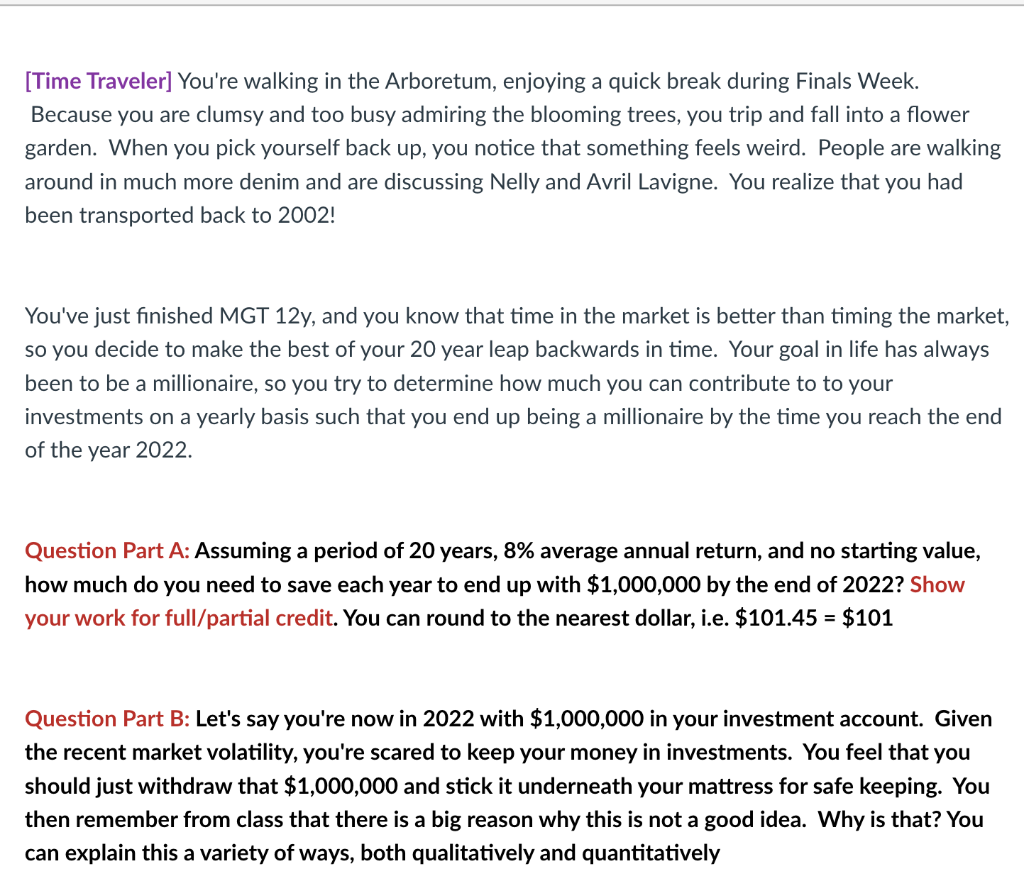

[Time Traveler] You're walking in the Arboretum, enjoying a quick break during Finals Week. Because you are clumsy and too busy admiring the blooming trees, you trip and fall into a flower garden. When you pick yourself back up, you notice that something feels weird. People are walking around in much more denim and are discussing Nelly and Avril Lavigne. You realize that you had been transported back to 2002! You've just finished MGT 12y, and you know that time in the market is better than timing the market, so you decide to make the best of your 20 year leap backwards in time. Your goal in life has always been to be a millionaire, so you try to determine how much you can contribute to to your investments on a yearly basis such that you end up being a millionaire by the time you reach the end of the year 2022. Question Part A: Assuming a period of 20 years, 8% average annual return, and no starting value, how much do you need to save each year to end up with $1,000,000 by the end of 2022? Show your work for full/partial credit. You can round to the nearest dollar, i.e. $101.45 = $101 Question Part B: Let's say you're now in 2022 with $1,000,000 in your investment account. Given the recent market volatility, you're scared to keep your money in investments. You feel that you should just withdraw that $1,000,000 and stick it underneath your mattress for safe keeping. You then remember from class that there is a big reason why this is not a good idea. Why is that? You can explain this a variety of ways, both qualitatively and quantitatively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts