Question: Please help me with this question Squeaky Shine provides car washing services in Jersey City, New Jersey. A three-month pass for automatic car wash sells

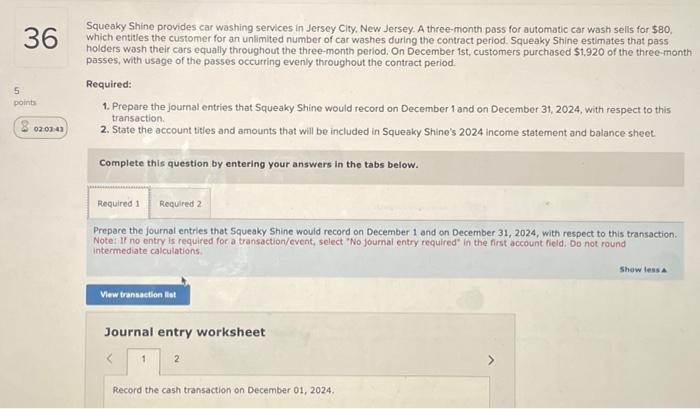

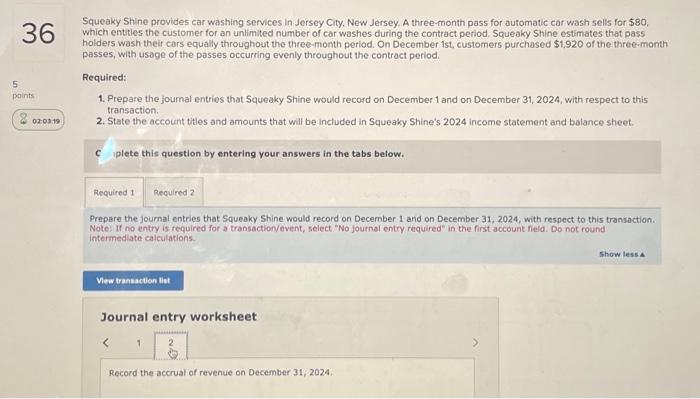

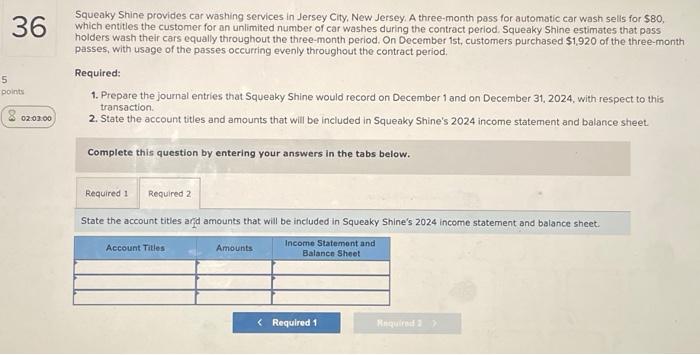

Squeaky Shine provides car washing services in Jersey City, New Jersey. A three-month pass for automatic car wash sells for $80, which entites the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the three-month period. On December ist, customers purchased $1,920 of the three-month passes, with usage of the passes occurring evenly throughout the contract period: Required: 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31,2024 , with respect to this transaction. 2. State the account titles and amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet. Complete this question by entering your answers in the tabs below. Prepare the fournal entries that Squeaky Shine would record on December 1 and on December 31, 2024, with respect to this transaction. Note: II no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Do not round intermediate calculations Journal entry worksheet 2 Record the cash transaction on December 01, 2024. Squeaky Shine provides car washing services in Jersey City, New Jersey. A three-month pass for automatic car wash sells for $80. which entities the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the three-month period. On December ist, customers purchased $1,920 of the three-month passes, with usage of the passes occurring evenly throughout the contract period. Required: 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31,2024 , with respect to this transaction. 2. State the account titles and amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet. c iplete this question by entering your answers in the tabs below. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2024, with respect to this transaction. Note: If no entry is required for a transactionvevent, select "No journal entry required" in the first account field. Do not round intermediate calculations. Journal entry worksheet Record the accrual of revenue on December 31, 2024. Squeaky Shine provides car washing services in Jersey City, New Jersey. A three-month pass for automatic car wash selis for $80, which entitles the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the three-month period. On December ist, customers purchased $1,920 of the three-month passes, with usage of the passes occurring evenly throughout the contract period. Required: 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2024, with respect to this transaction. 2. State the account titles and amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet. Complete this question by entering your answers in the tabs below. State the account titles ard amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts