Question: Please help me with this question. Thank you so much! Theme: 1. explain the purpose and format of the statement of cash flows. Also, describe

Please help me with this question. Thank you so much!

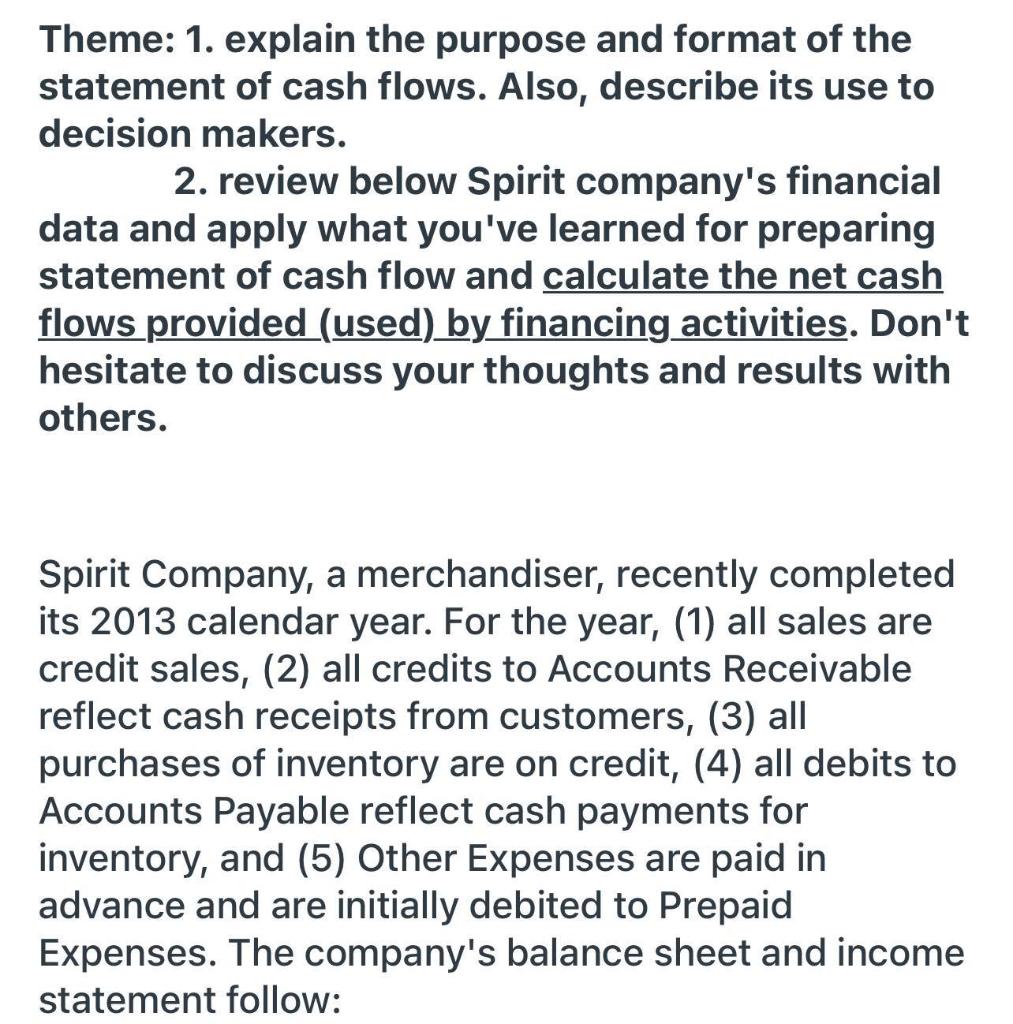

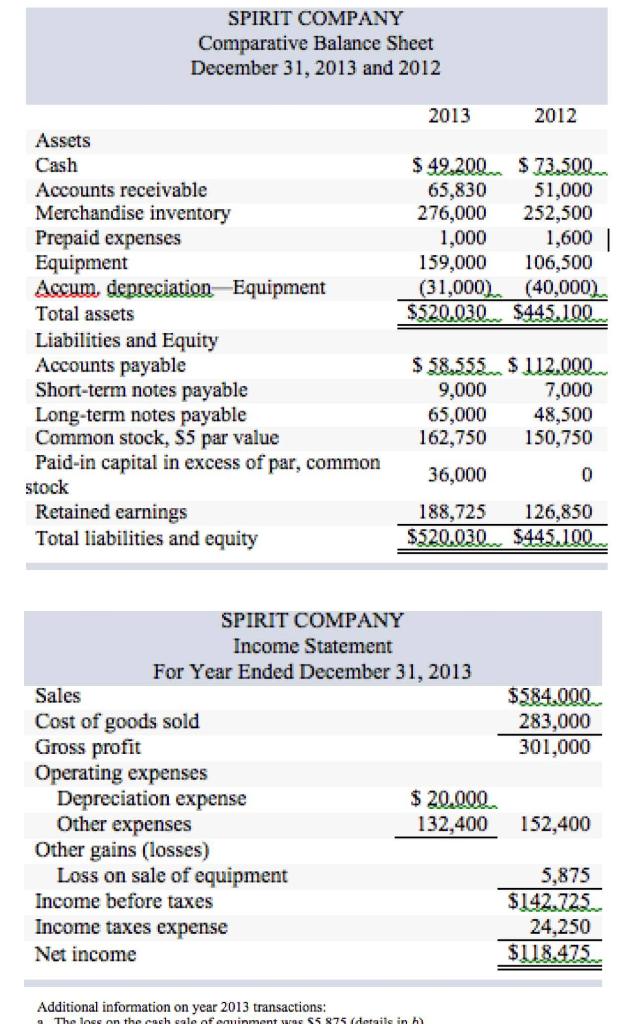

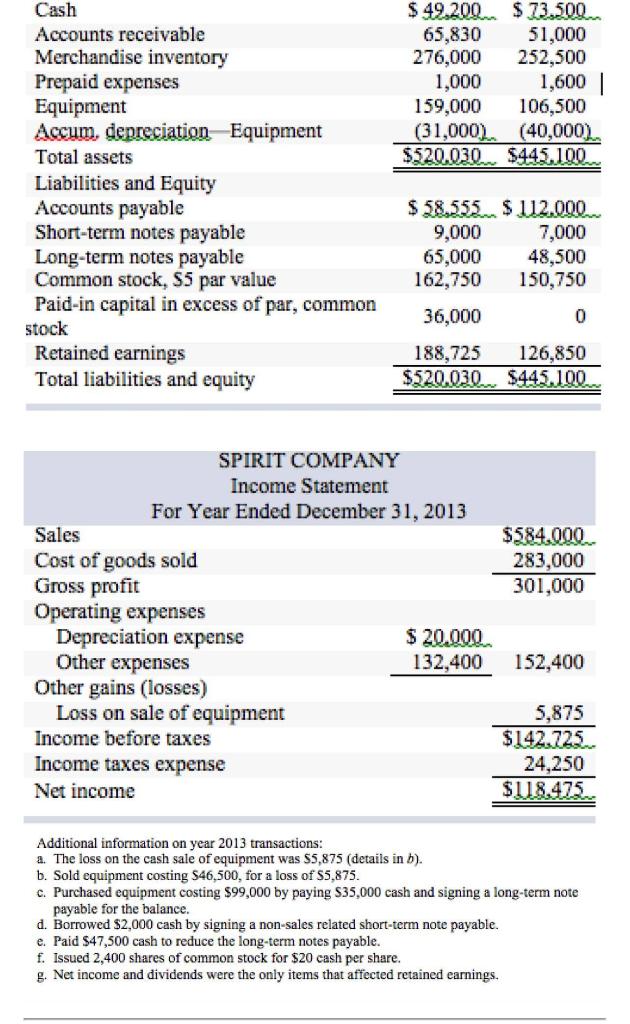

Theme: 1. explain the purpose and format of the statement of cash flows. Also, describe its use to decision makers. 2. review below Spirit company's financial data and apply what you've learned for preparing statement of cash flow and calculate the net cash flows provided (used) by financing activities. Don't hesitate to discuss your thoughts and results with others. Spirit Company, a merchandiser, recently completed its 2013 calendar year. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company's balance sheet and income statement follow: SPIRIT COMPANY Comparative Balance Sheet December 31, 2013 and 2012 2013 2012 $ 49,200 $ 73,500 65,830 51,000 276,000 252,500 1,000 1,600 159,000 106,500 (31,000). (40,000) $520.030 $445.100 Assets Cash Accounts receivable Merchandise inventory Prepaid expenses Equipment Accum depreciation Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable Long-term notes payable Common stock, S5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $ 58,555 $112.000 9,000 7,000 65,000 48,500 162,750 150,750 36,000 0 188,725 $520.030 126,850 $445.100 SPIRIT COMPANY Income Statement For Year Ended December 31, 2013 Sales $584.000 Cost of goods sold 283,000 Gross profit 301,000 Operating expenses Depreciation expense $ 20,000 Other expenses 132,400 152,400 Other gains (losses) Loss on sale of equipment 5,875 Income before taxes $142.725. Income taxes expense 24,250 Net income $118.475. Additional information on year 2013 transactions: The loss on the cash sale of cainment S5875 (details in h) $49.202 $ 73.500 65,830 51,000 276,000 252,500 1,000 1,600 159,000 106,500 (31,000) (40,000) $520.030 $445.100 Cash Accounts receivable Merchandise inventory Prepaid expenses Equipment Accum, depreciation Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable Long-term notes payable Common stock, S5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $58.555... $ 112.000 9,000 7,000 65,000 48,500 162,750 150,750 36,000 0 188,725 126,850 $520.030 $445.100 SPIRIT COMPANY Income Statement For Year Ended December 31, 2013 Sales $584.000 Cost of goods sold 283,000 Gross profit 301,000 Operating expenses Depreciation expense $ 20.000 Other expenses 132,400 152,400 Other gains (losses) Loss on sale of equipment 5,875 Income before taxes $142.725 Income taxes expense 24,250 Net income $118.475. Additional information on year 2013 transactions: a. The loss on the cash sale of equipment was $5,875 (details in b). b. Sold equipment costing S46,500, for a loss of S5,875. Purchased equipment costing $99,000 by paying $35,000 cash and signing a long-term note payable for the balance. d. Borrowed $2,000 cash by signing a non-sales related short-term note payable. e. Paid $47,500 cash to reduce the long-term notes payable. f. Issued 2,400 shares of common stock for $20 cash per share. g. Net income and dividends were the only items that affected retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts