Question: Please help me with this question. Thank you so much! Case Study Review below company's information to compute costs to products using first-in, first-out (FIFO)

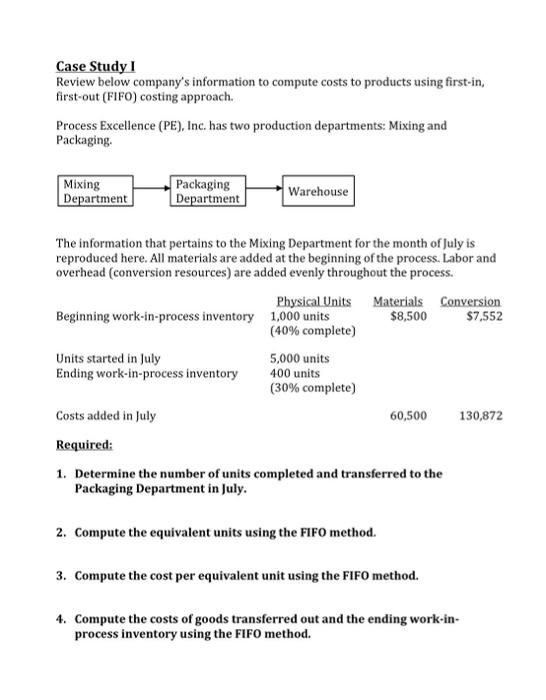

Case Study Review below company's information to compute costs to products using first-in, first-out (FIFO) costing approach. Process Excellence (PE), Inc. has two production departments: Mixing and Packaging Mixing Department Packaging Department Warehouse The information that pertains to the Mixing Department for the month of July is reproduced here. All materials are added at the beginning of the process. Labor and overhead (conversion resources) are added evenly throughout the process. Physical Units Materials Conversion Beginning work-in-process inventory 1,000 units $8,500 $7.552 (40% complete) Units started in July 5,000 units Ending work-in-process inventory 400 units (30% complete) Costs added in July 60,500 130,872 Required: 1. Determine the number of units completed and transferred to the Packaging Department in July. 2. Compute the equivalent units using the FIFO method. 3. Compute the cost per equivalent unit using the FIFO method. 4. Compute the costs of goods transferred out and the ending work-in- process inventory using the FIFO method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts