Question: Please help me with this question. Thank you so much! 1 Sunset Products manufactures skateboards. The following transactions occurred in March. 2 points 1 Purchased

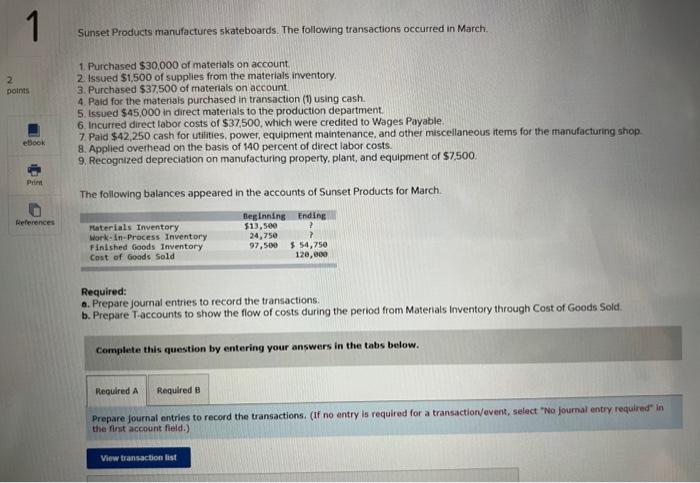

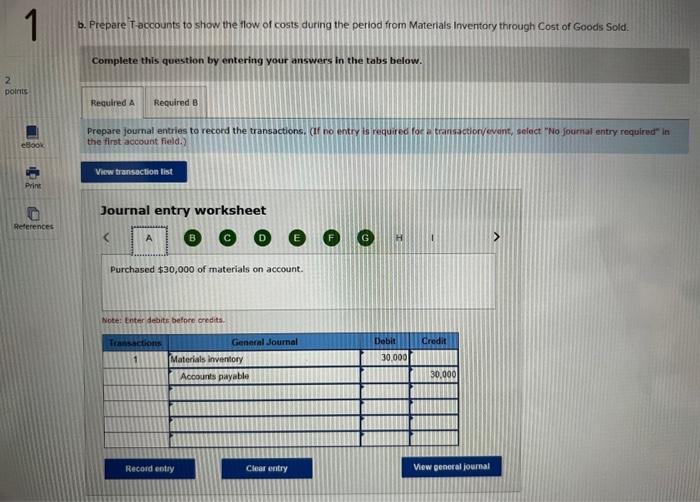

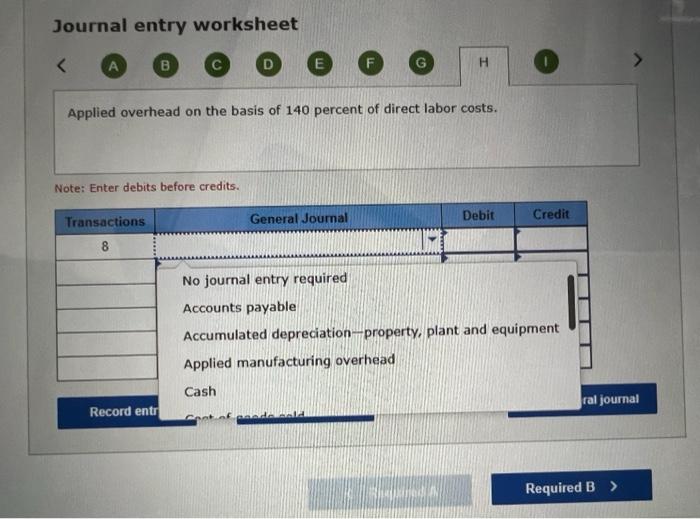

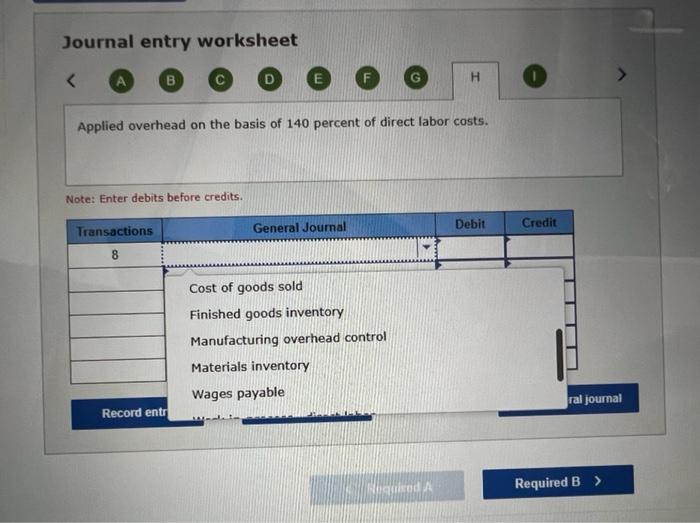

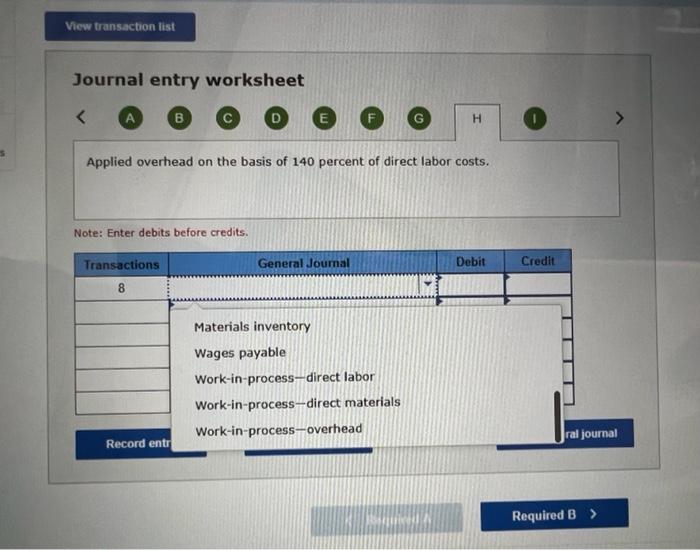

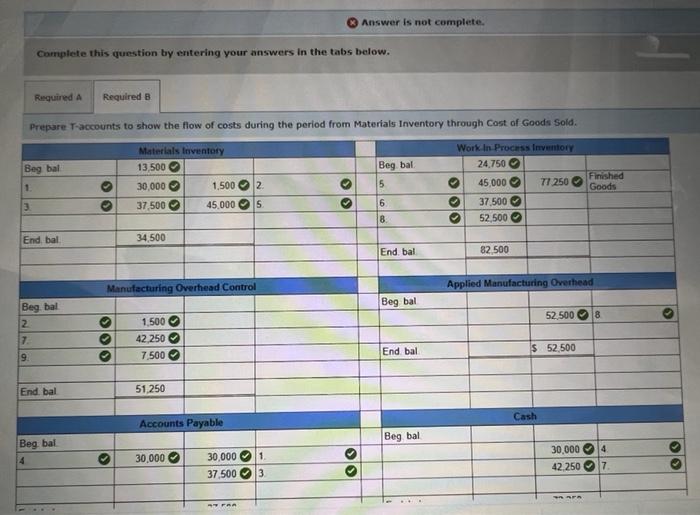

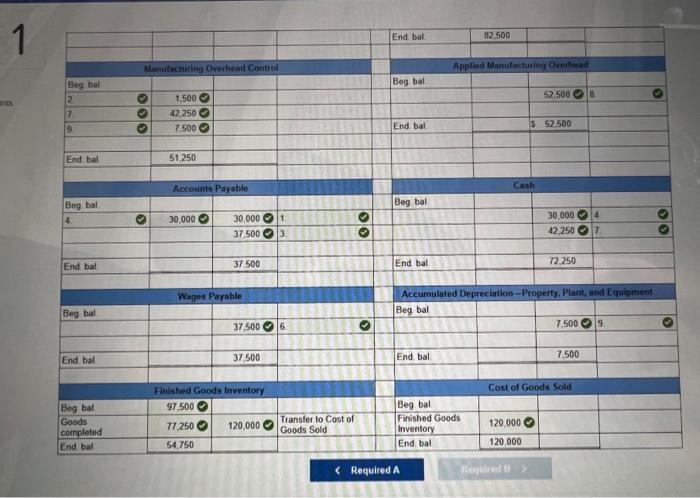

1 Sunset Products manufactures skateboards. The following transactions occurred in March. 2 points 1 Purchased $30,000 of materials on account 2. Issued $1,500 of supplies from the materials inventory 3. Purchased $37,500 of materials on account 4. Paid for the materials purchased in transaction (1) using cash. 5. Issued $45,000 in direct materials to the production department 6. Incurred direct labor costs of $37,500, which were credited to Wages Payable 7. Paid $42,250 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop 8. Applied overhead on the basis of 140 percent of direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $7.500. ebook Print References The following balances appeared in the accounts of Sunset Products for March Beginning Ending Materials Inventory $13,500 ? Work-In-Process Inventory 24,750 > Finished Goods Inventory 97,500 $ 54,750 Cost of Goods Sold 120,000 Required: a. Prepare journal entries to record the transactions b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries to record the transactions, (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list 1 b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through cost of Goods Sold. Complete this question by entering your answers in the tabs below. 2 points Required A Required B Prepare journal entries to record the transactions. (If no entry is required for transactior/event, select "No journal entry required in the first account field.) eBook View transaction List Print Journal entry worksheet References A Purchased $30,000 of materials on account. Note: Enter debits before credits Transaction Credit General Journal Materials inventory Accounts payable Debit 30,000 30,000 Record entry Clear entry View general journal Journal entry worksheet Applied overhead on the basis of 140 percent of direct labor costs. Note: Enter debits before credits General Journal Debit Credit Transactions 8 GO No journal entry required Accounts payable Accumulated depreciation property, plant and equipment Applied manufacturing overhead Cash ral journal Record entr CAR ad Required B Journal entry worksheet B D E F H Applied overhead on the basis of 140 percent of direct labor costs. Note: Enter debits before credits Debit General Journal Transactions Credit 8 Cost of goods sold Finished goods inventory Manufacturing overhead control Materials inventory Wages payable ral journal Record entr Nagu ed A Required B) View transaction list Journal entry worksheet Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Prepare T-accounts to show the flow of costs during the period from Materials Inventory through cost of Goods Sold. Beg bal Beg bal Materials Inventory 13,500 30,000 1,5002 37.500 45.000 5 5 1 Work In Process Inventory 24,750 45,000 71 250 37.500 52 500 > 0 Finished Goods 3 6 8 End bal 34,500 End bal 82.500 Manufacturing Overhead Control Applied Manufacturing Overhead Beg bal Beg bal 52 500 8 N 7 9. Solo 1,500 42.250 7.500 End bal $ 52,500 End bal 51.250 Cash Accounts Payable Beg bal Beg bal 4 4 30,000 30,000 1 37.5003 OO 30,000 42.250 7 FRA 82.500 End bal 1 Manufacturing Overhead Control Applied Manufacturing Overhead Beg bat Beg bal 52 5000 ants 2 7 19 1,500 42.250 7.500 End bal $ 52,500 End bal 51.250 Accounts Payable Cash Beg bal Beg bal 4 30,000 30,0001 37,5003 olo 30,00014 42 2507 Olo 37.500 End bal 72 250 End bal Wages Payable Beg bal Accumulated Depreciation - PropertyPlant, and Equipment Beg bal 7,5009 37,500 6. 0 37,500 End, bal 7.500 End bal Cost of Goods Sold Beg bal Finished Goods Inventory 97,500 71 250 120,000 Transfer to Cost of Goods Sold Goods completed End bal Beg bal Finished Goods Inventory End bal 120.000 120.000 54,750 (Required A Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts