Question: Please help me with this question. The stuff I have written is just a guess. Three different lease transactions are presented below for Blossom Enterprises.

Please help me with this question. The stuff I have written is just a guess.

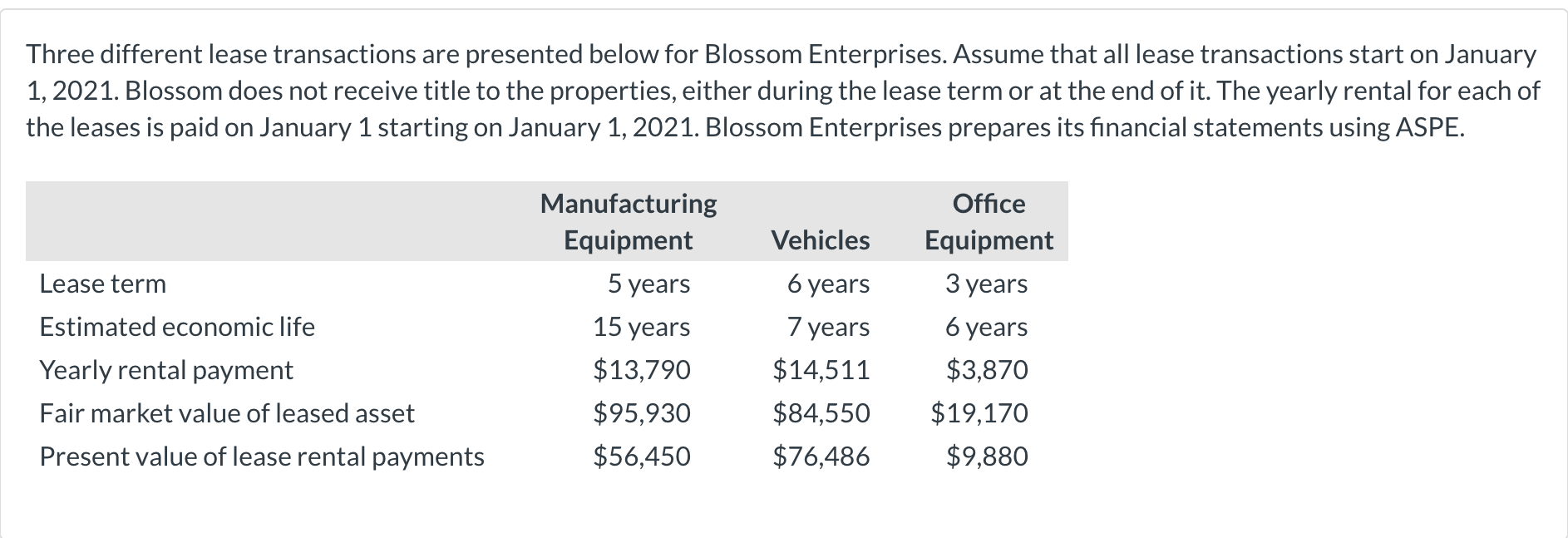

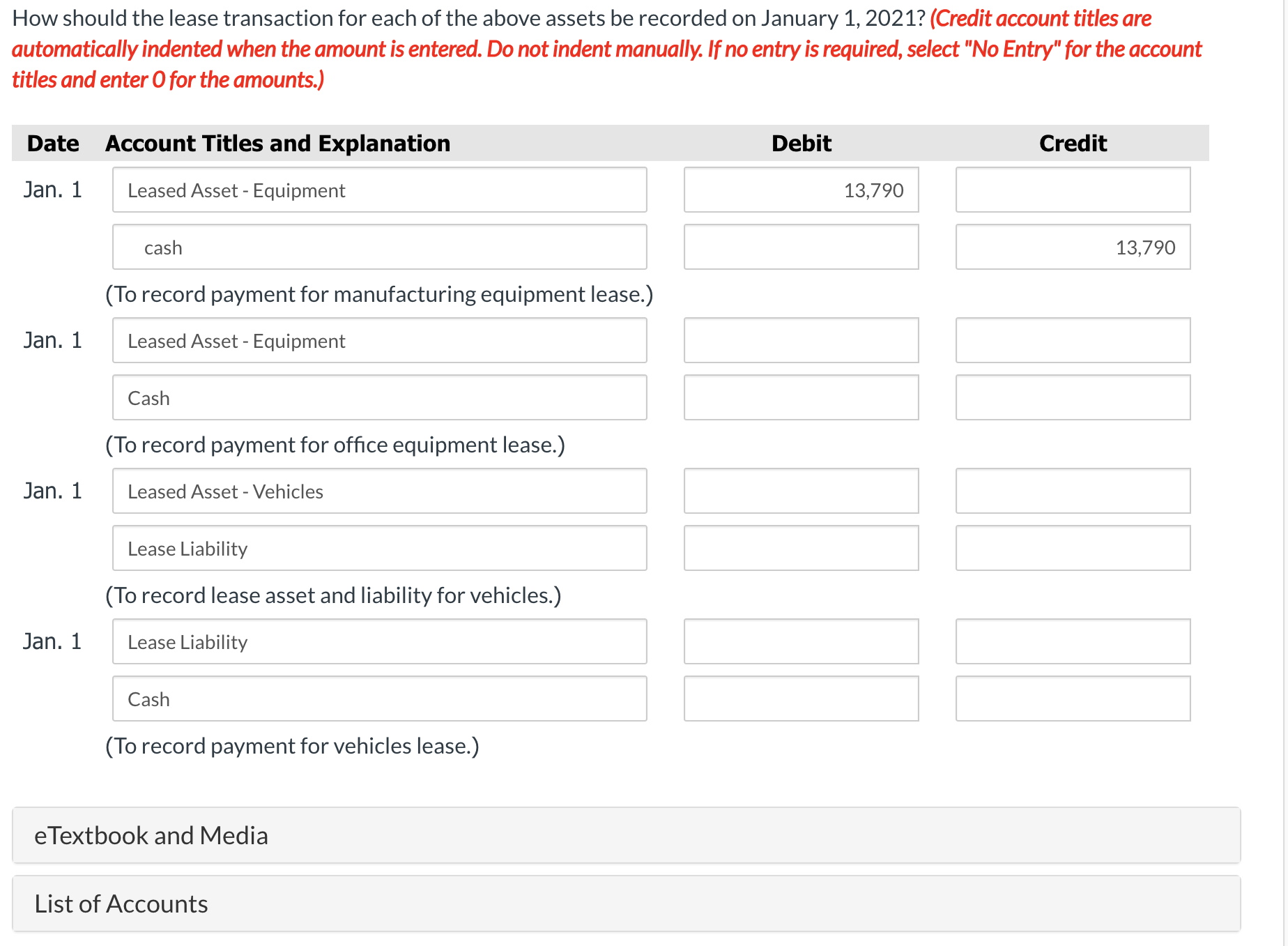

Three different lease transactions are presented below for Blossom Enterprises. Assume that all lease transactions start on January 1, 2021. Blossom does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid on January 1 starting on January 1,2021. Blossom Enterprises prepares its nancial statements using ASPE. Manufacturing Ofce Equipment Vehicles Equipment Lease term 5 years 6 years 3 years Estimated economic life 15 years 7 years 6 years Yearly rental payment $13,790 $14,511 $3,870 Fair market value of leased asset $95,930 $84,550 $19,170 Present value of lease rental payments $56,450 $76,486 $9,880 How should the lease transaction for each of the above assets be recorded on January 1, 2021? (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 Leased Asset - Equipment 13,790 cash 13,790 (To record payment for manufacturing equipment lease.) Jan. 1 Leased Asset - Equipment Cash (To record payment for office equipment lease.) Jan. 1 Leased Asset - Vehicles Lease Liability (To record lease asset and liability for vehicles.) Jan. 1 Lease Liability Cash (To record payment for vehicles lease.) e Textbook and Media List of Accounts