Question: please help me with this questions. its one question with many parts. make sure to answer all for a up vote and i have 1

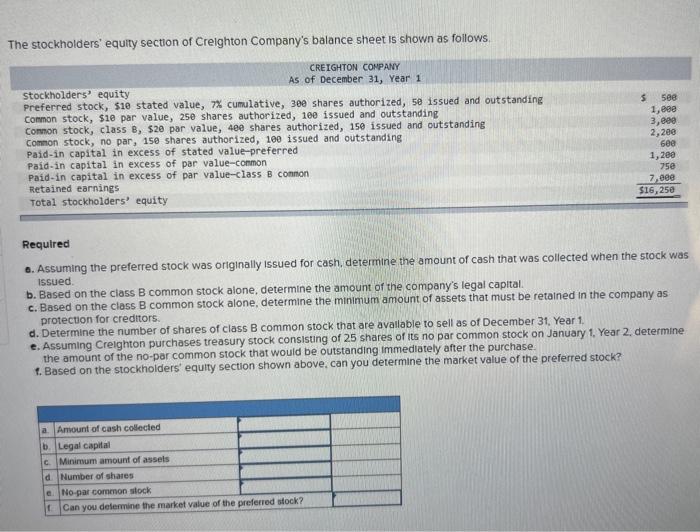

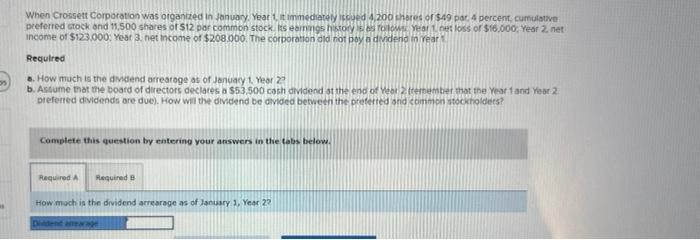

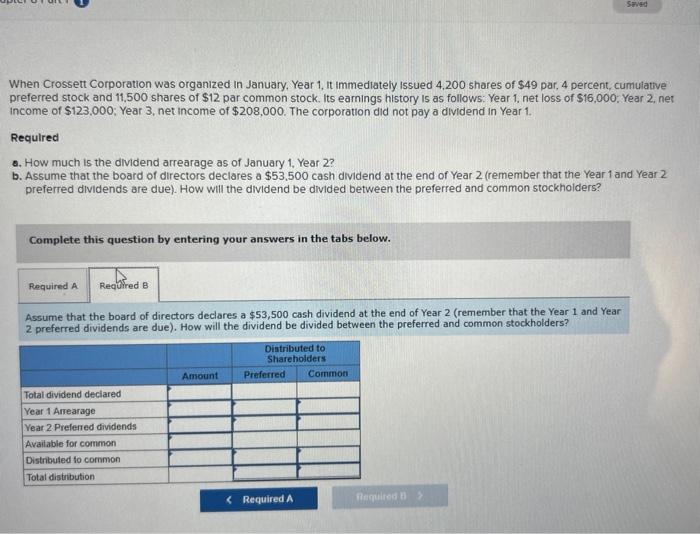

The stockholders' equity section of Creighton Company's balance sheet is shown as follows. Required -. Assuming the preferred stock was originally issued for cash, determine the amount of cash that was collected when the stock was 1ssued. b. Based on the class B common stock alone, determine the amount of the company's legal capital. c. Based on the class B common stock alone, determine the minimum amount of assets that must be retained in the company as protection for creditors. d. Determine the number of shares of class B common stock that are avallable to sell as of December 31 , Year 1 , e. Assuming Creighton purchases treasury stock consisting of 25 shares of its no par common stock on January 1, Year 2 . determine the amount of the no-par common stock that would be outstanding immediately after the purchase: t. Based on the stockholders' equity section shown above, can you determine the market value of the preferred stock? income of $123,000, Yeat 3. net income of $208000. The corporation did fot poy an tindend in rear: Required 8. How much is the dividend arrestoge of of jenuay 1 , yeer 2? brefered dividends are due). How wil the didend be divided between the preferted and cominion wtockholdees? Complete this question by entering your answers in the tabs below. How much is the dividend arrearage as of Jantary 2, Year 22 When Crossett Corporation was organized in January. Year 1, It immediately issued 4,200 shares of $49 par, 4 percent, cumulative preferred stock and 11,500 shares of \$12 par common stock. Its earnings history is as follows: Year 1, net loss of \$16,000; Year 2, net income of $123,000; Year 3 , net income of $208,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2 ? b. Assume that the board of directors declares a $53,500 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Assume that the board of directors declares a $53,500 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts