Question: please help me with this, thank you core: olipt 6A-26 (similar to) Question Help Assume that Crave Coffee Shop completed the following periodic Inventory transactions

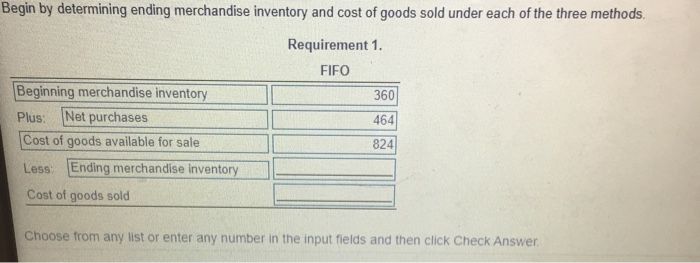

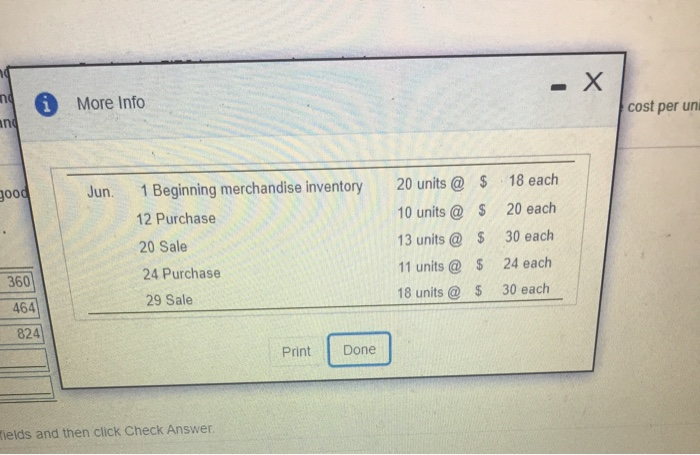

core: olipt 6A-26 (similar to) Question Help Assume that Crave Coffee Shop completed the following periodic Inventory transactions for a line of merchandise inventory Click the icon to view the transactions Requirements 1. Compute ending merchandise Inventory cost of goods sold, and gross prof using the FIFO inventory costing method 2. Compute ending merchandise inventory cost of goods sold and gross profit using the LIFO inventory costing method 3. Compute ending merchandise inventory cost of goods sold, and gross profit using the weighted average Inventory costing method (Round weighted average cost per unit to the nearest cent and all other amounts to the neares Bar Requirements 1., 2., and Compute ending merchandise inventory cost of goods sold and gross profit using the (1) FFO Inventory costing method, 2) UFO inventory coating method, and (b) weighted average inventory costing method (Round weighted average cost per unit to the nearest cant and all other amounts to the nearest dollar) Begins by determining ending merchandise inventory and cost of good sold under each of the three methods Requirement FIFO Being merchandise inventory 360 Plus No purchases Com of goods available for sale . then click here Begin by determining ending merchandise inventory and cost of goods sold under each of the three methods. Requirement 1. FIFO Beginning merchandise inventory 360 Plus: Net purchases 464 Cost of goods available for sale 824 Less: Ending merchandise inventory Cost of goods sold Choose from any list or enter any number in the input fields and then click Check Answer . nd and * More Info cost per un 18 each good Jun. 20 each 1 Beginning merchandise inventory 12 Purchase 20 Sale 24 Purchase 29 Sale 20 units @ $ 10 units @ $ 13 units @ $ 11 units @ $ 18 units @ $ 30 each 24 each 360 30 each 464 824 Print Done Tields and then click Check Answer. Requirements 1. Compute ending merchandise inventory, cost of goods sold, and gross profit using the FIFO inventory costing method. 2. Compute ending merchandise inventory, cost of goods sold, and gross profit using the LIFO inventory costing method. 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the weighted average inventory costing metho nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts