Question: Please help me with this, thank you so much! ASSETS INCREASE: DEBIT DECREASE: CREDIT LIABILITIES INCREASE: CREDIT DECREASE: DEBIT OWNER'S EQUITY INCREASE: CREDIT DECREASE: DEBIT

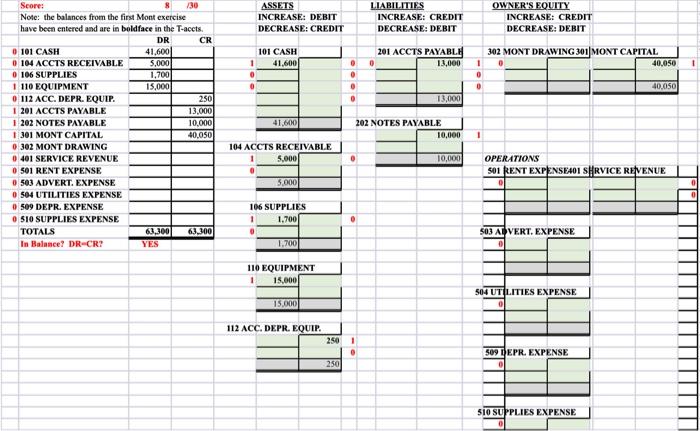

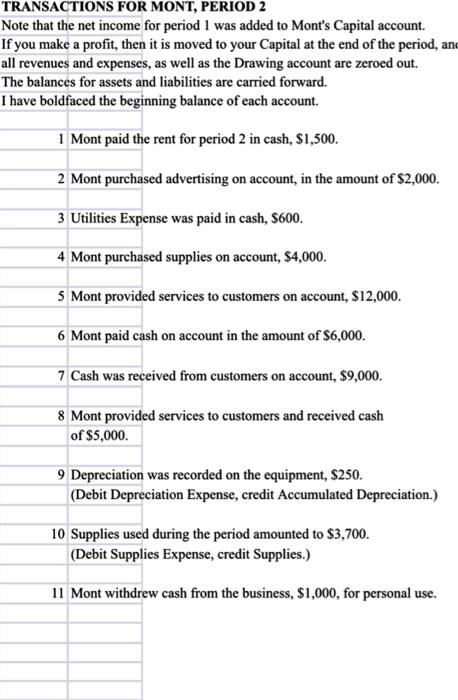

ASSETS INCREASE: DEBIT DECREASE: CREDIT LIABILITIES INCREASE: CREDIT DECREASE: DEBIT OWNER'S EQUITY INCREASE: CREDIT DECREASE: DEBIT 101 CASH 41.600 201 ACCTS PAYABLE 13,000 302 MONT DRAWING 301 MONT CAPITAL 40,050 0 1 0 0 0 0 40.050 13,000 Score: /30 Note: the balances from the first Mont exercise have been entered and are in boldface in the T-acets. DR CR 0 101 CASH 41,600 0 104 ACCTS RECEIVABLE 5,000 0106 SUPPLIES 1,700 1 110 EQUIPMENT 15,000 0 112 ACC. DEPR. EQUIP. 250 1 201 ACCTS PAYABLE 13.000 1 202 NOTES PAYABLE 10,000 1 301 MONT CAPITAL 40.050 0 302 MONT DRAWING 0 401 SERVICE REVENUE 0 501 RENT EXPENSE 0503 ADVERT. EXPENSE 0504 UTILITIES EXPENSE 0509 DEPR. EXPENSE 0 510 SUPPLIES EXPENSE TOTALS 63,300 63.300 In Balance? DR-CR? YES 41.600 202 NOTES PAYABLE 10,000 104 ACCTS RECEIVABLE 5.000 10,000 OPERATIONS 501 RENT EXPENSE401 SHRVICE REVENUE 5.000 0 106 SUPPLIES 1 1.700 503 AVERT. EXPENSE 1.7001 110 EQUIPMENT 15,000 504 UTILITIES EXPENSE 15.000 112 ACC. DEPR. EQUIP 250 1 0 509 REPR. EXPENSE 250 510 SUPPLIES EXPENSE TRANSACTIONS FOR MONT, PERIOD 2 Note that the net income for period I was added to Mont's Capital account. If you make a profit, then it is moved to your Capital at the end of the period, an all revenues and expenses, as well as the Drawing account are zeroed out. The balances for assets and liabilities are carried forward. I have boldfaced the beginning balance of each account. 1 Mont paid the rent for period 2 in cash, $1,500. 2 Mont purchased advertising on account, in the amount of $2,000. 3 Utilities Expense was paid in cash, $600. 4 Mont purchased supplies on account, $4,000. 5 Mont provided services to customers on account, $12,000. 6 Mont paid cash on account in the amount of $6,000. 7 Cash was received from customers on account, $9,000. 8 Mont provided services to customers and received cash of $5,000. 9 Depreciation was recorded on the equipment, $250. (Debit Depreciation Expense, credit Accumulated Depreciation.) 10 Supplies used during the period amounted to $3,700. (Debit Supplies Expense, credit Supplies.) 11 Mont withdrew cash from the business, $1,000, for personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts