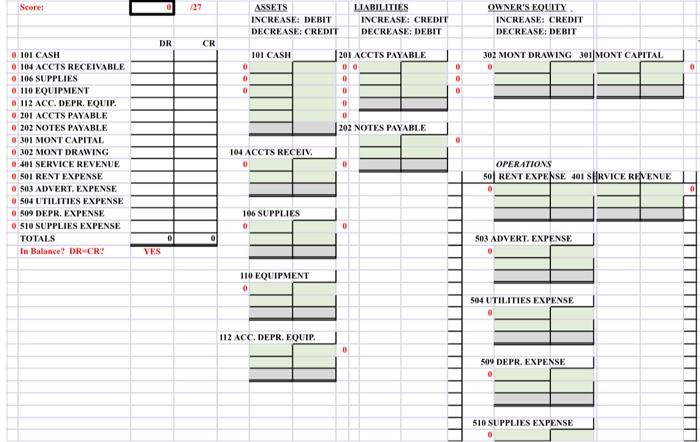

Question: Please help me with this, thank you so much Score /27 ASSETS INCREASE: DEBIT DECREASE: CREDIT LIABILITIES INCREASE: CREDIT DECREASE: DEBIT OWNER'S EQUITY INCREASE: CREDIT

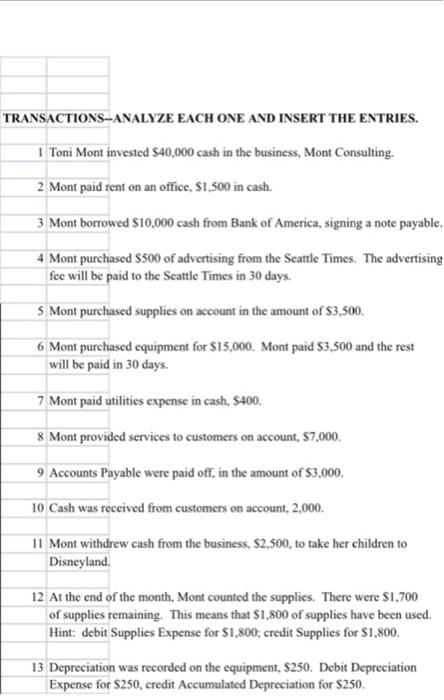

Score /27 ASSETS INCREASE: DEBIT DECREASE: CREDIT LIABILITIES INCREASE: CREDIT DECREASE: DEBIT OWNER'S EQUITY INCREASE: CREDIT DECREASE: DEBIT DR CR 101 CASH 201 ACCTS PAYABLE 00 302 MONT DRAWING 301 MONT CAPITAL O 0 202 NOTES PAYABLE 0 101 CASH 104 ACCTS RECEIVABLE 106 SUPPLIES 0 110 EQUIPMENT 0 112 ACC. DEPR. EQUIP 201 ACCTS PAYABLE 202 NOTES PAYABLE 301 MONT CAPITAL 302 MONT DRAWING 0 401 SERVICE REVENUE 0 501 RENT EXPENSE 0503 ADVERT. EXPENSE 504 UTILITIES EXPENSE 509 DEPR. EXPENSE 510 SUPPLIES EXPENSE TOTALS In Balance? DR CR? 104 ACCTS RECEIV. OPERATIONS 50 RENT EXPENSE 401 SHRVICE REVENUE 106 SUPPLIES 0 O . 503 ADVERT. EXPENSE YES 110 EQUIPMENT 504 UTILITIES EXPENSE 112 ACC. DEPR. EQUIP 0 509 DEPR. EXPENSE 510 SUPPLIES EXPENSE TRANSACTIONS--ANALYZE EACH ONE AND INSERT THE ENTRIES. I Toni Mont invested $40,000 cash in the business, Mont Consulting. 2 Mont paid rent on an office, S1,500 in cash. 3 Mont borrowed $10,000 cash from Bank of America, signing a note payable, 4 Mont purchased $500 of advertising from the Seattle Times. The advertising fee will be paid to the Seattle Times in 30 days. 5 Mont purchased supplies on account in the amount of $3,500, 6 Mont purchased equipment for $15,000. Mont paid $3,500 and the rest will be paid in 30 days 7 Mont paid utilities expense in cash, S400. 8 Mont provided services to customers on account, $7,000 9 Accounts Payable were paid off, in the amount of $3,000. 10 Cash was received from customers on account, 2.000. 11 Mont withdrew cash from the business, $2,500, to take her children to Disneyland 12 At the end of the month, Mont counted the supplies. There were S1.700 of supplies remaining. This means that $1.800 of supplies have been used. Hint: debit Supplies Expense for $1,800, credit Supplies for $1,800. 13 Depreciation was recorded on the equipment, $250. Debit Depreciation Expense for $250, credit Accumulated Depreciation for $250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts