Question: PLEASE help me with this! This is the 5th time I am re-uploading this question. I even have the chart below. Budgeting and Income Projections.

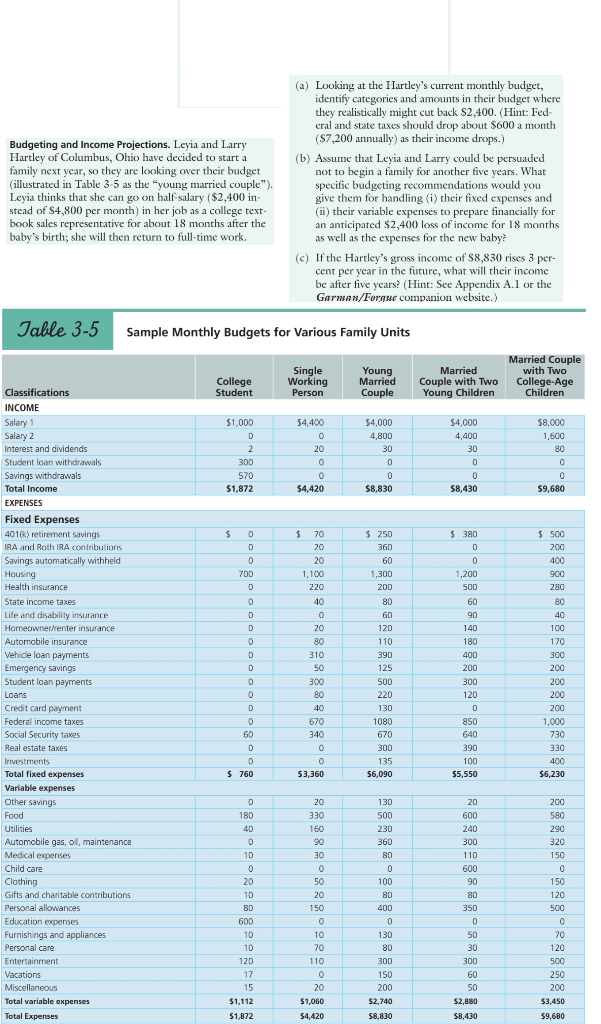

PLEASE help me with this! This is the 5th time I am re-uploading this question. I even have the chart below. Budgeting and Income Projections. Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget. Leyia thinks that she can go on half-salary ($2,400 instead of $4,800 per month) in her job as a college textbook sales representative for about 18 months after the babys birth; she will then return to full-time work.

(a) Looking at the Hartleys current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400.

(b) Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling their fixed expenses and their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby?

(c) If the Hartleys gross income of $8,830 rises 3 percent per year in the future, what will their income be after five years?

Budgeting and Income Projections. Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the "young married couple"). Levia thinks that she can go on half salary ($2,400 in- stead of S4,800 per month) in her job as a college text- book sales representative for about 18 months after the baby's birth; she will then return to full-time work. (a) Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400. (Hint: Fed- eral and state taxes should drop about $600 a month (S7,200 annually) as their income drops.) (b) Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling (i) their fixed expenses and (ii) their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby! (c) If the Hartley's gross income of $8,830 rises 3 per- cent per year in the future, what will their income be after five years? (Hint: See Appendix A.1 or the Garman/Forgue companion website.) Table 3-5 Sample Monthly Budgets for Various Family Units College Student Single Working Person Young Married Couple Married Couple with Two Young Children Married couple with Two College-Age Children $1,000 D 0 2 300 570 $1,872 $4,400 0 20 0 0 $4,420 $4,000 4,800 30 0 0 $8,830 $4,000 4,400 30 0 0 58,430 $8,000 1,600 80 0 0 59,680 $ $ $ 70 0 0 0 700 D $ 250 360 60 $ 380 0 0 1,200 500 1,300 200 0 0 D 80 60 60 90 140 0 120 110 390 125 Classifications INCOME Salary 1 Salary 2 Interest and dividends Student loan withdrawals Savings withdrawals Total Income EXPENSES Fixed Expenses 401(k) retirement savings IRA and Roth IRA Contributions Savings automatically withheld Housing Health insurance State income taxes Life and disability insurance Homeowner/renter insurance Automobile insurance Vehicle loan payments Emergency savings Student loan payments Loans Credit card payment Federal income taxes Social Security taxes Real estate taxes Investments Total fixed expenses Variable expenses Other Savings Food Utilities Automobile gas, oil, maintenance Medical expenses Child care Clothing Gifts and charitable contributions Personal allowances Education expenses Furnishings and appliances Personal care Entertainment Vacations Miscellaneous Total variable expenses Total Expenses O $ 500 200 400 900 280 80 40 100 170 300 200 200 200 200 1,000 730 330 400 $6,230 0 0 D 0 60 D 0 $ 760 180 400 200 300 120 0 0 850 640 390 100 $5,550 500 220 130 1080 670 300 135 $6,090 **988 08888888888888088308880219 200 580 290 320 150 D 180 40 0 0 10 0 20 10 80 600 10 10 120 17 15 $ $1,112 $1,872 130 500 230 360 80 0 0 100 80 400 0 130 80 300 150 200 $2,740 $8,830 20 600 240 300 110 600 90 80 350 0 0 50 30 300 60 50 WWWWWW28 150 120 500 0 120 500 250 200 $3,450 59,680 $2,880 58,430 Budgeting and Income Projections. Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the "young married couple"). Levia thinks that she can go on half salary ($2,400 in- stead of S4,800 per month) in her job as a college text- book sales representative for about 18 months after the baby's birth; she will then return to full-time work. (a) Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400. (Hint: Fed- eral and state taxes should drop about $600 a month (S7,200 annually) as their income drops.) (b) Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling (i) their fixed expenses and (ii) their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby! (c) If the Hartley's gross income of $8,830 rises 3 per- cent per year in the future, what will their income be after five years? (Hint: See Appendix A.1 or the Garman/Forgue companion website.) Table 3-5 Sample Monthly Budgets for Various Family Units College Student Single Working Person Young Married Couple Married Couple with Two Young Children Married couple with Two College-Age Children $1,000 D 0 2 300 570 $1,872 $4,400 0 20 0 0 $4,420 $4,000 4,800 30 0 0 $8,830 $4,000 4,400 30 0 0 58,430 $8,000 1,600 80 0 0 59,680 $ $ $ 70 0 0 0 700 D $ 250 360 60 $ 380 0 0 1,200 500 1,300 200 0 0 D 80 60 60 90 140 0 120 110 390 125 Classifications INCOME Salary 1 Salary 2 Interest and dividends Student loan withdrawals Savings withdrawals Total Income EXPENSES Fixed Expenses 401(k) retirement savings IRA and Roth IRA Contributions Savings automatically withheld Housing Health insurance State income taxes Life and disability insurance Homeowner/renter insurance Automobile insurance Vehicle loan payments Emergency savings Student loan payments Loans Credit card payment Federal income taxes Social Security taxes Real estate taxes Investments Total fixed expenses Variable expenses Other Savings Food Utilities Automobile gas, oil, maintenance Medical expenses Child care Clothing Gifts and charitable contributions Personal allowances Education expenses Furnishings and appliances Personal care Entertainment Vacations Miscellaneous Total variable expenses Total Expenses O $ 500 200 400 900 280 80 40 100 170 300 200 200 200 200 1,000 730 330 400 $6,230 0 0 D 0 60 D 0 $ 760 180 400 200 300 120 0 0 850 640 390 100 $5,550 500 220 130 1080 670 300 135 $6,090 **988 08888888888888088308880219 200 580 290 320 150 D 180 40 0 0 10 0 20 10 80 600 10 10 120 17 15 $ $1,112 $1,872 130 500 230 360 80 0 0 100 80 400 0 130 80 300 150 200 $2,740 $8,830 20 600 240 300 110 600 90 80 350 0 0 50 30 300 60 50 WWWWWW28 150 120 500 0 120 500 250 200 $3,450 59,680 $2,880 58,430

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts