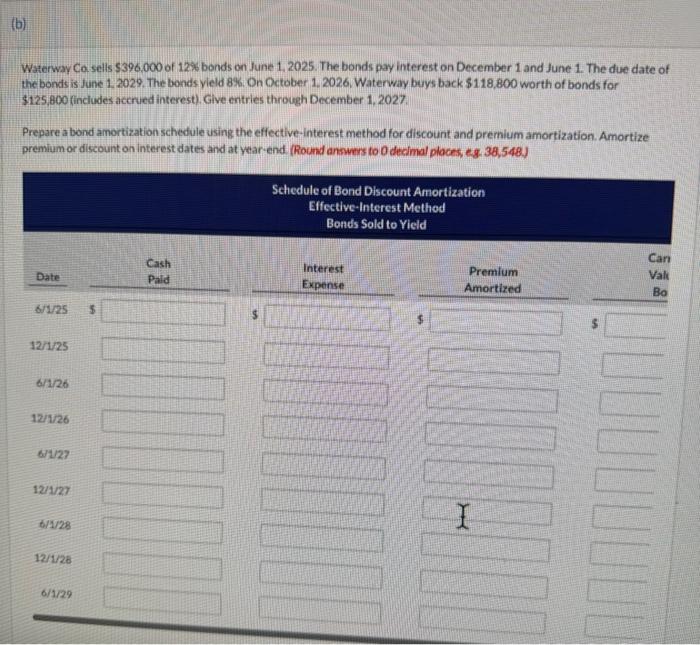

Question: please help me with this (To record interest expense and premium amortization) (Iforecord buy back of bonds) Wrerway Co sells $396,000 of 12% bonds on

(To record interest expense and premium amortization) (Iforecord buy back of bonds) Wrerway Co sells $396,000 of 12% bonds on June 1,2025. The bonds pay interest on December 1 and June 1 . The due date of the bonds is fune 1.2029, The bonds yield 8\%. On October 1.2026. Waterway buys back $118,800 worth of bonds for $125,800 (includes accrued interest). Give entries through December 1,2027. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 declmal ploces, eg. 38,548.) (To record interest expense and premium amortization) (Iforecord buy back of bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts