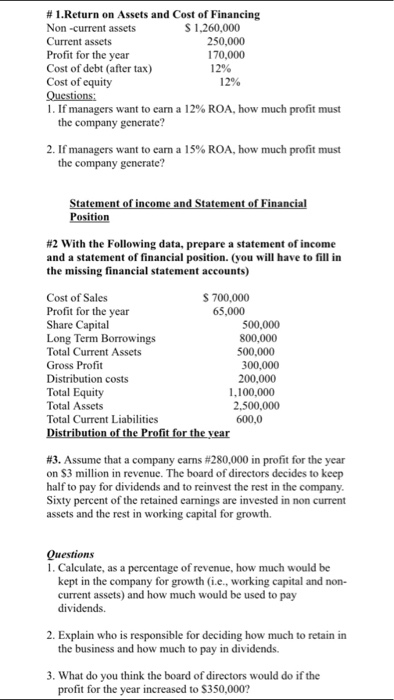

Question: Please help me with this two questions . It's Finance for non-financial managers Chapter 1.ASAP # 1,Return on Assets and Cost of Financing Non-current assets

# 1,Return on Assets and Cost of Financing Non-current assets Current assets Profit for the year Cost of debt (after tax) Cost of equity Questions: 1 . If managers want to earn a 12% ROA, how much profit must S 1,260,000 250,000 170,000 12% 12% the company generate? 2. If managers want to earn a 15% ROA, how much profit must the company generate? Stat Position #2 with the Following data, prepare a statement of income and a statement of financial position. (you will have to fill in the missing financial statement accounts) S 700,000 65,000 Cost of Sales Profit for the year Share Capital Long Term Borrowings Total Current Assets Gross Profit Distribution costs Total Equity Total Assets Total Current Liabilities 500,000 800,000 500,000 300,000 200,000 1,100,000 2,500,000 600,0 #3. Assume that a company earns #280,000 in profit for the year on S3 million in revenue. The board of directors decides to keep half to pay for dividends and to reinvest the rest in the company Sixty percent of the retained earnings are invested in non current assets and the rest in working capital for growth. . Calculate, as a percentage of revenue, how much would be kept in the company for growth (i.e., working capital and non- current assets) and how much would be used to pay dividends. 2. Explain who is responsible for deciding how much to retain in the business and how much to pay in dividends. 3. What do you think the board of directors would do if the profit for the year increased to S350,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts