Question: Please help me with ( Warren E. Buffett, 2015) Case a. Use the hypothetical examples presented in the case (i.e., Exhibits 1.6 and 1.7) to

Please help me with ( Warren E. Buffett, 2015) Case

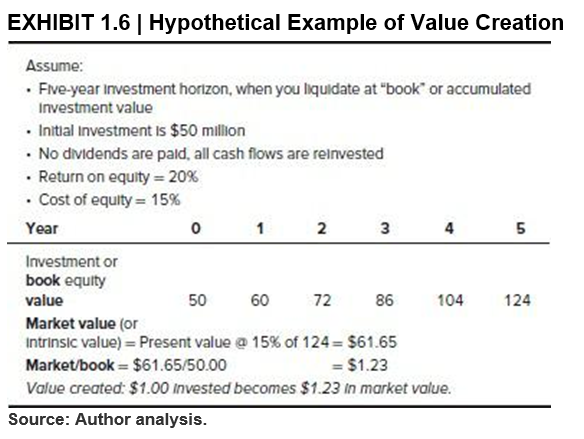

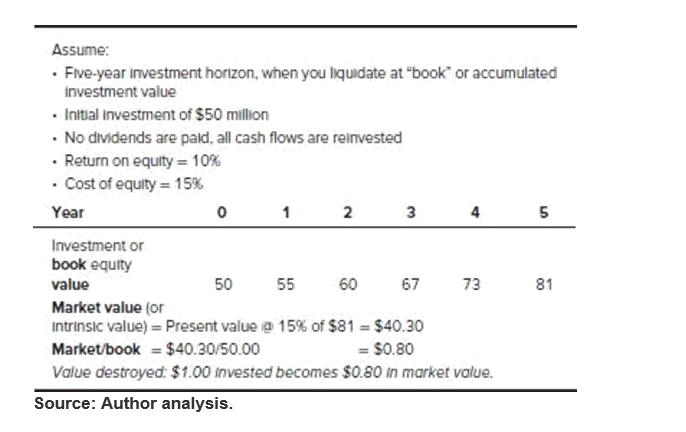

a. Use the hypothetical examples presented in the case (i.e., Exhibits 1.6 and 1.7) to explain value creation and destruction b. Elaborate on why Buffett disagrees with the alternatives to the intrinsic value mentioned in the case i.e., book value, stock prices i. Economic reality vs Accounting reality ii. Invest based on information, analysis,

and self-discipline; not on emotion or hunch

and self-discipline; not on emotion or hunch

EXHIBIT 1.6 Hypothetical Example of Value Creation 6 Assume: Five-year investment horizon, when you liquidate at "book" or accumulated Investment value Initial Investment is $50 million No dividends are pald, all cash flows are relnvested Return on equity = 20% . Cost of equity = 15% Year 0 1 2 3 4 5 Investment or book equity value 50 60 72 86 104 124 Market value for Intrinsic value) = Present value a 15% of 124 = $61.65 Market/book= $61.65/50.00 = $1.23 Volue created: $1.00 Invested becomes $1.23 in market value. Source: Author analysis. 3 5 Assume: Five-year investment horizon, when you liquidate at "book" or accumulated Investment value Initial investment of $50 million No dividends are pald, all cash flows are reinvested Return on equity = 10% . Cost of equity = 15% Year 0 1 2 3 4 5 Investment or book equity value 50 55 60 67 73 81 Market value (or Intrinsic value) = Present value a 15% of $81 = $40.30 Market/book = $40.30/50.00 = $0.80 Value destroyed $1.00 invested becomes $0.80 in market value. Source: Author analysis. EXHIBIT 1.6 Hypothetical Example of Value Creation 6 Assume: Five-year investment horizon, when you liquidate at "book" or accumulated Investment value Initial Investment is $50 million No dividends are pald, all cash flows are relnvested Return on equity = 20% . Cost of equity = 15% Year 0 1 2 3 4 5 Investment or book equity value 50 60 72 86 104 124 Market value for Intrinsic value) = Present value a 15% of 124 = $61.65 Market/book= $61.65/50.00 = $1.23 Volue created: $1.00 Invested becomes $1.23 in market value. Source: Author analysis. 3 5 Assume: Five-year investment horizon, when you liquidate at "book" or accumulated Investment value Initial investment of $50 million No dividends are pald, all cash flows are reinvested Return on equity = 10% . Cost of equity = 15% Year 0 1 2 3 4 5 Investment or book equity value 50 55 60 67 73 81 Market value (or Intrinsic value) = Present value a 15% of $81 = $40.30 Market/book = $40.30/50.00 = $0.80 Value destroyed $1.00 invested becomes $0.80 in market value. Source: Author analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts