Question: Please help me work this problem. Universal Electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR).

Please help me work this problem.

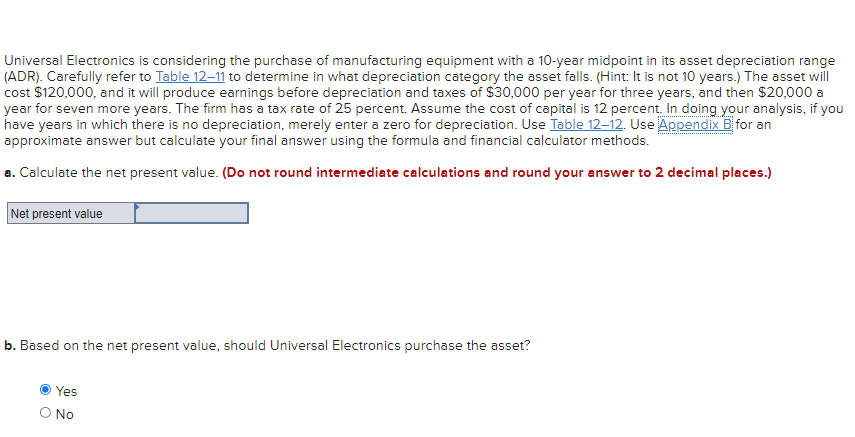

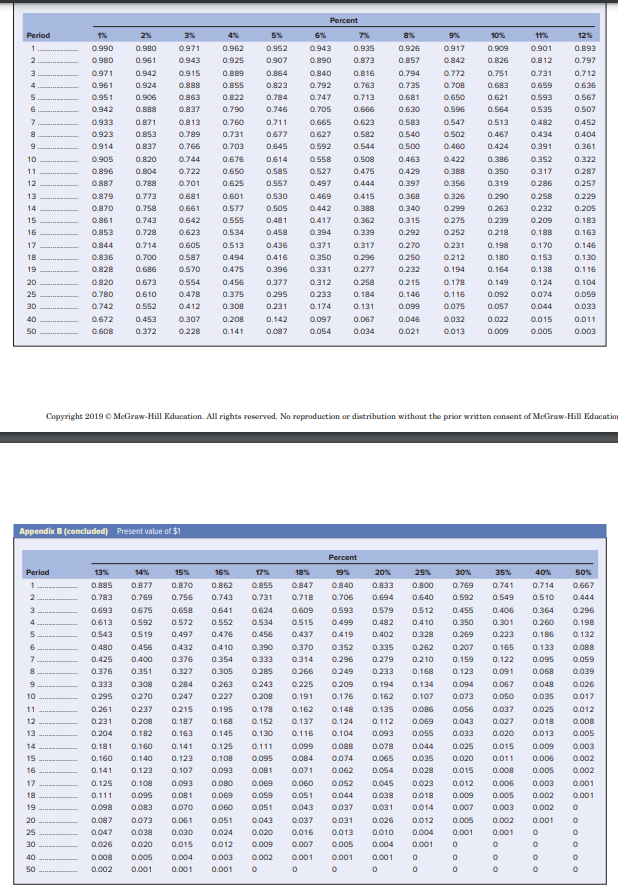

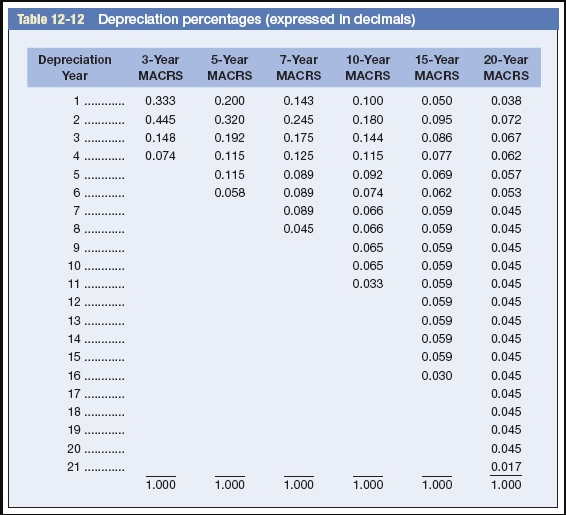

Universal Electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to Table 1211 to determine in what depreciation category the asset falls. (Hint: It is not 10 years.) The asset will cost $120,000, and it will produce earnings before depreciation and taxes of $30,000 per year for three years, and then $20,000 a year for seven more years. The firm has a tax rate of 25 percent. Assume the cost of capital is 12 percent. In doing your analysis, if you have years in which there is no depreciation, merely enter a zero for depreciation. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Calculate the net present value. (Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value b. Based on the net present value, should Universal Electronics purchase the asset? Yes O No Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 3-Year MACRS 0.333 0.445 0.148 0.074 2 3 4 5-Year MACRS 0.200 0.320 0.192 0.115 0.115 0.058 7-Year MACRS 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 5 6 7 8 10-Year MACRS 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 15-Year MACRS 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 9 10 11 12 20-Year MACRS 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 13 14 15 16 17 18 19 20 21 1.000 1.000 1.000 1.000 1.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts