Question: Please help me write the ANALYSIS + fill in the numerical answers for Require 10-12! I got Requirements 1-9 correct, so you can refer to

Please help me write the ANALYSIS + fill in the numerical answers for Require 10-12! I got Requirements 1-9 correct, so you can refer to those answers. I'll give you a good rating!

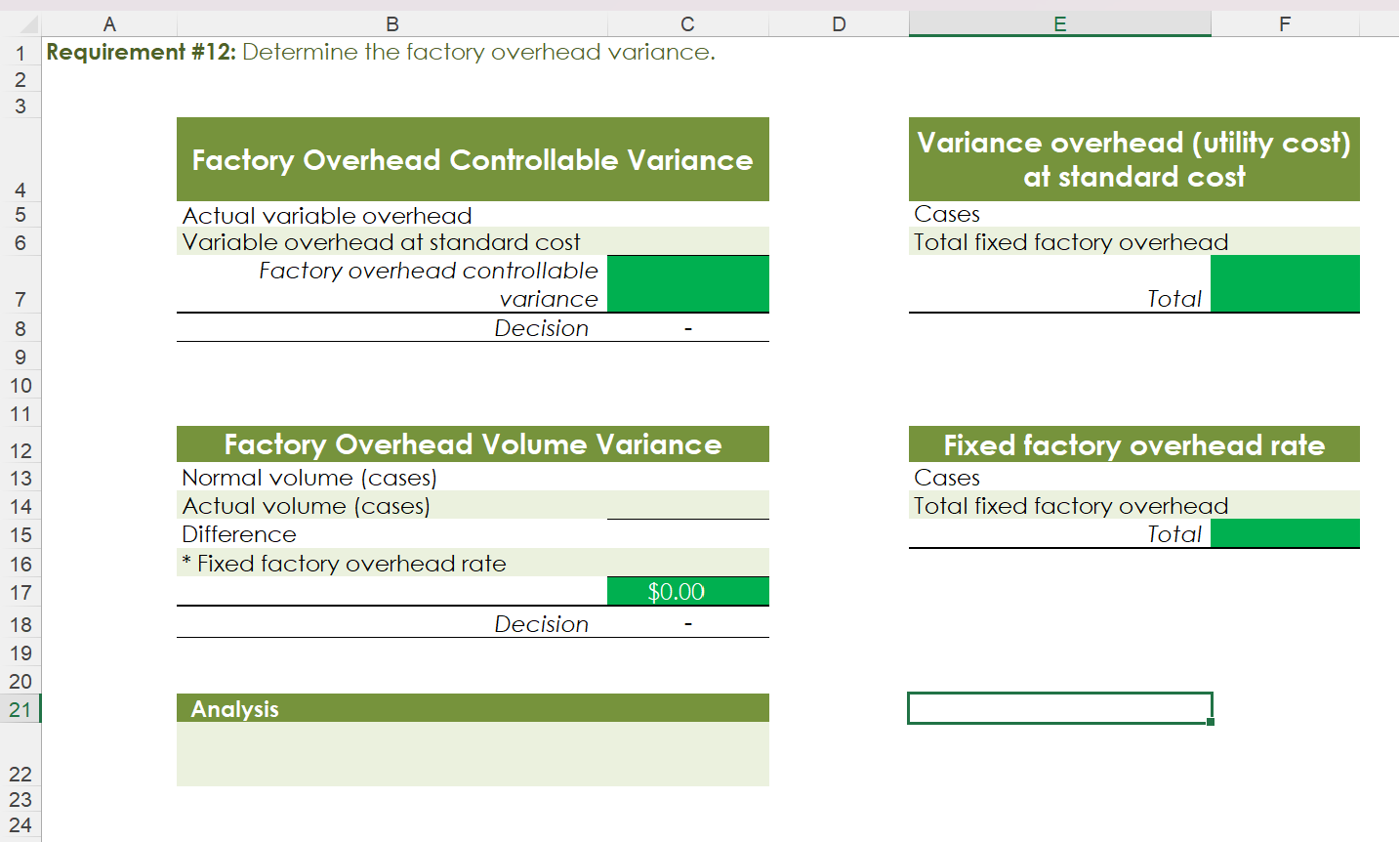

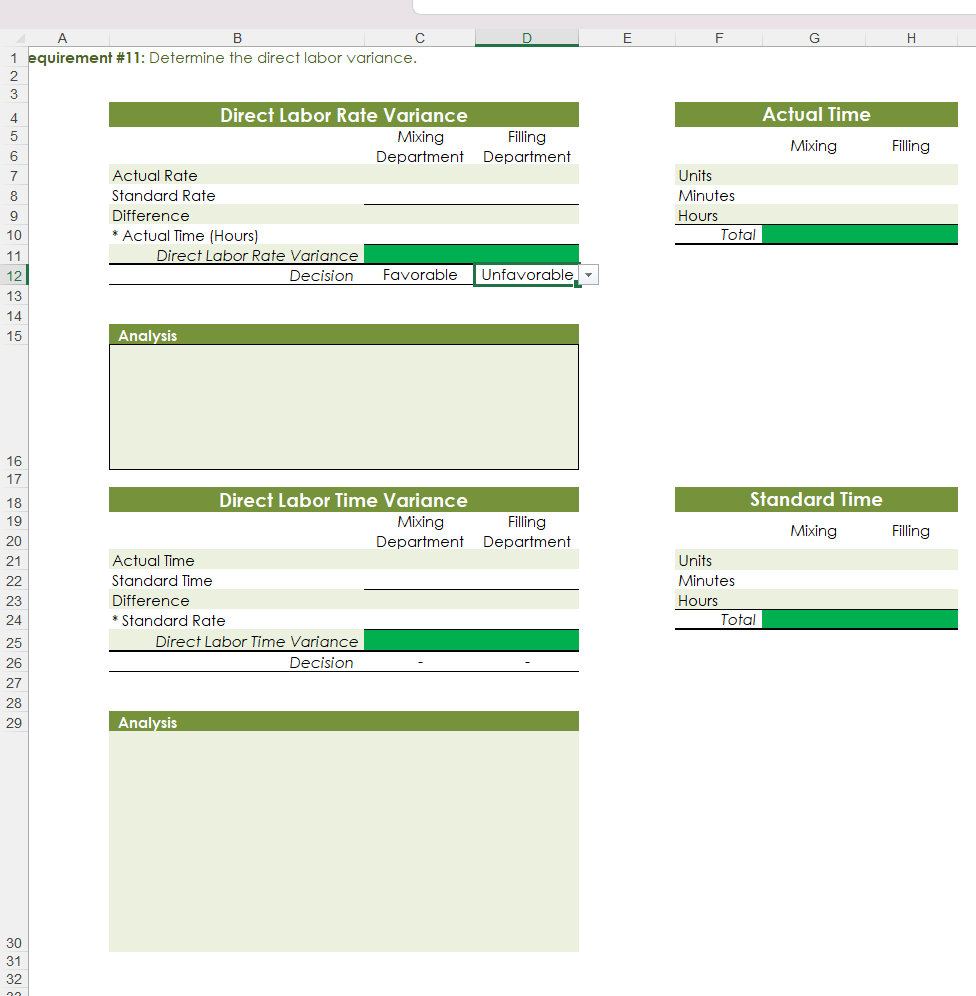

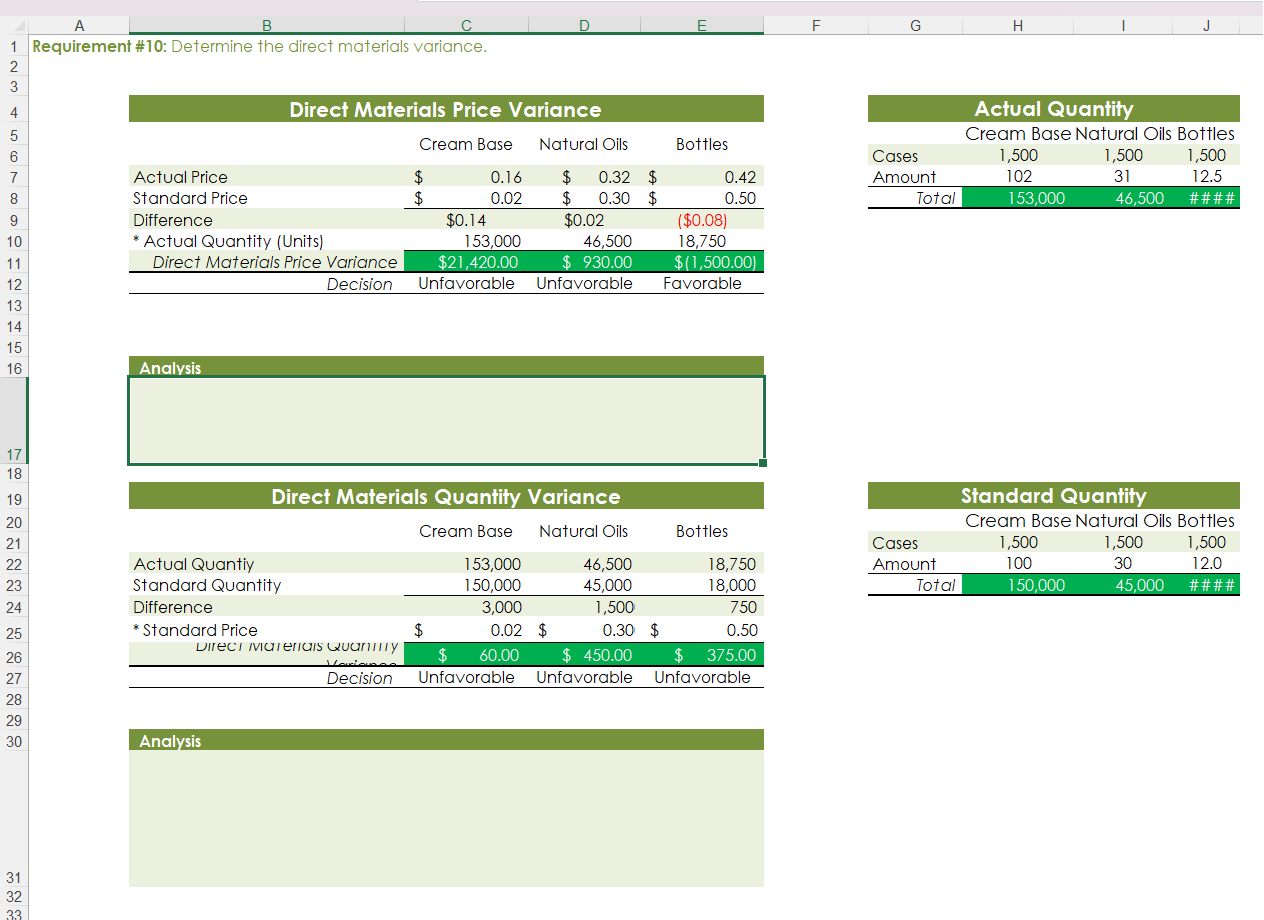

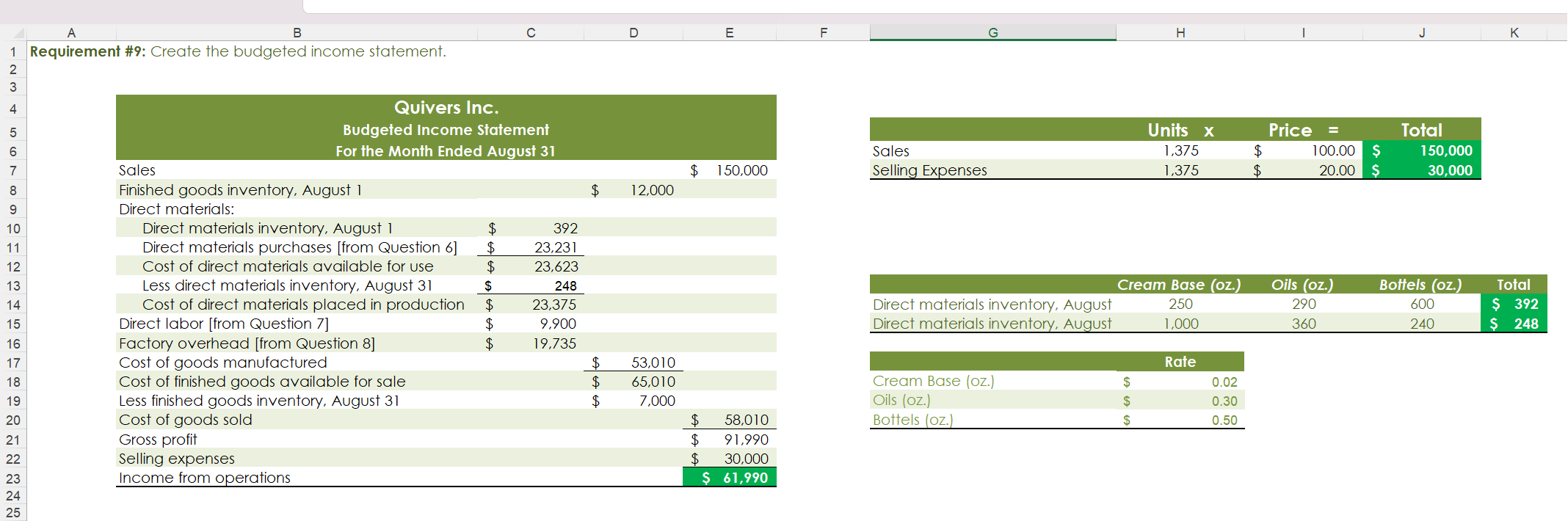

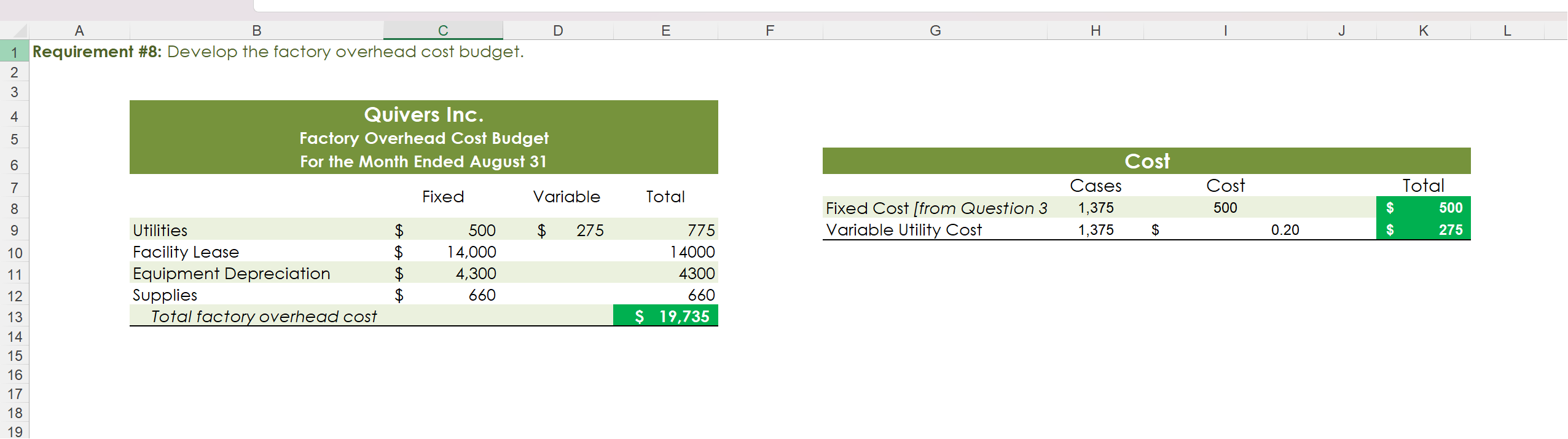

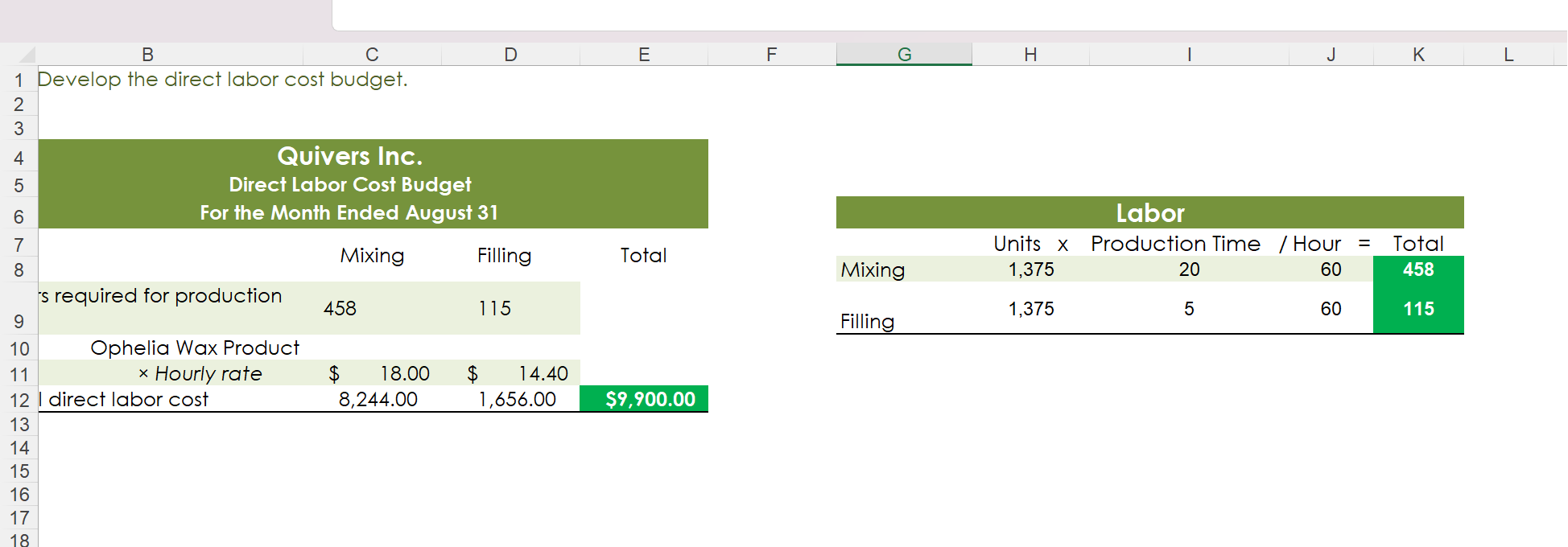

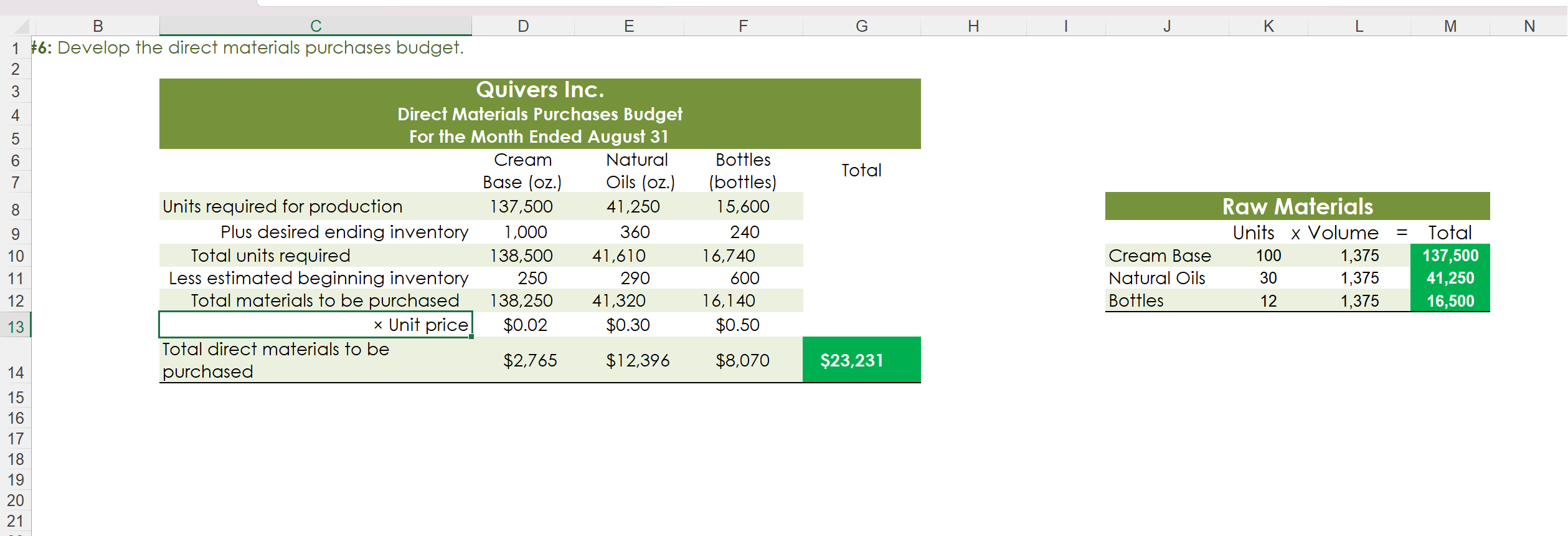

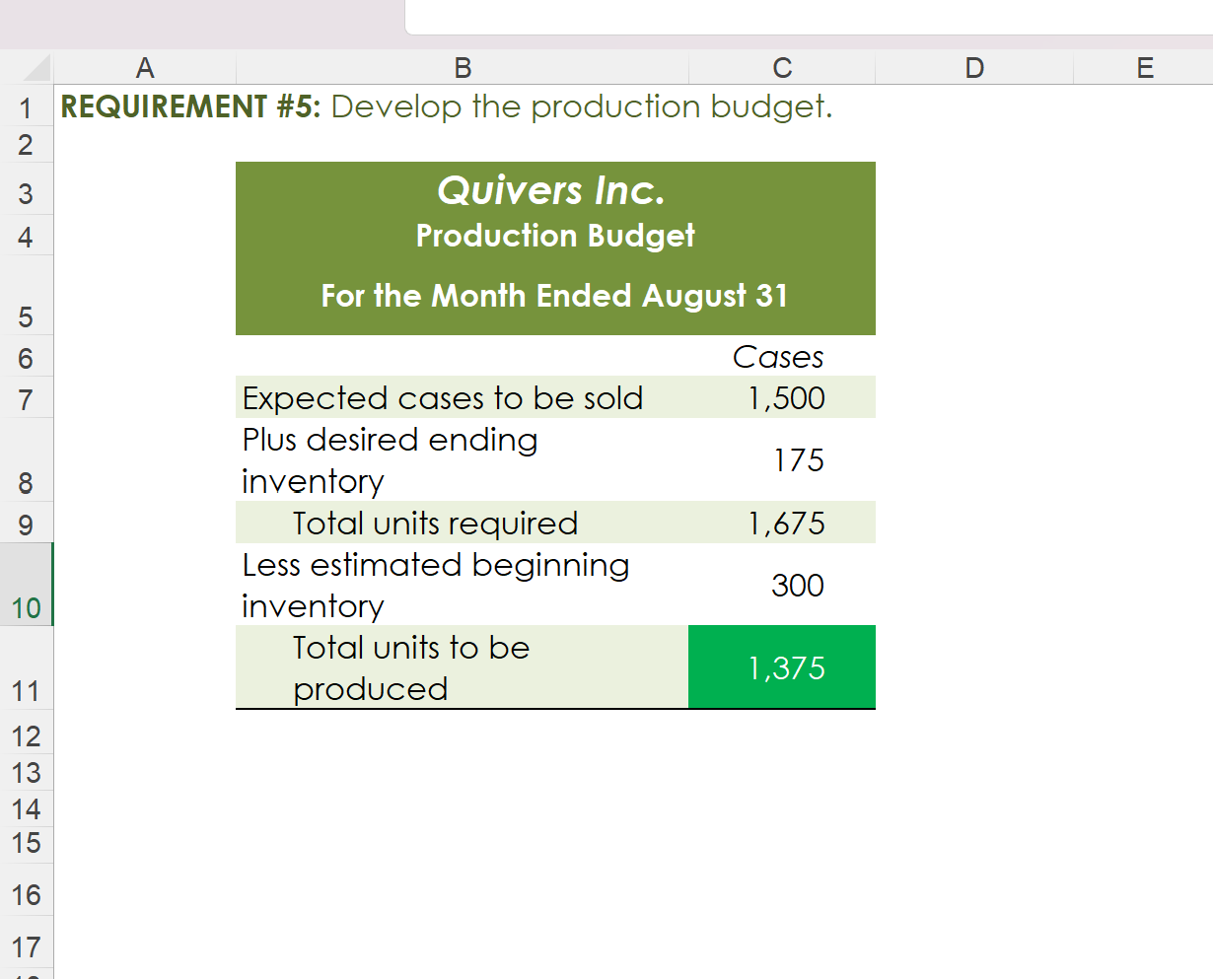

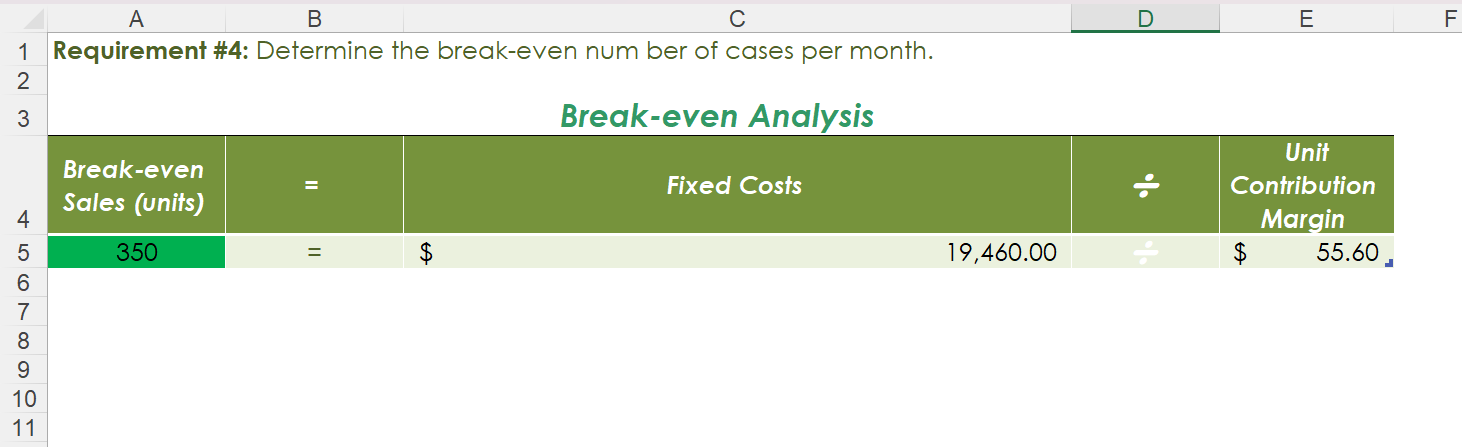

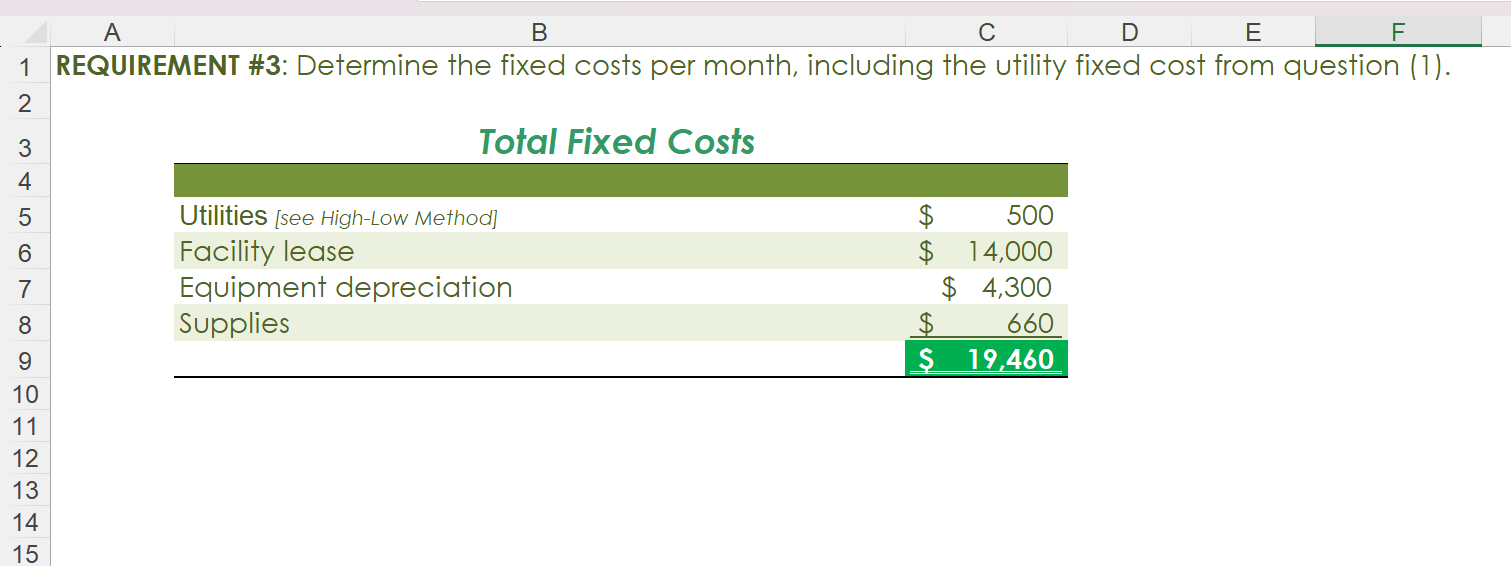

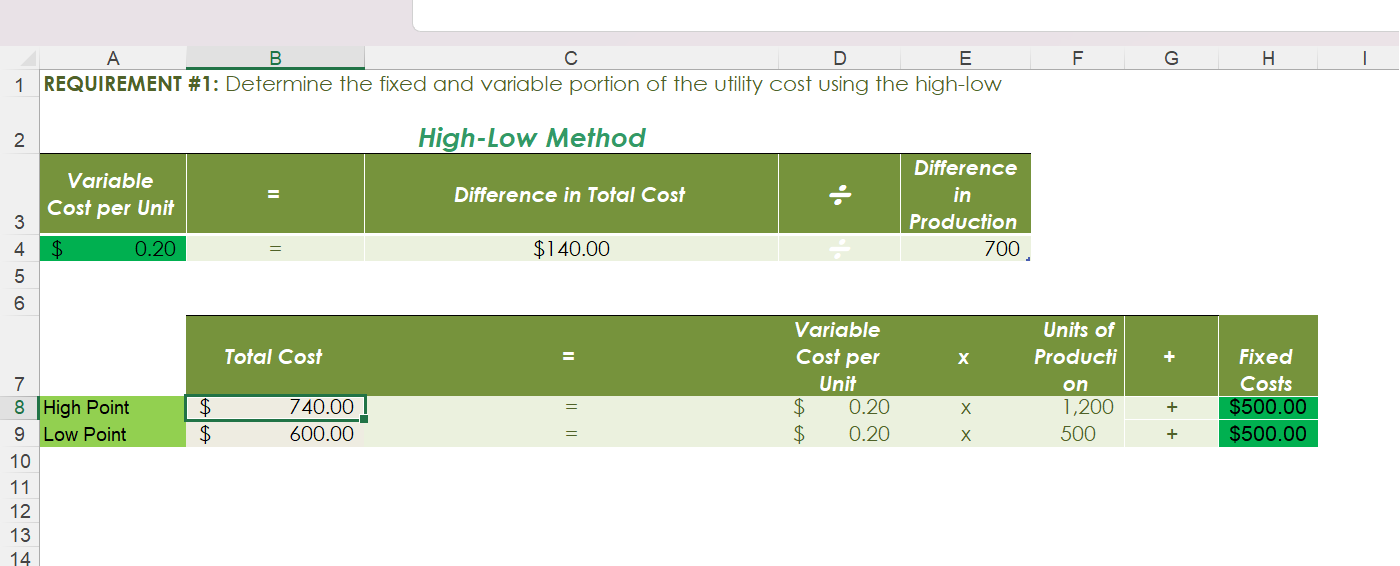

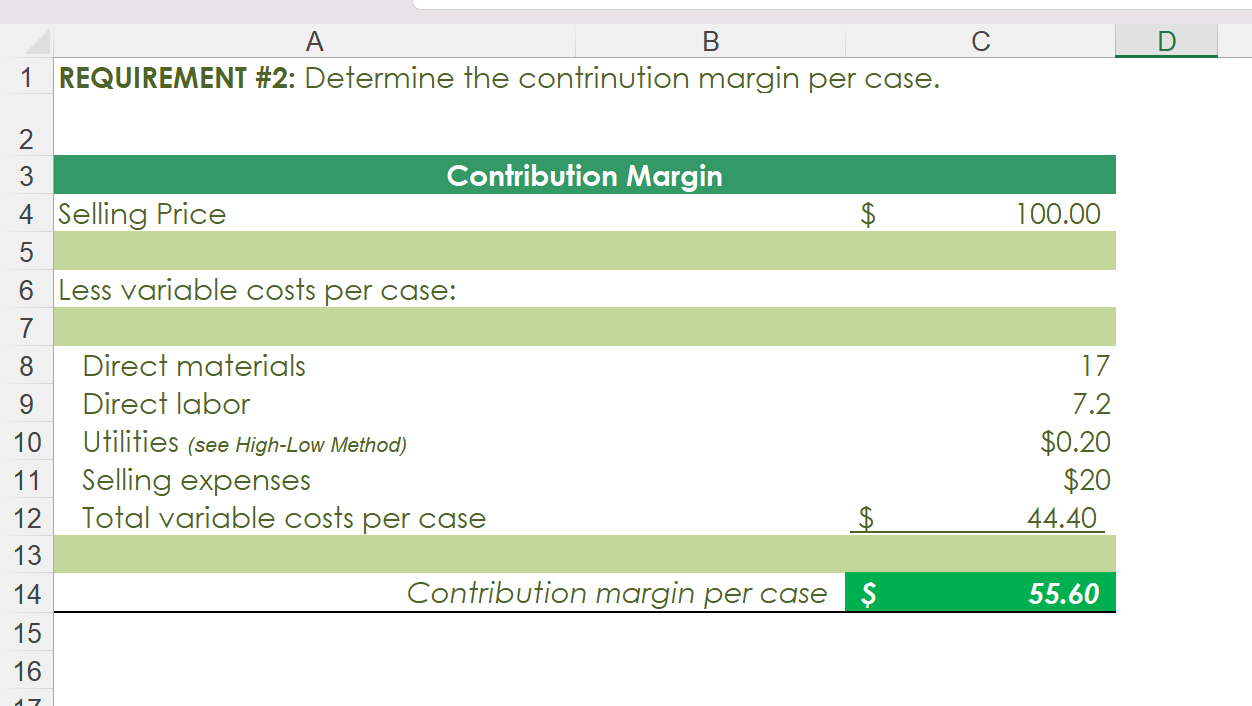

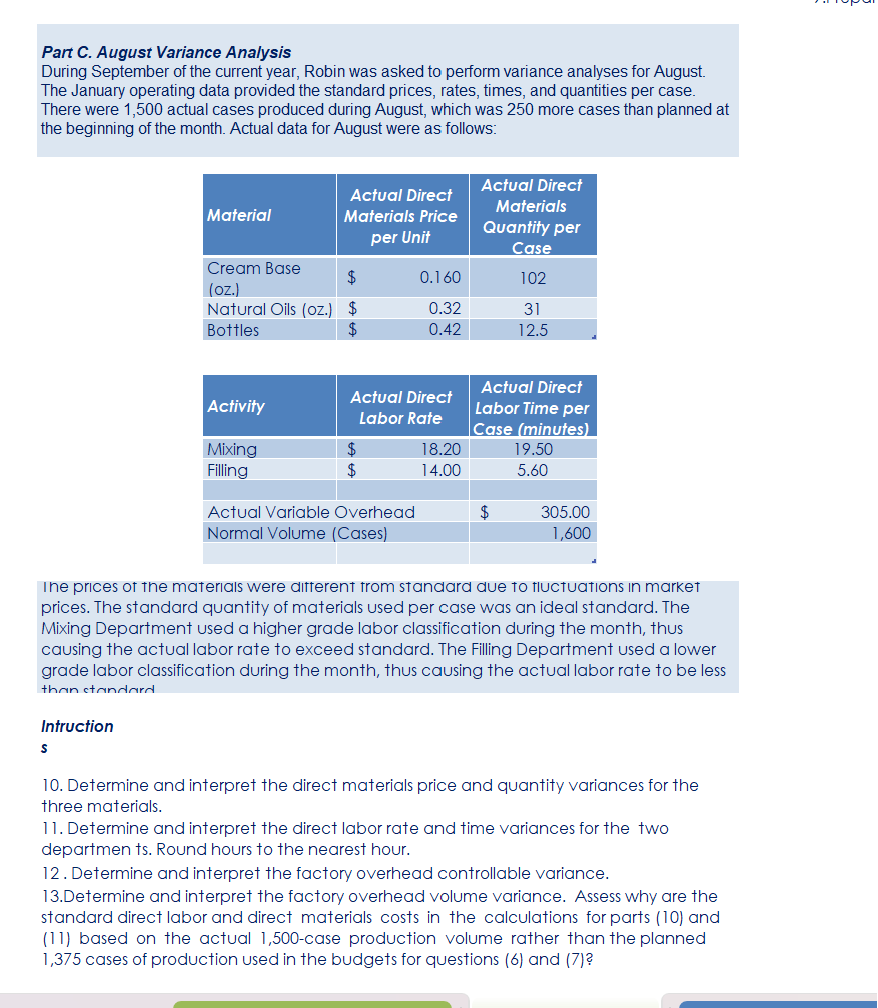

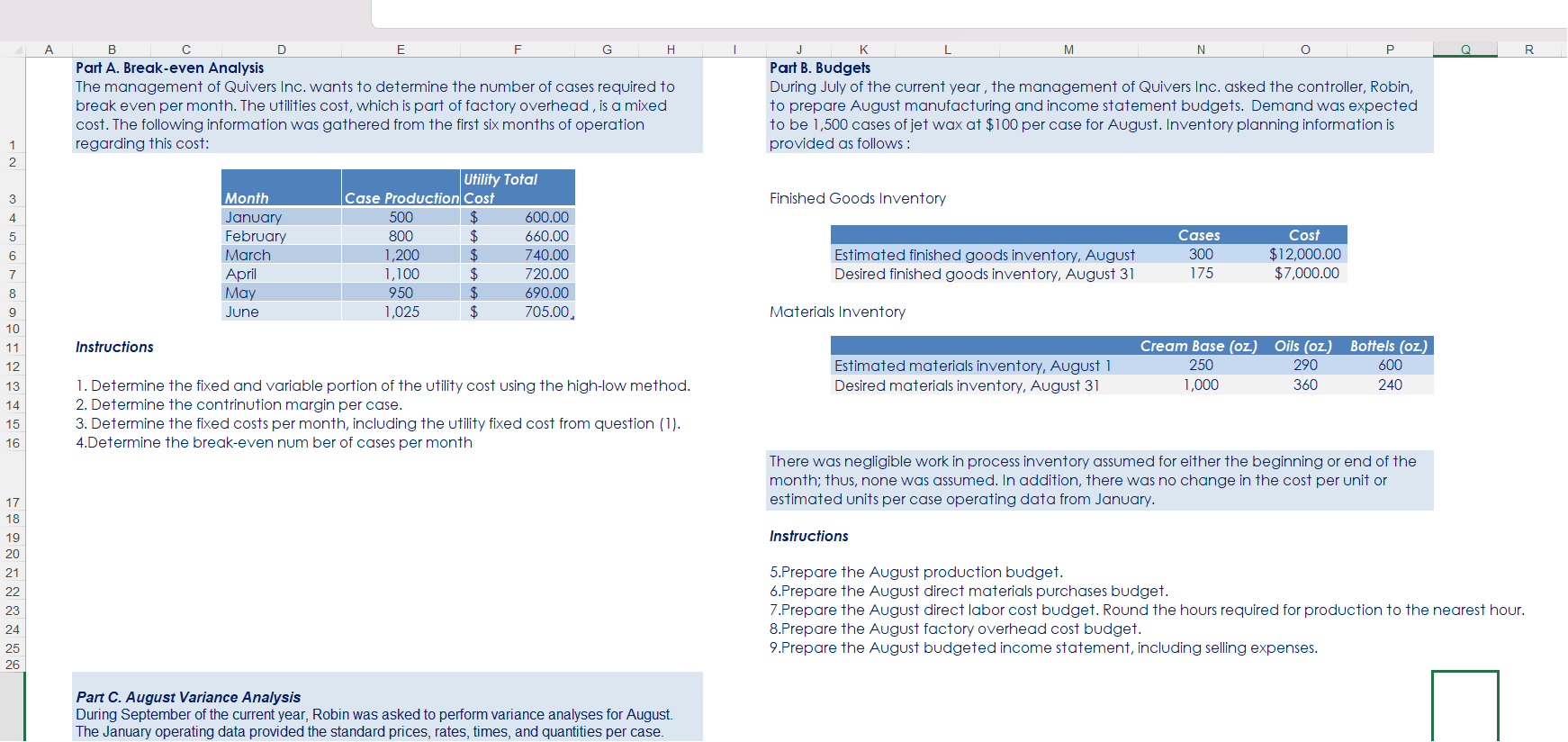

Requirement \# 12: Determine the factory overhead variance. 1 equirement \#11: Determine the direct labor variance. Requirement \#10: Determine the direct materials variance. Requirement \#9: Create the budgeted income statement. Requirement \#8: Develop the factory overhead cost budget. Develop the direct labor cost budget. \#6: Develop the direct materials purchases budget. REQUIREMENT \#5: Develop the production budget. 1 Requirement \#4: Determine the break-even num ber of cases per month. 3 Break-even Analysis \begin{tabular}{c|l|c|c|c|c|} \hline \begin{tabular}{c} Break-even \\ Sales (units) \end{tabular} & = & Fixed Costs & & \begin{tabular}{c} Unit \\ Contribution \\ Margin \end{tabular} \\ \hline 350 & = & $ & 19,460.00 & $ & 55.60 \end{tabular} REQUIREMENT \#3: Determine the fixed costs per month, including the utility fixed cost from question (1). Total Fixed Costs \begin{tabular}{lrr} \hline & & \\ Utilities [see High-Low Method] & 500 \\ Facility lease & $ & 14,000 \\ Equipment depreciation & $4,300 \\ Supplies & $ & 660 \\ \hline & $19,460 \\ \hline \end{tabular} Hinh-I nw Mothnd \begin{tabular}{|c|c|c|c|} \hline & A & & C \\ \hline 1 & \multirow{2}{*}{\multicolumn{3}{|c|}{ REQUIREMENT \#2: Determine the contrinution margin per case. }} \\ \hline 2 & & & \\ \hline 3 & \multicolumn{3}{|l|}{ Contribution Margin } \\ \hline 4 & Selling Price & $ & 100.00 \\ \hline 5 & & & \\ \hline 6 & Less variable costs per case: & & \\ \hline 7 & & & \\ \hline 8 & Direct materials & & 17 \\ \hline 9 & Direct labor & & 7.2 \\ \hline 10 & Utilities (see High-Low Method) & & $0.20 \\ \hline 11 & Selling expenses & & $20 \\ \hline 12 & Total variable costs per case & $ & 44.40 \\ \hline 13 & & & \\ \hline 14 & Contribution margin per case & $ & 55.60 \\ \hline \end{tabular} Part C. August Variance Analysis During September of the current year, Robin was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and quantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the beginning of the month. Actual data for August were as follows: Ine prices of the materials were ditterent trom standard due to tluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a lower grade labor classification during the month, thus causing the actual labor rate to be less than ctandard Intruction s 10. Determine and interpret the direct materials price and quantity variances for the three materials. 11. Determine and interpret the direct labor rate and time variances for the two departmen ts. Round hours to the nearest hour. 12. Determine and interpret the factory overhead controllable variance. 13.Determine and interpret the factory overhead volume variance. Assess why are the standard direct labor and direct materials costs in the calculations for parts (10) and (11) based on the actual 1,500-case production volume rather than the planned 1,375 cases of production used in the budgets for questions ( 6 ) and (7) ? Part A. Break-even Analysis The management of Quivers Inc. wants to determine the number of cases required to break even per month. The utilities cost, which is part of factory overhead, is a mixed cost. The following information was gathered from the first six months of operation regarding this cost: Part B. Budgets During July of the current year , the management of Quivers Inc. asked the controller, Robin, to prepare August manufacturing and income statement budgets. Demand was expected to be 1,500 cases of jet wax at $100 per case for August. Inventory planning information is provided as follows : Finished Goods Inventory Materials Inventory There was negligible work in process inventory assumed for either the beginning or end of the month; thus, none was assumed. In addition, there was no change in the cost per unit or estimated units per case operating data from January. Instructions 5.Prepare the August production budget. 6.Prepare the August direct materials purchases budget. 7.Prepare the August direct labor cost budget. Round the hours required for production to the nearest hour. 8.Prepare the August factory overhead cost budget. 9.Prepare the August budgeted income statement, including selling expenses. Part C. August Variance Analysis During September of the current year, Robin was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and quantities per case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts