Question: please help me Year 2 0 0 3,000 100 0 100 0 0 Question 7 (30 points) Suppose that we are now in year o.

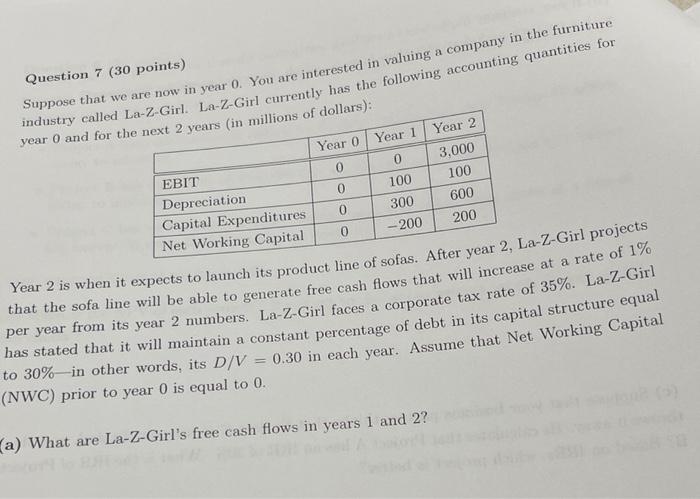

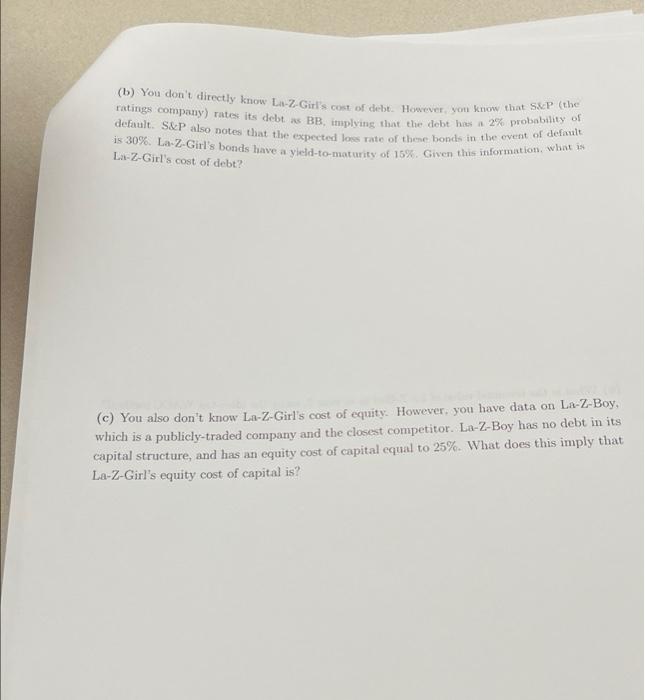

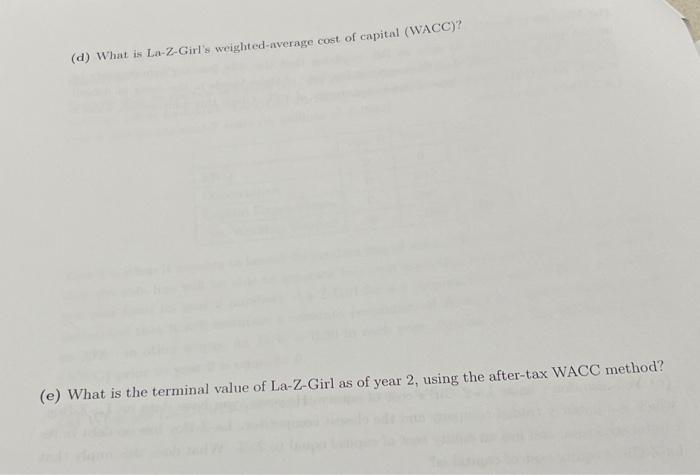

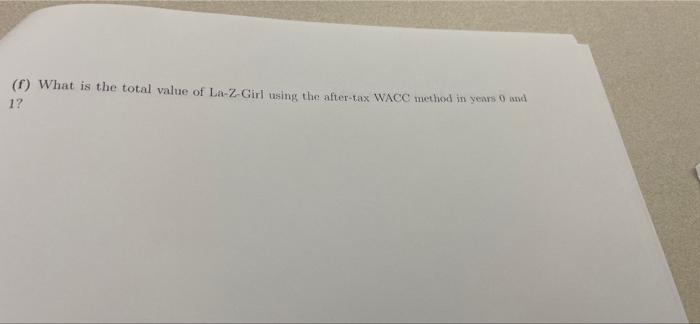

Year 2 0 0 3,000 100 0 100 0 0 Question 7 (30 points) Suppose that we are now in year o. You are interested in valuing a company in the furniture industry called La-z-Girl. La-z-Girl currently has the following accounting quantities for year 0 and for the next 2 years (in millions of dollars): Year 0 Year 1 EBIT Depreciation Capital Expenditures 300 600 Net Working Capital - 200 200 Year 2 is when it expects to launch its product line of sofas. After year 2, La-z-Girl projects that the sofa line will be able to generate free cash flows that will increase at a rate of 1% per year from its year 2 numbers. La-z-Girl faces a corporate tax rate of 35%. La-z-Girl has stated that it will maintain a constant percentage of debt in its capital structure equal to 30%-in other words, its D/V = 0.30 in each year. Assume that Net Working Capital (NWC) prior to year 0 is equal to 0. a) What are La-Z-Girl's free cash flows in years 1 and 2? (b) You don't directly know La-z-Girls cost of debt. However you know that S&P (the ratings company) rates its debt as BB, plying that the debt ha 2% probability of default. S&P also notes that the expected loss rate of these bonds in the event of default is 30%. La-z-Girl's bonds have a vield-to-maturity of 15%. Given this information, what is LZ-Girl's cost of debt? (c) You also don't know La-z-Girl's cost of equity. However, you have data on La-Z-Boy, which is a publicly-traded company and the closest competitor. La-z-Boy has no debt in its capital structure, and has an equity cost of capital equal to 25%. What does this imply that La-z-Girl's equity cost of capital is? (d) What is La-z-Girl's weighted average cost of capital (WACC)? (e) What is the terminal value of La-z-Girl as of year 2, using the after-tax WACC method? (f) What is the total value of La-z-Girl using the after-tax WACC method in years 0 med 1? Year 2 0 0 3,000 100 0 100 0 0 Question 7 (30 points) Suppose that we are now in year o. You are interested in valuing a company in the furniture industry called La-z-Girl. La-z-Girl currently has the following accounting quantities for year 0 and for the next 2 years (in millions of dollars): Year 0 Year 1 EBIT Depreciation Capital Expenditures 300 600 Net Working Capital - 200 200 Year 2 is when it expects to launch its product line of sofas. After year 2, La-z-Girl projects that the sofa line will be able to generate free cash flows that will increase at a rate of 1% per year from its year 2 numbers. La-z-Girl faces a corporate tax rate of 35%. La-z-Girl has stated that it will maintain a constant percentage of debt in its capital structure equal to 30%-in other words, its D/V = 0.30 in each year. Assume that Net Working Capital (NWC) prior to year 0 is equal to 0. a) What are La-Z-Girl's free cash flows in years 1 and 2? (b) You don't directly know La-z-Girls cost of debt. However you know that S&P (the ratings company) rates its debt as BB, plying that the debt ha 2% probability of default. S&P also notes that the expected loss rate of these bonds in the event of default is 30%. La-z-Girl's bonds have a vield-to-maturity of 15%. Given this information, what is LZ-Girl's cost of debt? (c) You also don't know La-z-Girl's cost of equity. However, you have data on La-Z-Boy, which is a publicly-traded company and the closest competitor. La-z-Boy has no debt in its capital structure, and has an equity cost of capital equal to 25%. What does this imply that La-z-Girl's equity cost of capital is? (d) What is La-z-Girl's weighted average cost of capital (WACC)? (e) What is the terminal value of La-z-Girl as of year 2, using the after-tax WACC method? (f) What is the total value of La-z-Girl using the after-tax WACC method in years 0 med 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts