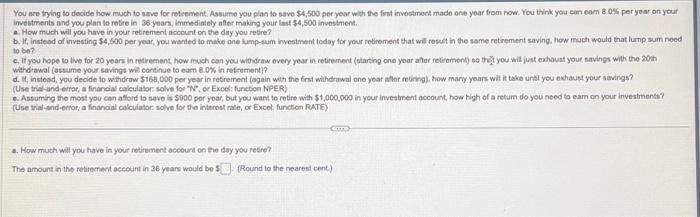

Question: please help me!! You are tying to decide how much to smve for retenment. Aswurne you plan to savo $4,500 por year with the fint

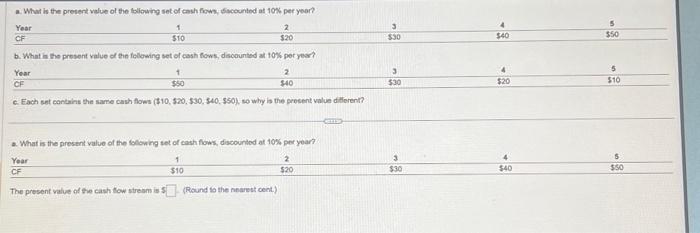

You are tying to decide how much to smve for retenment. Aswurne you plan to savo $4,500 por year with the fint ievestment made one year from now. You think you can eam 80.4 per yoar on your imvestments and you plan to retre in 38 yean, immediately after making your last 54,500 invostment. a. How much well you have in your retrement docount on the diy you retire? b. If, inctead of inveating 54,500 per year, you wanted to mabe one lump-sum invesiment todoy for your rotiroment that will resul in the same retrement saving. how much would that lump sum need to ber? c. If you hope to the for 20 years in retirement, how much can you withdraw every year in retirement (starting one year afler feliemont) so thint you wil just exhaust your savings with the 20 th whithd awal (assume your savings wil continue to eam 8.0% in retrement)? (Use trid-and-errer, a finandial cakculator solve for "N, or Expel: function NPER) e. Assuming the most you can afford to save is $500 por year, but you wam to retire with $1,000,000 in your investment nocount, how high of a retum do you need to eam on your investmontt? (Use trialiand-error, a financial calculator solve for the intorost rale, or Excel. function RATE) 3. How much will you have in your redremert accourt on the doy you retire? The amount in the retirement account in 36 years would be : (Round to the nearest cent) a. Whut is the present value of the loliowing set of cash fown, ficeuntod at 10% per year? Year 5101 5202 5303 b. What in the presert value of the fallowing set of cash fows, discounted at 10% per year? Year 1$502$40 \begin{tabular}{|ccc} 3 & 4 & 5 \\ \hline 530 & 520 & 510 \end{tabular} C. Each set contains the same cash flows (\$10, 520,530,540,$50), so why io the prosent value diflerenh? a. What is the present value of the following set of cash fows, discountod at 10% per yoar? YoarCFThepresentvalueofthecashtowstreomis5-(Roundtothenearestcent).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts