Question: Please help me. - Your answer is partially correct. The comparative statements of Blossom Company are presented here. BLOSSOM COMPANY Income Statements For the Years

Please help me.

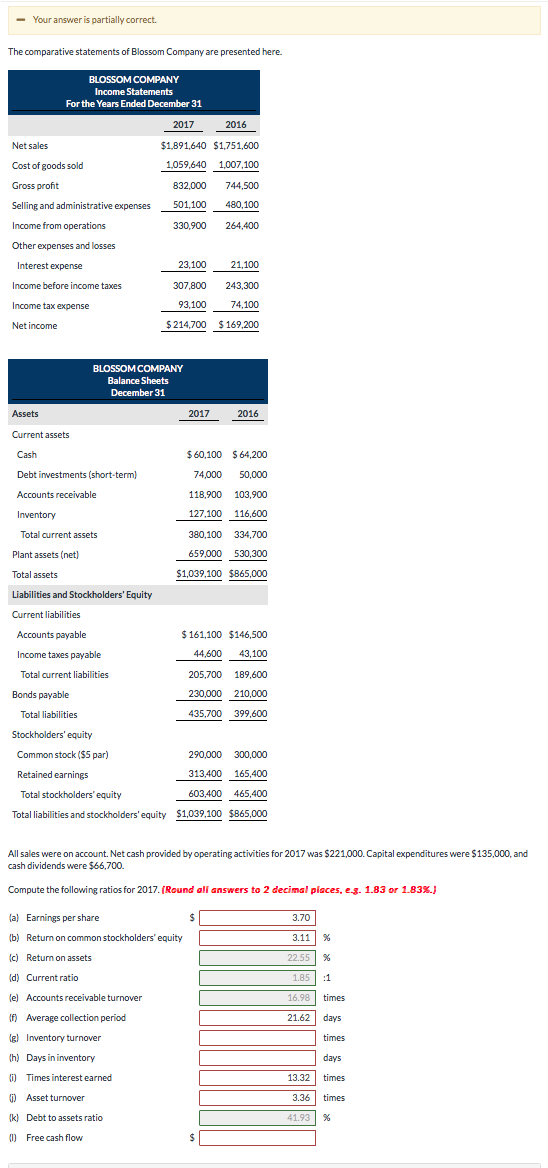

- Your answer is partially correct. The comparative statements of Blossom Company are presented here. BLOSSOM COMPANY Income Statements For the Years Ended December 31 Net sales Cost of goods sold Gross profit Selling and administrative expenses 2017 2016 $1,891,640 $1,751,600 1.059,640 1,007,100 832,000 744,500 501,100 480,100 330,900 264.400 Income from operations Other expenses and losses Interest expense Income before income taxes 23,100 307,800 93,100 $ 214,700 21,100 243,300 74,100 $ 169,200 Income tax expense Net income BLOSSOM COMPANY Balance Sheets December 31 Assets 2017 2016 Current assets Cash $ 60,100 $ 64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable 118,900 103,900 Inventory 127,100 116,600 Total current assets 380,100 334,700 Plant assets (net) 659.000 530,300 Total assets $1,039,100 $865,000 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 161,100 $146,500 Income taxes payable 44,600 43,100 Total current liabilities 205,700 189,600 Bonds payable 230,000 210,000 Total liabilities 435,700 399,600 Stockholders' equity Common stock ($5 par) 290,000 300,000 Retained earnings 313,400 165,400 Total stockholders' equity 603,400 465,400 Total liabilities and stockholders' equity $1,039,100 $365,000 All sales were on account. Net cash provided by operating activities for 2017 was $221,000. Capital expenditures were $135,000, and cash dividends were $66,700. Compute the following ratios for 2017. (Round all answers to 2 decimal places, eg. 1.83 or 1.83%.) 3.11 2255 (a) Earnings per share (b) Return on common stockholders' equity (c) Return on assets d) Current ratio lel Accounts receivable turnover (f) Average collection period (g) Inventory turnover times th) Days in Inventory JOE BUUBE times 3.36 () Times interest earned 0) Asset turnover (k) Debt to assets ratio (0) Free cash flow 41.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts