Question: please help me. Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the

please help me.

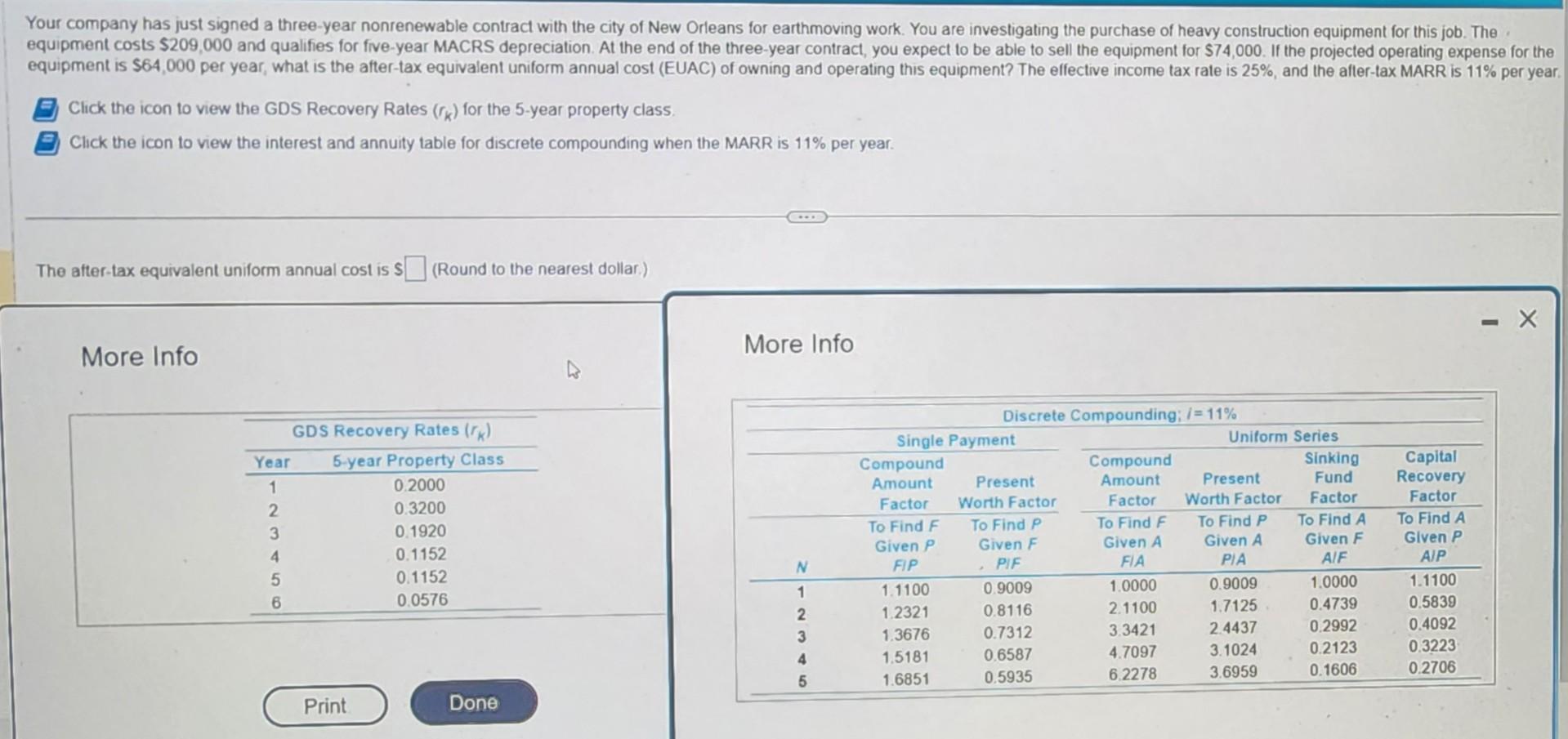

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $209,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $74,000. If the projected operating expense for the equipment is $64,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 25%, and the after-tax MARR is 11% per year Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar.) More Info More Info

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts