Question: please help MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Muchachi Company purchased factory equipment for $640,000

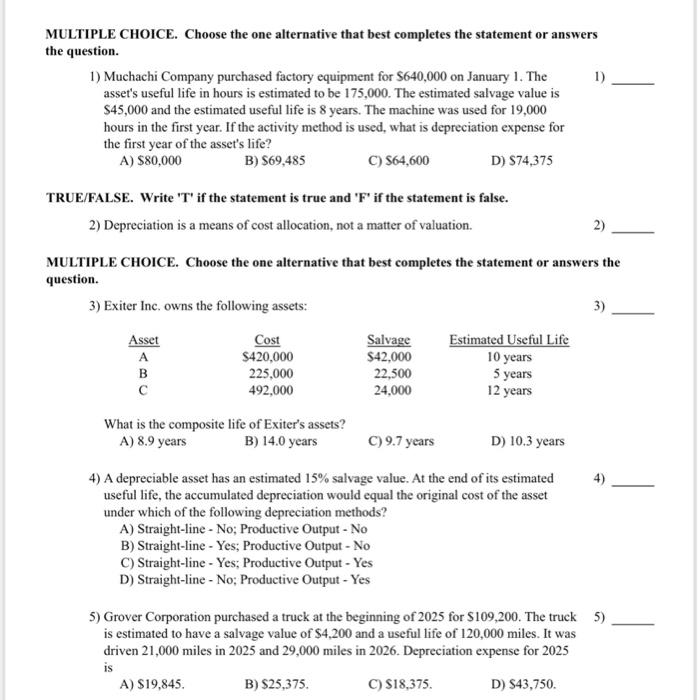

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Muchachi Company purchased factory equipment for $640,000 on January 1. The 1) asset's useful life in hours is estimated to be 175,000 . The estimated salvage value is $45,000 and the estimated useful life is 8 years. The machine was used for 19,000 hours in the first year. If the activity method is used, what is depreciation expense for the first year of the asset's life? A) $80,000 B) $69,485 C) $64,600 D) $74,375 TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 2) Depreciation is a means of cost allocation, not a matter of valuation. 2) MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 3) Exiter Inc. owns the following assets: 3) What is the composite life of Exiter's assets? A) 8.9 years B) 14.0 years C) 9.7 years D) 10.3 years 4) A depreciable asset has an estimated 15% salvage value. At the end of its estimated 4) useful life, the accumulated depreciation would equal the original cost of the asset under which of the following depreciation methods? A) Straight-line - No; Productive Output - No B) Straight-line - Yes; Productive Output - No C) Straight-line - Yes; Productive Output - Yes D) Straight-line - No; Productive Output - Yes 5) Grover Corporation purchased a truck at the beginning of 2025 for $109,200. The truck 5) is estimated to have a salvage value of $4,200 and a useful life of 120,000 miles. It was driven 21,000 miles in 2025 and 29,000 miles in 2026. Depreciation expense for 2025 is A) $19,845. B) $25,375 C) $18,375. D) $43,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts