Question: Please help!! Multiple parts but only one question, me and my friends will upvote!!! Braverman Company has two manufacturing departments-Finishing and Fabrication. The predetermined overhead

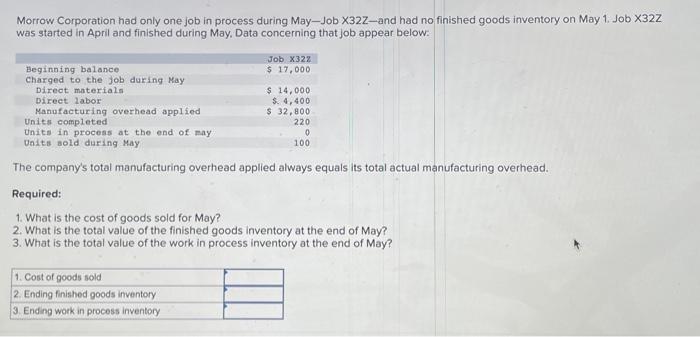

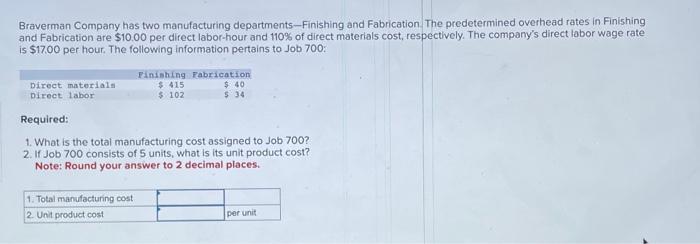

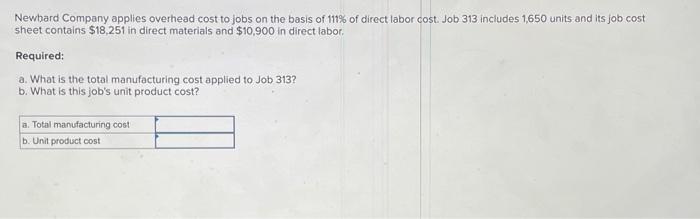

Braverman Company has two manufacturing departments-Finishing and Fabrication. The predetermined overhead rates in Finishing and Fabrication are $10.00 per direct labor-hour and 110% of direct materials cost, respectively. The company's direct labor wage rate is $17.00 per hour. The following information pertains to Job 700 : Required: 1. What is the total manufacturing cost assigned to Job 700 ? 2. If Job 700 consists of 5 units, what is its unit product cost? Note: Round your answer to 2 decimal places. Newbard Company applies overhead cost to jobs on the basis of 111% of direct labor cost. Job 313 includes 1,650 units and its job cost sheet contains $18,251 in direct materials and $10,900 in direct labor. Required: a. What is the total manufacturing cost applied to Job 313 ? b. What is this job's unit product cost? Morrow Corporation had only one job in process during May-Job X32Z-and had no finished goods inventory on May 1. Job X32Z was started in April and finished during May. Data concerning that job appear below: The company's total manufacturing overhead applied always equals its total actual manufacturing overhead. Required: 1. What is the cost of goods sold for May? 2. What is the total value of the finished goods inventory at the end of May? 3. What is the total value of the work in process inventory at the end of May

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts