Question: Please help my homework problems! It's due tomorrow!! In the fall of 2009, Kraft Foods attempted to buy Cadbury plc. Data for each of the

Please help my homework problems! It's due tomorrow!!

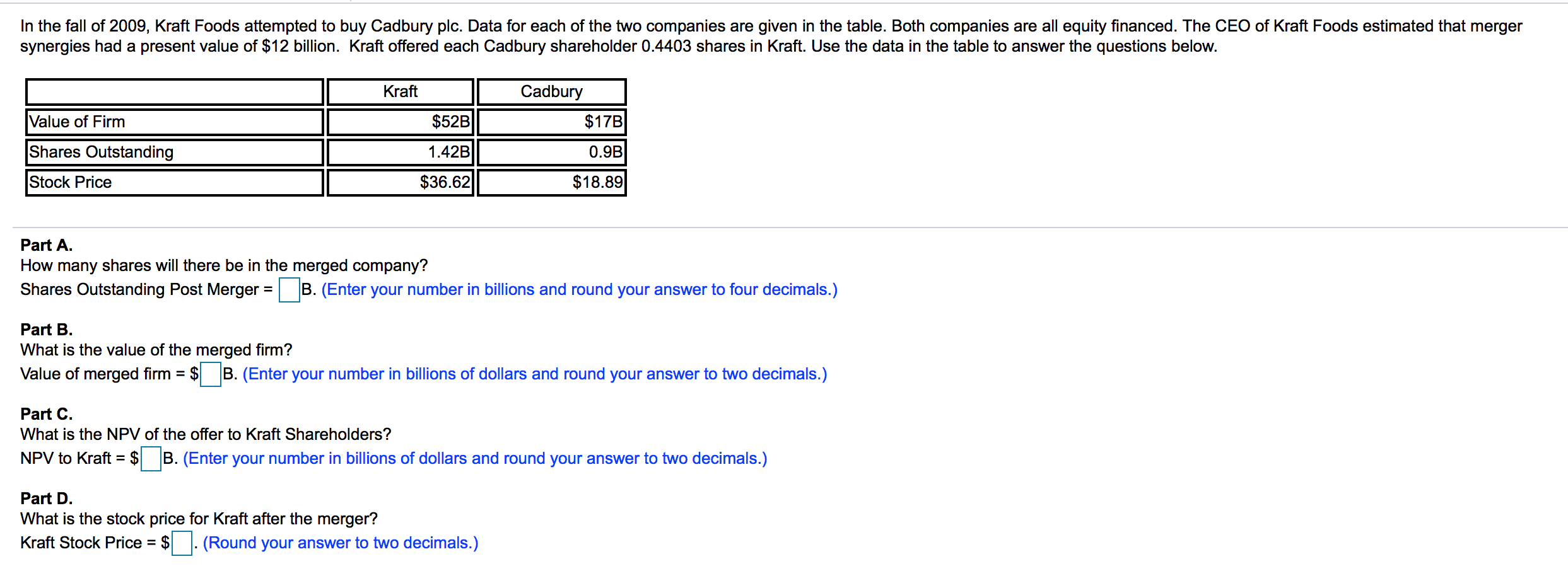

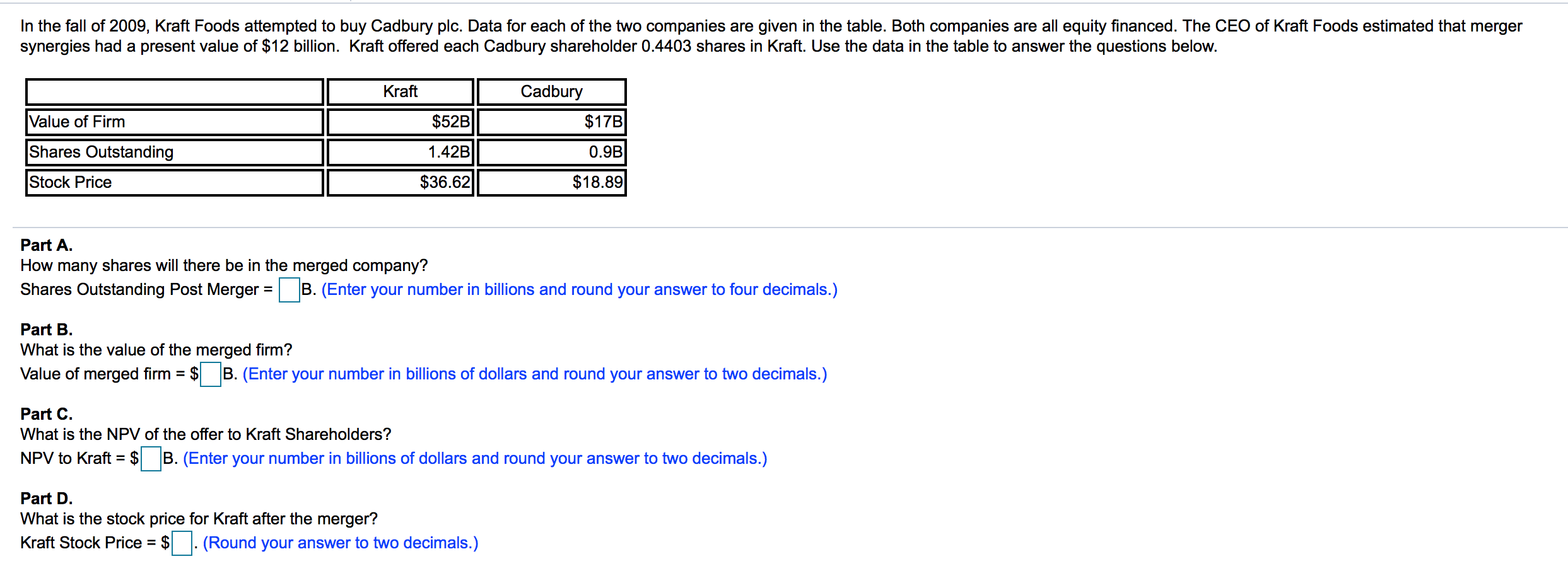

In the fall of 2009, Kraft Foods attempted to buy Cadbury plc. Data for each of the two companies are given in the noble. Both companies are all equity nanced. The CEO of Kraft Foods estimated that merger synergies had a present value of $12 billion. Kraft offered each Cadbury shareholder 0.4403 shares in Kraft. Use the data in the table to answer the questions below. I:l Part A. How many shares will there be in the merged company? Shares Outstanding Post Merger = B. (Enter your number in billions and round your answer to four decimals.) Part B. What is the value of the merged rm? Value of merged rm = $ B. (Enter your number in billions of dollars and round your answer to two decimals.) Part c. What is the NPV of the offer to Kraft Shareholders? NPV to Kraft = 3 B. (Enter your number in billions of dollars and round your answer to two decimals.) Part D. What is the stock price for Kraft after the merger'! Kraft Stock Price = $ . (Round your answer to two decimals.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts