Question: Please help, need all work Which alternative do you recommend? Fire Breather Hot Stuff Question 4 0.1 pts Consider the extra $28,000 needed to purchase

Please help, need all work

Please help, need all work

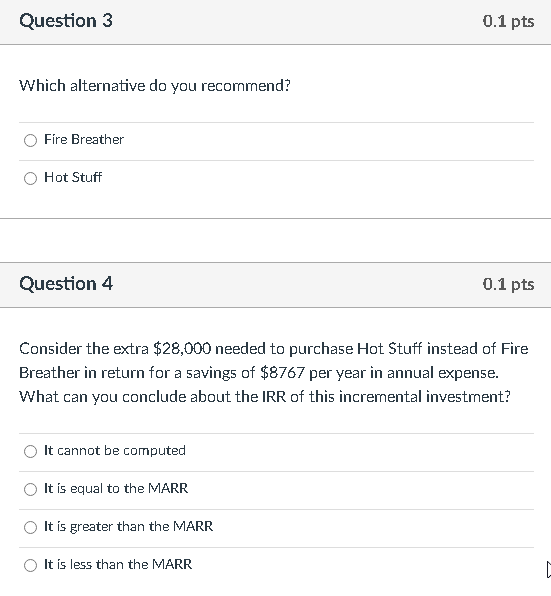

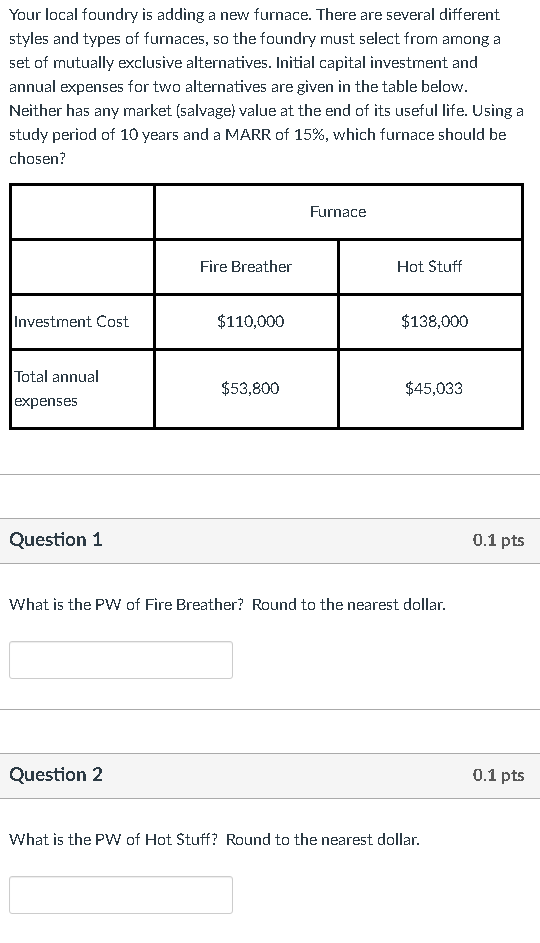

Which alternative do you recommend? Fire Breather Hot Stuff Question 4 0.1 pts Consider the extra $28,000 needed to purchase Hot Stuff instead of Fire Breather in return for a savings of $8767 per year in annual expense. What can you conclude about the IRR of this incremental investment? It cannot be computed It is equal to the MARR It is greater than the MARR It is less than the MARR Your local foundry is adding a new furnace. There are several different styles and types of furnaces, 50 the foundry must select from among a set of mutually exclusive alternatives. Initial capital investrnent and annual expenses for two alternatives are given in the table below. Neither has any market (5alvage) value at the end of its useful life. Using a study period of 10 years and a MARR of 15%, which furnace should be chosen? Question 1 0.1 pts What is the PW of Fire Breather? Round to the nearest dollar. Question 2 0.1 pts What is the PW of Hot Stuff? Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts