Question: PLEASE HELP!!! Need help answering questions 19 and 20. Work must be shown for full credit and its due TODAY! Please help me I cannot

PLEASE HELP!!! Need help answering questions 19 and 20. Work must be shown for full credit and its due TODAY! Please help me I cannot figure it out!

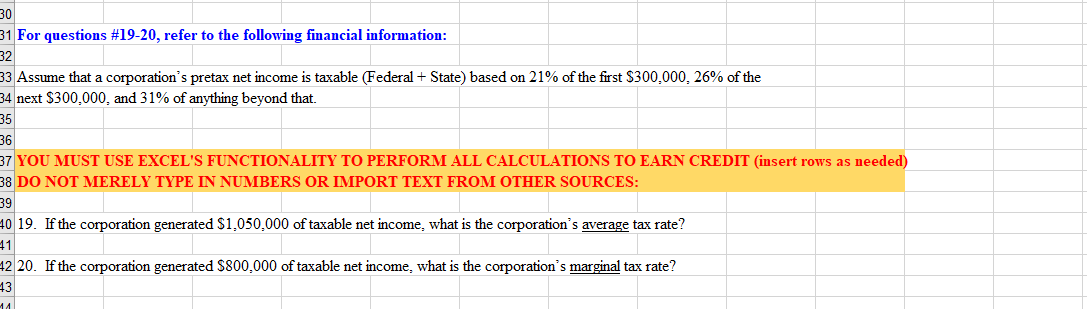

For questions \#19-20, refer to the following financial information: Assume that a corporation's pretax net income is taxable (Federal + State) based on 21% of the first $300,000,26% of the next $300,000, and 31% of anything beyond that. YOU MUST USE EXCEL'S FUNCTIONALITY TO PERFORM ALL CALCULATIONS TO EARN CREDIT (insert rows as needed) 8 DO NOT MERELY TYPE IN NUMBERS OR IMPORT TEXT FROM OTHER SOURCES: 19. If the corporation generated $1,050,000 of taxable net income, what is the corporation's average tax rate? 20. If the corporation generated $800,000 of taxable net income, what is the corporation's marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts