Question: please help, need help on the problem with an arrow drawn to it as well as requirement 2 (high lighted yellow). All information needed is

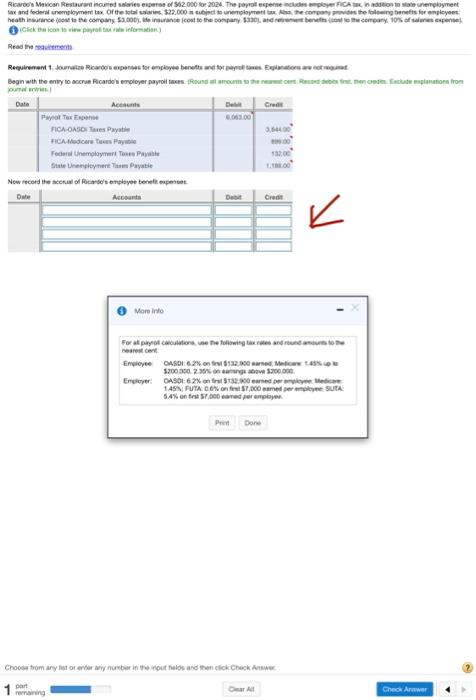

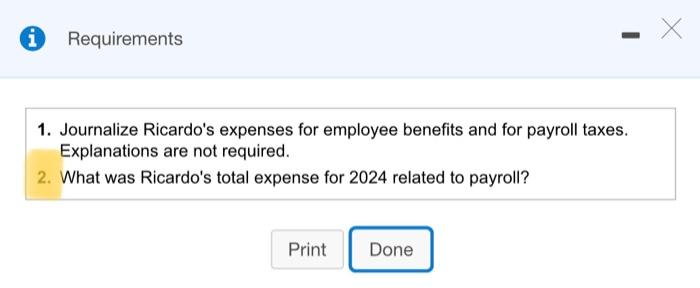

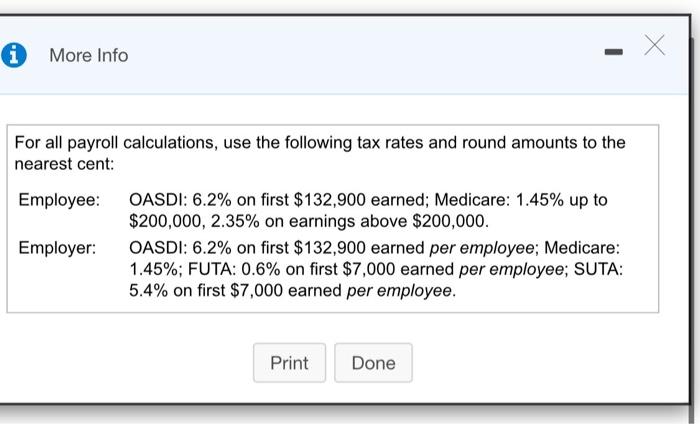

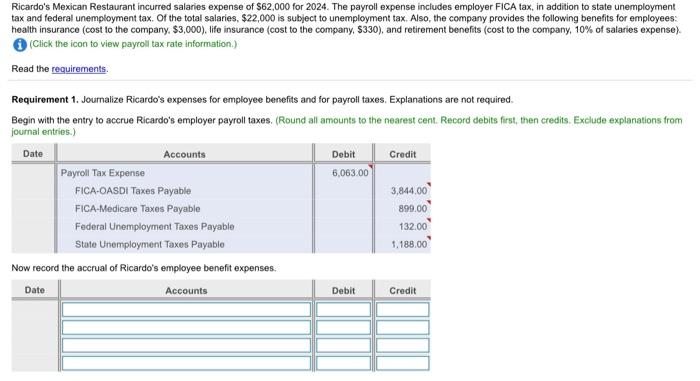

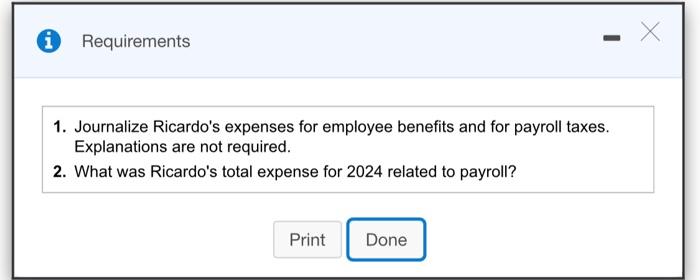

Rico Mexican Restaureries expense of $42.000 for 2024. The presentencludes Conteniment fe and federal employment tax of the tale 22.000 subito un erotta he comes the games for employee health insurance to the company $9.000), insurance cost to the company 5130), and then the company 10% of expenses Click to view the form Reader Requirement1 Jourraitze Ricardoperes for employee berettsandt. Entre Begin with the entry to socrun Ricardo's employer payroi taxes. Round el meum shearwater Resort, en anden acute aplanation from urnal Date Ace Crede FICA CASO Tes Paste RICA Medicare Pay Federal Unampaymart Tourer State Unangleyment Tu Payutie Now record the coast of Ricardes employee bent een Account Cro K More info For at ayolotion the finger and so percent Employee ASD 62% on 132.000 and Medicine 5200000.250 5.200.00 Employer DASDI: 62% of 132.300 med 145FUTA CO,000 wamed SURA 54% ont ST.00 anderen Done Choose from any sorrer y number in the routes and then click Check part memang CA Check Awwer 0 Requirements X 1 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations are not required. 2. What was Ricardo's total expense for 2024 related to payroll? Print Done X 0 More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned per employee; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned per employee; SUTA: 5.4% on first $7,000 earned per employee. Print Done Ricardo's Mexican Restaurant incurred salaries expense of $62,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benefits for employees health insurance (cost to the company. $3,000), life insurance (cost to the company, $330), and retirement benefits (cost to the company, 10% of salaries expense) Click the icon to view payroll tax rate information.) Read the requirements. Debit Requirement 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations are not required. Begin with the entry to accrue Ricardo's employer payroll taxes. (Round all amounts to the nearest cent. Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Credit Payroll Tax Expense 6,063.00 FICA-OASDI Taxes Payable 3,844.00 FICA-Medicare Taxes Payable 899.00 Federal Unemployment Taxes Payable 132.00 State Unemployment Taxes Payablo 1.188.00 Now record the accrual of Ricardo's employee benefit expenses. Date Accounts Debit Credit Requirements 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations are not required. 2. What was Ricardo's total expense for 2024 related to payroll? Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts