Question: Please help, need help with NPV Need to find the NPV of the new investment. Your answer is partially correct. Sheffield Corp. is planning to

Please help, need help with NPV

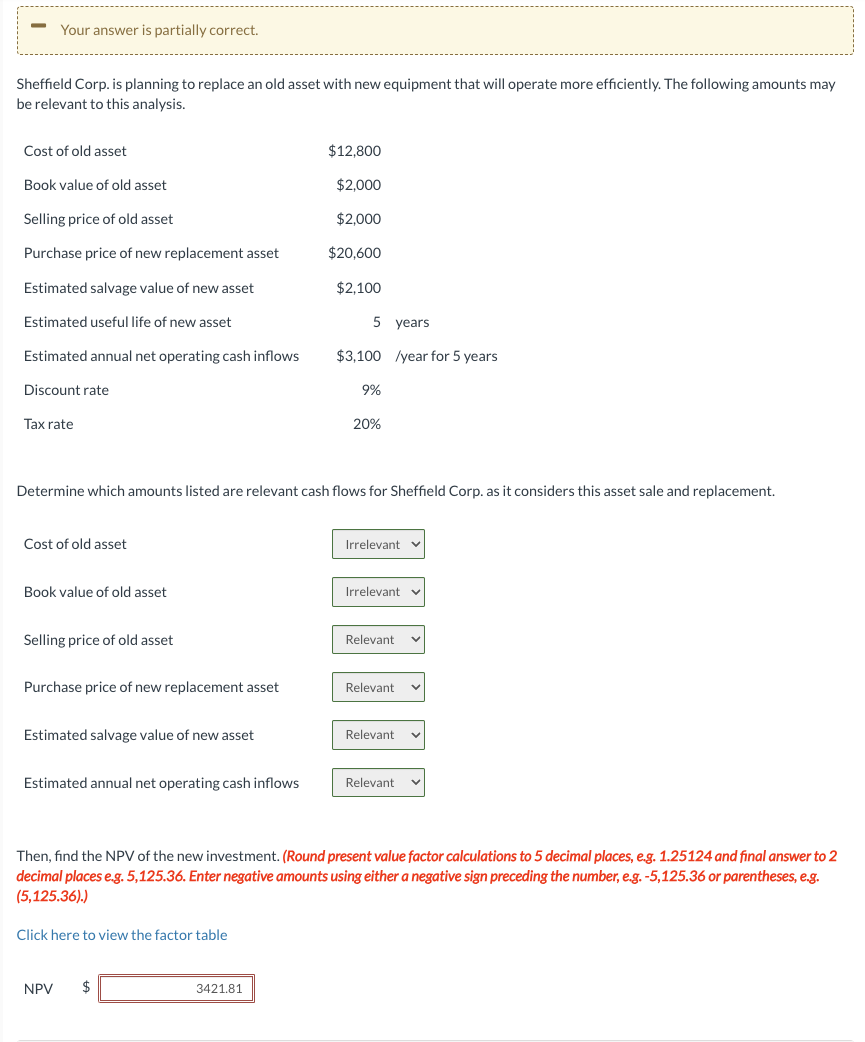

Need to find the NPV of the new investment.

Your answer is partially correct. Sheffield Corp. is planning to replace an old asset with new equipment that will operate more efficiently. The following amounts may be relevant to this analysis. Cost of old asset Book value of old asset Selling price of old asset Purchase price of new replacement asset Estimated salvage value of new asset Estimated useful life of new asset Estimated annual net operating cash inflows Discount rate Tax rate $12,800 $2,000 $2,000 $20,600 $2,100 5 years $3,100 /year for 5 years 9% 20% Determine which amounts listed are relevant cash flows for Sheffield Corp. as it considers this asset sale and replacement. Cost of old asset Book value of old asset Selling price of old asset Purchase price of new replacement asset Estimated salvage value of new asset Estimated annual net operating cash inflows Then, find the NPV of the new investment. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36). Click here to view the factor table NPV \$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts