Question: Please help need it for today! Part 2 Question 5 Intercompany transactions (12 points) Polly owns 100% of the stock in Solly. On January 1,

Please help need it for today!

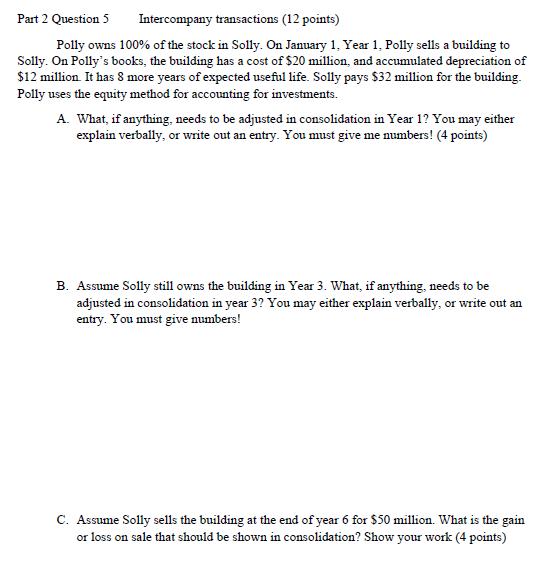

Part 2 Question 5 Intercompany transactions (12 points) Polly owns 100% of the stock in Solly. On January 1, Year 1, Polly sells a building to Solly. On Polly's books, the building has a cost of $20 million, and accumulated depreciation of $12 million. It has 8 more years of expected useful life. Solly pays $32 million for the building. Polly uses the equity method for accounting for investments. A. What, if anything, needs to be adjusted in consolidation in Year 1? You may either explain verbally, or write out an entry. You must give me numbers! (4 points) B. Assume Solly still owns the building in Year 3. What, if anything, needs to be adjusted in consolidation in year 3? You may either explain verbally, or write out an entry. You must give numbers! C. Assume Solly sells the building at the end of year 6 for $50 million. What is the gain or loss on sale that should be shown in consolidation? Show your work (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts