Question: please help, need quickly! will like!! The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of

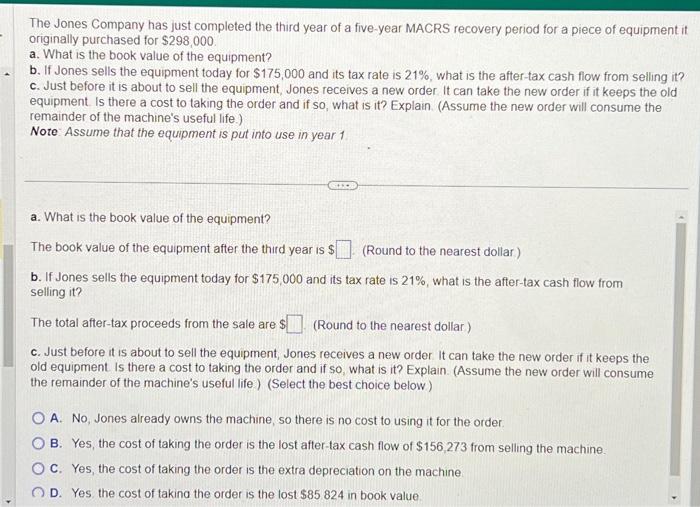

The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $298,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $175,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? c. Just before it is about to sell the equipment, Jones receives a new order. It can take the new order if it keeps the old equipment. is there a cost to taking the order and if so, what is it? Explain. (Assume the new order will consume the remainder of the machine's useful life.) Note: Assume that the equipment is put into use in year 1 a. What is the book value of the equipment? The book value of the equipment after the third year is \$ (Round to the nearest dollar) b. If Jones sells the equipment today for $175,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? The total after-tax proceeds from the sale are \$ (Round to the nearest dollar) c. Just before it is about to sell the equipment, Jones receives a new order It can take the new order if it keeps the old equipment. is there a cost to taking the order and if so, what is it? Explain. (Assume the new order will consume the remainder of the machine's useful life) (Select the best choice below) A. No, Jones already owns the machine, so there is no cost to using it for the order. B. Yes, the cost of taking the order is the lost after-tax cash flow of $156,273 from selling the machine. C. Yes, the cost of taking the order is the extra depreciation on the machine D. Yes the cost of takina the order is the lost $85824 in book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts