Question: PLEASE HELP!! Need this answer by tonight. Please answer!! This is only one question. Please fill in ALL yellow blanks and show work please. THANK

PLEASE HELP!! Need this answer by tonight. Please answer!! This is only one question.

Please fill in ALL yellow blanks and show work please. THANK YOU!!!!

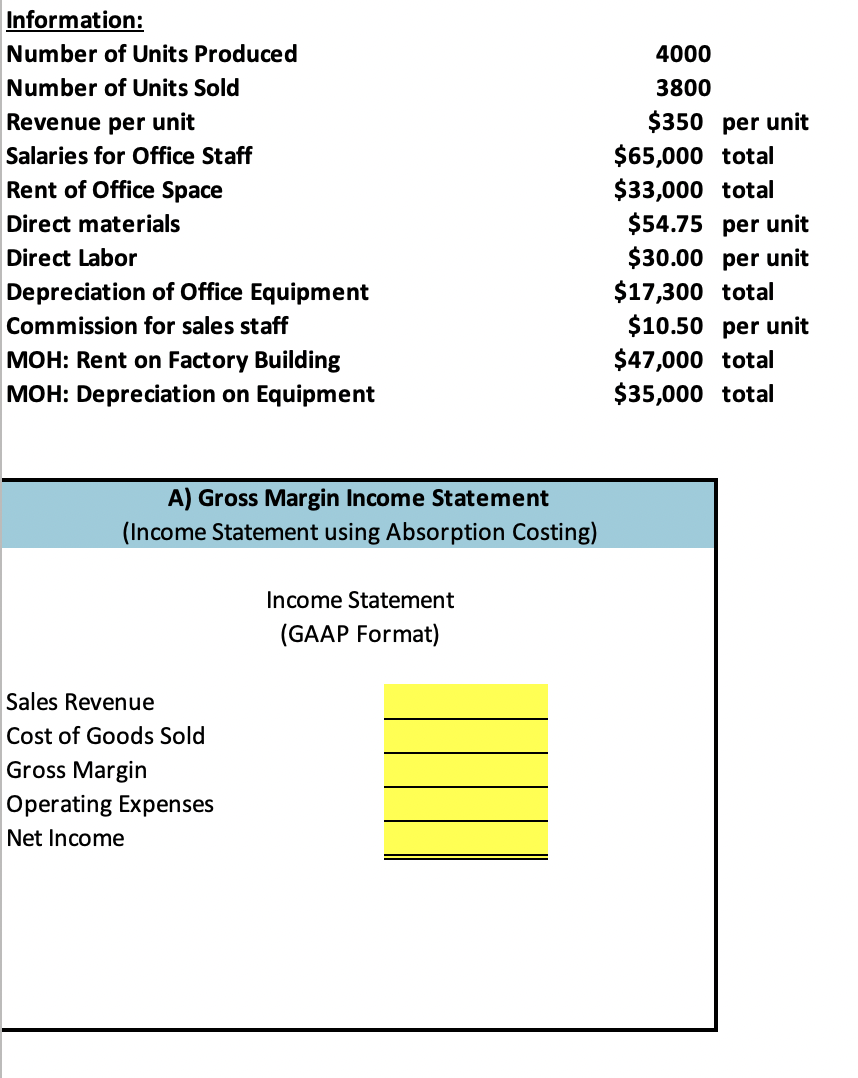

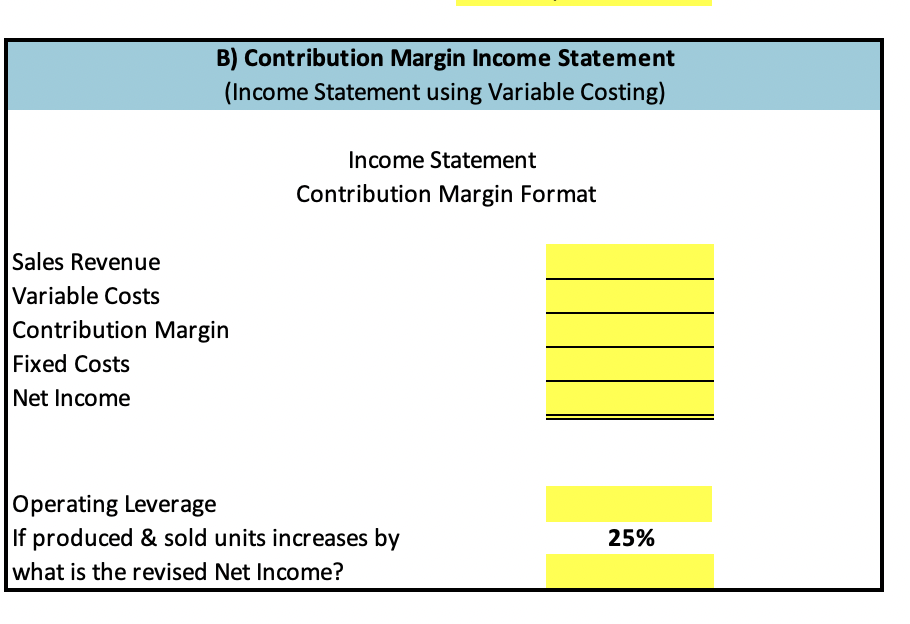

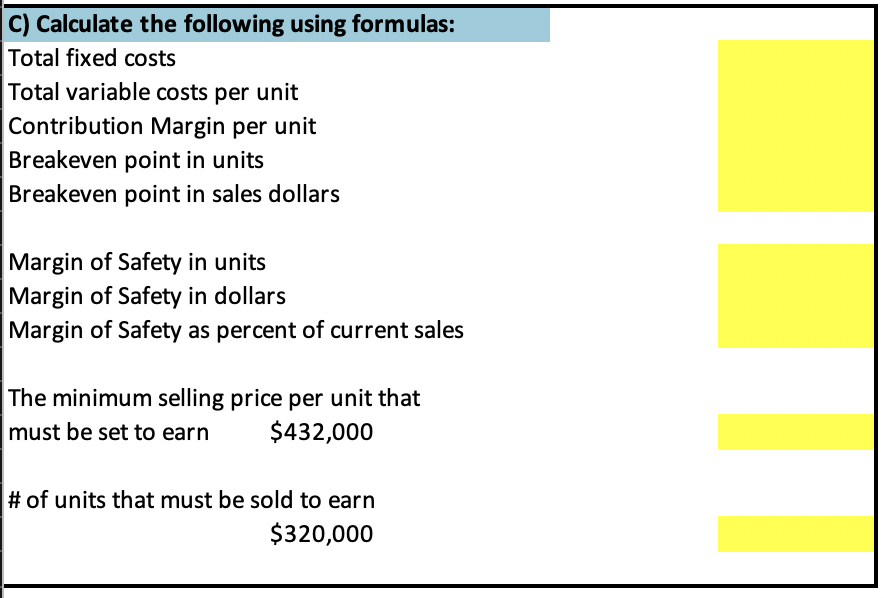

Information: \begin{tabular}{lrl} \hline Number of Units Produced & 4000 \\ Number of Units Sold & 3800 \\ Revenue per unit & $350 per unit \\ Salaries for Office Staff & $65,000 total \\ Rent of Office Space & $33,000 total \\ Direct materials & $54.75 per unit \\ Direct Labor & $30.00 per unit \\ Depreciation of Office Equipment & $17,300 total \\ Commission for sales staff & $10.50 per unit \\ MOH: Rent on Factory Building & $47,000 total \\ MOH: Depreciation on Equipment & $35,000 total \end{tabular} \begin{tabular}{l} \hline A) Gross Margin Income Statement \\ (Income Statement using Absorption Costingl \\ Income Statement (GAAP Format) \\ Sales Revenue \\ Cost of Goods Sold \\ Gross Margin \\ Operating Expenses \\ Net Income \end{tabular} B) Contribution Margin Income Statement (Income Statement using Variable Costing) Income Statement Contribution Margin Format Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Income Operating Leverage If produced \& sold units increases by 25% what is the revised Net Income? C) Calculate the following using formulas: Total fixed costs Total variable costs per unit Contribution Margin per unit Breakeven point in units Breakeven point in sales dollars Margin of Safety in units Margin of Safety in dollars Margin of Safety as percent of current sales The minimum selling price per unit that must be set to earn $432,000 \# of units that must be sold to earn $320,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts