Question: please help number 2 and 3 Problem 2: Ratio Analysis Use the financial statements from problem I with the income statement below to calculate the

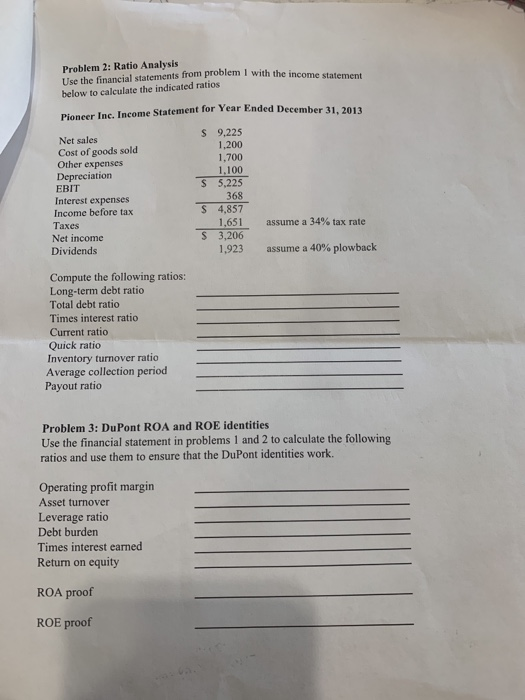

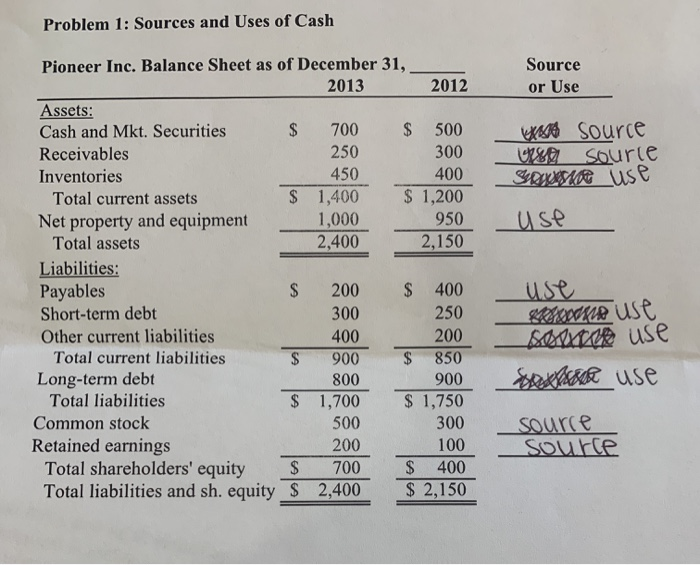

Problem 2: Ratio Analysis Use the financial statements from problem I with the income statement below to calculate the indicated ratios Pioneer Inc. Income Statement for Year Ended December 31, 2013 S 9,225 1,200 1,700 1,100 $ 5,225 Net sales Cost of goods sold Other expenses Depreciation EBIT Interest expenses Income before tax Taxes Net income Dividends 368 $ 4,857 1,651 S 3,206 1,923 assume a 34% tax rate assume a 40 % plowback Compute the following ratios: Long-term debt ratio Total debt ratio Times interest ratio Current ratio Quick ratio Inventory turnover ratio Average collection period Payout ratio Problem 3: DuPont ROA and ROE identities Use the financial statement in problems 1 and 2 to calculate the following ratios and use them to ensure that the DuPont identities work. Operating profit margin Asset turnover Leverage ratio Debt burden Times interest earned Return on equity ROA proof ROE proof Problem 1: Sources and Uses of Cash Pioneer Inc. Balance Sheet as of December 31, 2013 Source 2012 or Use Assets: Cash and Mkt. Securities Receivables eaSource SOurie $ 500 700 250 300 450 400 Inventories $ 1,200 $ 1,400 1,000 2,400 Total current assets Use Net property and equipment Total assets 950 2,150 Liabilities: Payables $ 400 use gaopd se E.SsACuse 200 S 300 250 Short-term debt Other current liabilities 400 200 Total current liabilities 850 900 Eoisuse Long-term debt Total liabilities 800 900 $ 1,700 1,750 Sourre SOurte Common stock 500 300 Retained earnings Total shareholders' equity Total liabilities and sh. equity S 2,400 200 $ 100 $ 400 $ 2,150 700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts