Question: please help numbers 4,5 and 7 please 258 PAS 19 5. Arrange the following steps in the accounting for defined Determine the components of the

please help

numbers 4,5 and 7 please

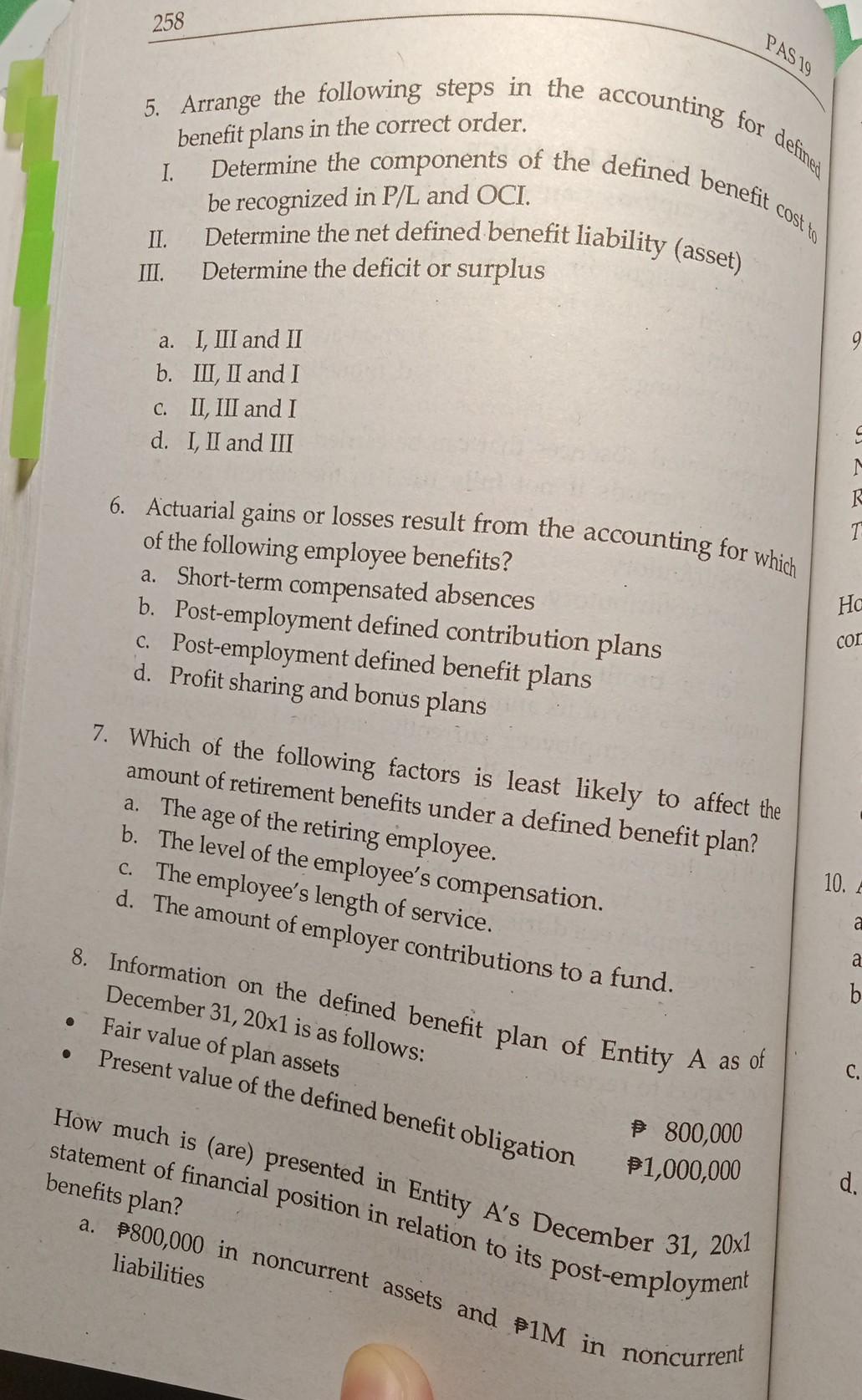

258 PAS 19 5. Arrange the following steps in the accounting for defined Determine the components of the defined benefit be recognized in P/L and OCI. Determine the net defined benefit liability (asset) II. III. Determine the deficit or surplus benefit plans in the correct order. I. cost to a. I, III and II b. III, II and I C. II, III and I d. I, II and III U2 6. Actuarial gains or losses result from the accounting for which of the following employee benefits? a. Short-term compensated absences b. Post-employment defined contribution plans c. Post-employment defined benefit plans d. Profit sharing and bonus plans con 7. Which of the following factors is least likely to affect the amount of retirement benefits under a defined benefit plan? a. The age of the retiring employee. b. The level of the employee's compensation. c. The employee's length of service. d. The amount of employer contributions to a fund. 10. a a 8. Information on the defined benefit plan of Entity A as of b b December 31, 20x1 is as follows: Fair value of plan assets Present value of the defined benefit obligation C. How much (are) presented in Entity A's December 31, 20x1 800,000 $1,000,000 d. benefits plan? a. P800,000 in noncurrent assets and pim in liabilities noncurrent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts